Investing.com’s stocks of the week

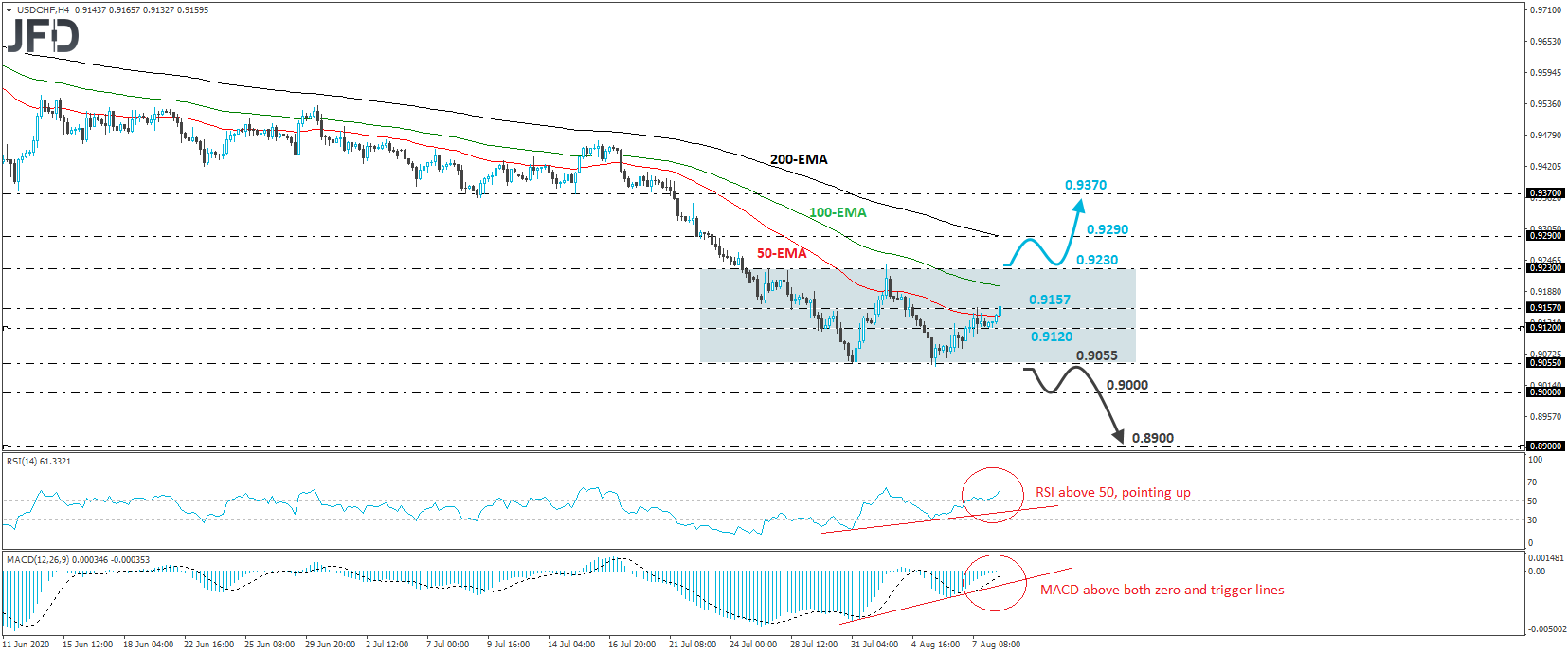

USD/CHF traded higher on Monday, breaking above the 0.9157 barrier, which is near Friday’s high. This may have cleared the path towards some higher areas, but until we see a decisive break above 0.9230, we prefer to stay sidelined. The reason why a break above 0.9230 may be more significant is because such a move would confirm a forthcoming higher high and signal the completion of a double bottom formation.

If indeed the bulls manage to reach and breach the 0.9230 hurdle, the completion of a double bottom may also signal a trend reversal. We may initially see advances towards the 0.9290 zone, the break of which could extend the rally towards the 0.9370 area, which acted as a strong support from June 11th until July 21st, when it was violated to the downside.

Shifting attention to our short-term oscillators, we see that the RSI lies above 50 and points up, while the MACD stands above both its zero and trigger lines, pointing north as well. On top of that, there is positive divergence between both indicators and the price action. This implies positive momentum and enhances the chances for a double-bottom completion in the not-too-distant future.

On the downside, we would like to see a strong dip below 0.9055 before we start examining the resumption of the prevailing downtrend. Such a move would confirm a forthcoming lower low and would take the rate into waters last tested in January 2015, during the recovery of the slump triggered by the SNB’s decision to remove the EUR/CHF floor of 1.20. The next important territory to consider as a support may be the psychological round figure of 0.9000, the break of which may set the stage for declines towards 0.8900.