Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

- Is USD/JPY Headed for 110?

- More Pain for AUD and NZD?

- NZD: What to Expect from RBNZ

- USD/CAD Rejects 1.10

- Dollar Soars to New Highs as Rates Continue to Rise

- EUR/CHF Soars on Talk of Negative Rates

- GBP Snaps Back After Hitting Fresh 10-Month Lows

Is USD/JPY Headed for 110?

For the third consecutive trading day, the U.S. dollar rose Wednesday to fresh multi-year highs against the Japanese yen. The same factors that triggered the initial USD/JPY breakout in late August are the same ones behind Wednesday's rally. U.S. rates extended their gains with 10-year yields reaching the strongest level since late July. From a fundamental perspective, we believe that USD/JPY could hit 110 but it may not occur until after next week's FOMC meeting. While we believe that USD/JPY will extend its gains ahead of Friday's retail sales report, a large part of USD/JPY's move is driven by the rise in U.S. rates and next week's FOMC meeting poses a big risk to the dollar rally. If Fed Chair Janet Yellen continues to downplay the improvements in the U.S. economy and fails to provide sufficient guidance on what happens after Quantitative Easing ends, the disappointment could lead to a wave of profit taking in USD/JPY. This would be temporary but the sell-off may not stabilize without a 2-to-4-yen correction. At the same time, Japanese data continues to surprise to the downside, raising concerns about the strength of Japan's recovery in the third quarter. Japanese machine tool orders grew at a slower pace in the month of July while producer prices fell 0.2%. A survey by PEW research also found that the Japanese are now the world's least optimistic about future economic conditions. Nonetheless, based on BoJ member Iwata's latest comments, the BoJ is not worried about the recent decline in price pressures or turn in economic data. Iwata said growing demand is helping to boost inflation and they see a high probability of reaching their 2% target in or around FY2015. He also spoke about the recent weakness of the Yen and interestingly enough, downplayed the benefit that a weaker currency provides to inflation and exports, which suggests they would be perfectly fine with a further decline in the Yen. Taking a look at the monthly USD/JPY chart, the currency pair has broken above the 61.8% Fibonnaci retracement of the 2007 to 2011 decline and at this stage there is no major resistance until 110. As long as USD/JPY remains above 104, the uptrend is intact.

More Pain for AUD and NZD?

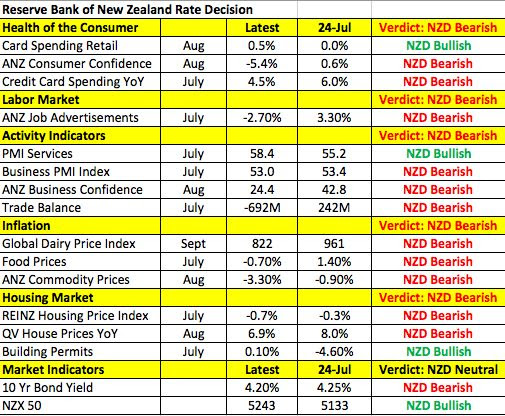

Wednesday night was shaping up to be a busy time for the Australian and New Zealand dollars. It starts with the Reserve Bank of New Zealand's monetary policy announcement, followed by Chinese inflation numbers and Australia's employment report. Both currencies are under significant pressure and could accelerate their losses easily. In the case of NZD, the RBNZ is widely expected to leave interest rates unchanged but how the New Zealand dollar reacts hinges upon the central bank's views of future rate rises. Back in July when they last met, the RBNZ said it was time to take a break from tightening before adjusting rates again. This month, if they emphasize the need to keep rates steady for a longer period, we expect NZD/USD to drop below 82 cents but if they reinforce their hawkish bias by spending more time talking about the need to bring rates back to neutral levels, the currency pair could rebound toward 0.8350. The following table illustrates how New Zealand's economy changed since the last monetary policy meeting in July where they raised interest rates by 25bp. Chinese inflation numbers are not expected to be big market movers but Australia's employment report is always important. Economists are looking for job growth to rebound after a decline in July but based upon the manufacturing and construction sector PMI reports, labor market conditions did not improve in August. Should job growth in Australia fall short of expectations, we can certainly expect further pain for the Australian dollar. The currency was sold sharply over the past 24 hours on the back of weaker consumer confidence and reports that iron ore prices could fall further. In contrast, USD/CAD rejected the 1.10 level with the loonie rallying against the greenback following an increase in capacity utilization. There are no major Canadian economic reports scheduled for release this week.

Dollar Soars to New Highs as Rates Continue to Rise

The U.S. dollar extended its gains against all of the major currencies Wednesday with the exception of the British pound. As there were no major U.S. economic reports released Wednesday, the market's voracious appetite for U.S. dollars continue to be driven by the rise in U.S. rates. At the beginning of this month, 10-year rates were hovering near 2.3%. On Wednesday it broke above 2.5% with plenty of room to the upside because rates have not even reached their 1-year average of 2.65%. Negative developments in other parts of the world have made U.S. assets increasingly attractive and we think this sentiment will be sustained going into Friday's retail sales report. Based on the uptick in spending reported by the International Council of Shopping Centers and Johnson Redbook, the U.S. retail number will have everyone forgetting about last week's soft non-farm payrolls report -- if they haven't done so already. Jobless claims are scheduled for release on Thursday but with payrolls released last week, the impact on the dollar should be limited.

EUR/CHF Soars on Talk of Negative Rates

The euro traded lower against the U.S. dollar Wednesday but with no Eurozone data or market moving comments from the ECB, that move was driven entirely by the decline in the German--U.S. 10-year yield spread. The bigger focus Wednesday was on EUR/CHF, which experienced its strongest one-day rally since March. The move was driven by comments from Swiss National Bank monetary policy committee member Moser who said negative rates is always a possibility. While this comment is not particularly new, it comes at a very important time for the currency. Since early August, EUR/CHF has been in a strong downtrend and after the ECB eased monetary policy this month, the currency pair hit a 22-month low. When the ECB cut interest rates, we argued that it could prompt action from the SNB because of the pressure it put on the currency. We were actually looking for verbal or physical FX intervention and while this remains a possibility, the prospect of changes in monetary policy grows as we near next week's SNB rate decision. The Swiss National Bank meets on September 18 and in the worst case scenario for EUR/CHF bulls, we expect a stronger commitment to the 1.20 peg and in the best-case scenario they will lower interest rates to negative levels. This of course is not unprecedented, particularly since Denmark brought rates to negative levels after the ECB decision. Either way, we expect EUR/CHF to remain bid going into next week's meeting.

GBP Snaps Back After Hitting Fresh 10-Month Lows

For a second day in a row, sterling rebounded against the U.S. dollar to end the North American session in positive territory after hitting fresh 10-month lows. The initial sell-off in the currency was driven by the growing support for Scottish independence. According to the latest polls, the Yen vote has now garnered 53% support but as indicated by our colleague Boris Schlossberg, "the methodology of the poll is suspect and as many analysts have pointed out the polls in UK are notoriously unreliable especially about such binary issues as independence with voters saying one thing but often doing the opposite in the privacy of the booth. At betfair the probability of a NO vote still remains at 70% with 2-5 odds across the board." We continue to believe that when push comes to shove on September 18, the majority in Scotland will vote to remain part of the U.K. The speed and velocity of the intra-day rebound in GBP/USD suggests that many sterling traders share our view. Once the referendum is over, the focus will return to monetary policy. This morning Bank of England officials reiterated their view that rates will rise in the Spring next year. According to BoE Governor Carney, "the point where rates need to rise has moved closer." While Miles, who is normally one of the most dovish members of the central bank, believes there's no urgency to start normalizing rates, Weale expressed concerns about stronger-than-expected price pressure and signs of a pickup in wage growth. If the 'No' votes win on September 18, we expect a very strong short squeeze in GBP/USD. But with 6 more trading days to go before the referendum, caution is warranted.