The easy answer is almost certainly “yes.” The more challenging question: Does a recession call rise to the level of a high-confidence forecast? No, not yet. For now, and probably for the immediate future, a high level of uncertainty will continue to keep the crowd guessing.

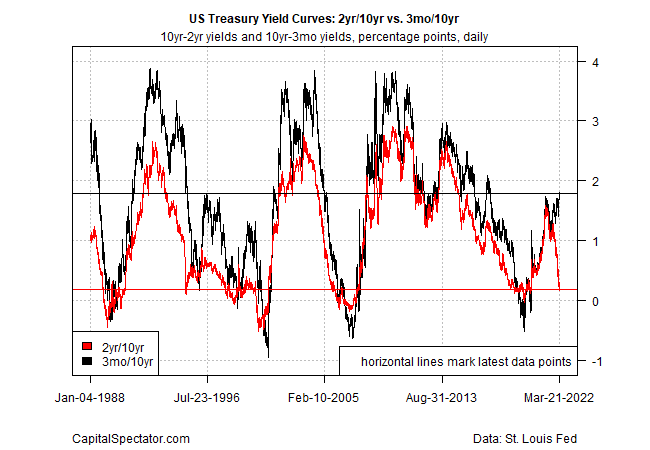

It’s tempting to argue otherwise by cherry picking one or two indicators that signal trouble ahead. The indicator of choice at the moment is the yield spread for the 10-year Treasury rate less its 2-year counterpart. This rate gap has fallen dramatically this year and at time of writing, is currently just 18 basis points (Mar. 21). When this curve inverts (gap turns negative), which could be any day, rest assured that headlines will announce that a formal recession prediction has been triggered.

Such a forecast may or may not be accurate, in part because the difference on the 3-month and 10-year yields—another widely followed yield spread (and arguably a more reliable one)— is still comfortably positive, offering a sharp contrast with the 2-year/10-year spread. One way to interpret the differing signals: the bond market has mixed views on estimating the risk of recession in the near term.

Hedging one’s bets on the business cycle for the US is, for now, rational. Indeed, this is not a “normal” cycle. Between the after-effects of the pandemic, Russia’s invasion of Ukraine and other factors, current conditions are far from a textbook example of how the ebb and flow of the economy interacts with monetary policy, inflation, employment, and so on. We are, quite simply, in an extraordinary moment in history, at least relative to the last several decades. As a result, making snap judgments using one or two indicators carries more risk than usual.

What we do know is that the US economy, while slowing (even before Russia’s invasion), is still expanding at a healthy pace. Monday's February data via the Chicago Fed National Activity Index all but confirmed that last month was not the start of a new recession.

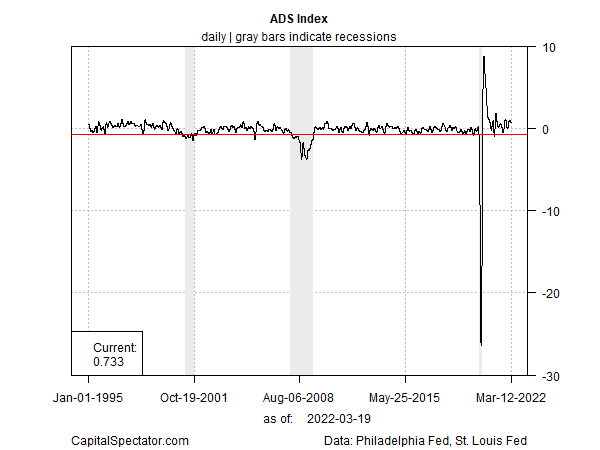

A month is an eternity these days and so the next question is whether there are signs of rapid, dramatic deterioration in economic activity in March? It’s too early to answer with a high degree of confidence because many key indicators for this month have yet to be published. That said, the early clues (which should be viewed cautiously) are encouraging. The Philly Fed's multi-factor ADS Index, for example, reflects a robust expansion, based on data from Mar. 12. Ditto for the New York Fed’s Weekly Economic Index.

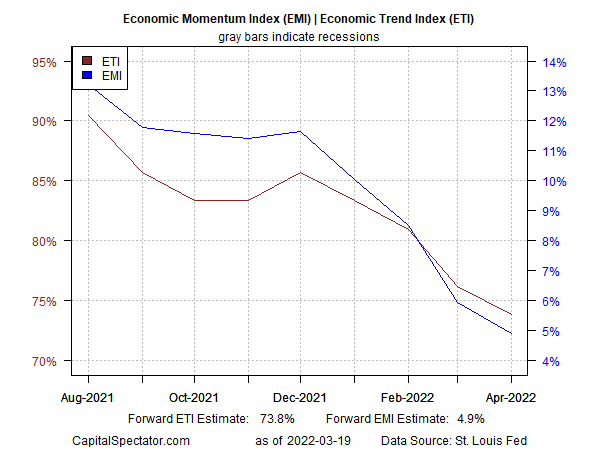

A pair of multi-factor business-cycle indicators published by The US Business Cycle Risk Report also reflect a solid, albeit decelerating rate of growth, based on forward estimates through April. These indicators are telling us that growth is slowing but output will stay positive through next month.

It would be naïve to assume that all is well and that recession risk is destined to remain low for the foreseeable future. But no less is true for assuming that contraction is destiny in the next several months. We simply don’t have enough data to make that call…yet. The future’s uncertain, no matter how many data sets you analyze.

To be sure, there are gathering clouds on the horizon. But in the realm of high-confidence forecasting, we’ll have to wait for more numbers while monitoring how the Ukraine war evolves, how the Fed adjusts monetary policy, how the economy reacts, and other factors. Meanwhile, recession forecasting beyond a month or so remains a highly speculative affair, as it always is. That may change, and perhaps soon. But for now, the case for assuming a US recession is fate at some point in the near future remains more of a guesstimate rather than a hard-data forecast.