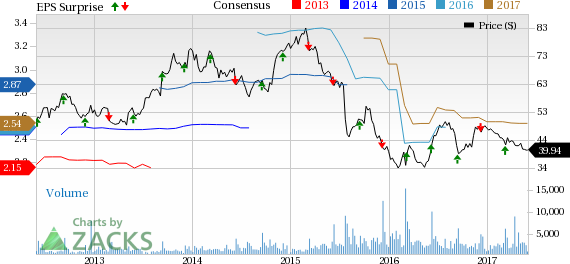

United Natural Foods, Inc. (NASDAQ:UNFI) is slated to release third-quarter fiscal 2017 results on Jun 6, after the market closes. The question lingering in investors’ minds is, whether this distributor of natural foods will be able to deliver a positive earnings surprise in the to-be-reported quarter. In the trailing four quarters, the company’s earnings have outperformed the Zacks Consensus Estimate by an average of 5.4%. Let’s see how things are shaping up prior to this announcement.

What Does the Zacks Model Unveil?

Our proven model does not show that United Natural is likely to beat earnings estimates this quarter. This is because a stock needs to have both a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP for this to happen. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

United Natural has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 76 cents. Moreover, it carries a Zacks Rank #4 (Sell) that makes our surprise prediction difficult.

Note that we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

What are Estimates Saying?

The current Zacks Consensus Estimate for the quarter under review is 76 cents that has been flat year over year and remained stable over the last 30 days. Further, the Zacks Consensus Estimate of $2.54 for fiscal 2017 is pegged down from $2.59 recorded in fiscal 2016. But analysts polled by Zacks expect revenues of $2,421 million for the third quarter, up 13.6% from the year-ago quarter. Also, revenues for fiscal 2017 are projected to grow 10.3% to $9.35 billion.

In fact, United Natural forms part of the Consumer Staples sector. Per the latest Earnings Outlook, as of May 31, the Consumer Staples sector’s earnings for the first quarter are expected to improve 4.6%, with 3% of revenue growth.

Factors at Play

United Natural has been grappling with the ongoing industry challenges, including deflationary environment. Evidently, promotional activities and competitive pricing pressure remained the major headwinds in the first half of fiscal 2017.

United Natural posted mixed second-quarter fiscal 2017 results, wherein earnings came in line with the Zacks Consensus Estimate, but revenues lagged the same. Deflation was 30 basis points in the second quarter of fiscal 2017, higher than 13 bps in the preceding quarter. Notably, these factors have been weighing upon its sales that have missed the Zacks Consensus Estimate for nine straight quarters including the second quarter. Further, the company has slashed its fiscal 2017 sales and earnings view.

Also, United Natural’s shares have declined 17.6% in the last six months against the Zacks categorized Food-Miscellaneous/Diversified industry’s gain of 6.3%.

Nevertheless, we are encouraged that the company has unveiled a new restructuring program, which is part of achieving greater efficiency amid a highly promotional environment. The move is primarily related to severance and other employee separation costs in conjunction with the opening of a shared services center, previously announced acquisitions, as well as other workforce reduction. Besides, we are also impressed with the company’s acquisition strategies and its efforts to increase its market share.

Stocks Poised to Beat Earnings Estimates

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Philip Morris International Inc. (NYSE:PM) has an Earnings ESP of +1.63% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Spectrum Brands Holdings, Inc. (NYSE:SPB) has an Earnings ESP of +0.52% and a Zacks Rank #3.

Dr Pepper Snapple Group, Inc. (NYSE:DPS) has an Earnings ESP of +0.78% and a Zacks Rank #3.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Dr Pepper Snapple Group, Inc (DPS): Free Stock Analysis Report

United Natural Foods, Inc. (UNFI): Free Stock Analysis Report

Spectrum Brands Holdings, Inc. (SPB): Free Stock Analysis Report

Philip Morris International Inc (PM): Free Stock Analysis Report

Original post

Zacks Investment Research