Key Points:

- Household borrowing remains buoyant, growing at 4%.

- Inflationary pressures increasing.

- Potential for action on rates from the Bank of England.

The composition of the United Kingdom’s GDP growth has been sliding towards more consumer focused consumption rather than exports over the past few years. In fact, growth in consumer credit has been a relatively poignant aspect of the UK’s recent growth figures. Even with the looming spectre of a Brexit, household borrowing has grown by over 4% in 2016. However, the party could be about to come to an end as a weakening Pound could post an obstacle to the consumer sector as the price of imports start to climb.

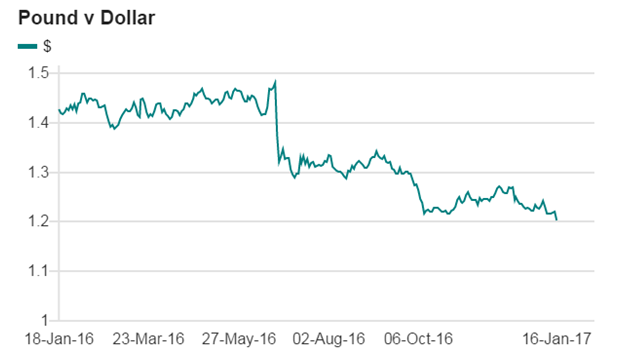

In fact, there has been a relatively consistent Cable depreciation over the past 12 months as the market comes to grips with the uncertainty that surrounds the UK’s exit from the European Union. Subsequently, we have seen the currency crash from highs around the 1.4500 level back to its current doldrums at 1.23-1.24. This has had a definite effect upon the import prices of goods and been noted in slowing household consumption and a rise in consumer price inflation.

Subsequently, consumers are currently facing the unenviable position of rising import prices, and underlying inflation, with the potential for near term interest rate rises. In fact, the next Bank of England’s monetary policy meeting could be an interesting one given the falling levels of unemployment and rising inflationary pressures. These same pressures have also caused the IMF to recently upgrade the UK’s GDP growth outlook to 1.5% (1.1% prev) which is a significant revision especially given the pending Brexit.

Ultimately, a consumer led slowdown is relatively likely but will in all probability be tempered by the rising prices and falling unemployment levels that currently exist within the UK. In all likelihood, we are likely to see the Bank of England act on the official bank rate in the very near future, despite some of the volatility within inflation and output channels, which would ultimately have a strengthening effect upon the Cable. Subsequently, the consumer party isn’t quite over yet but we may see some slowing and subsequent GDP composition changes in the coming quarter.