Heading into the final lap of the 2012 presidential campaign, Obama appears to have the electoral college edge. Any lead that Romney may or may not have in the national polls is irrelevant if he cannot capture enough battleground states. The fact is, the election probably hinges on Ohio.

I said it throughout October and I will say it again here, there is a very strong probability that Tuesday, November 6, will not produce a clear-cut victory for either candidate; recounts/provisional ballots in Ohio may ultimately determine the next resident of the White House.

If investors cannot make tails or heads of a post-campaign struggle — if the outcome of the election is not known for weeks — history tells us that stock markets may falter. In Bush vs Gore (November 2000), stocks lost roughly 8% of their value. Back then, there wasn’t a fiscal cliff to negotiate by year’s end.

Perhaps ironically, the election itself is not the real cliffhanger. Not for investors, anyway. For risk assets to prevail, Congress and the White House will need to come to terms on expiring tax breaks and automatic spending cuts.

Without resolution, there can be no rally in stocks. Without resolution, long-dated Treasury bonds may soar.

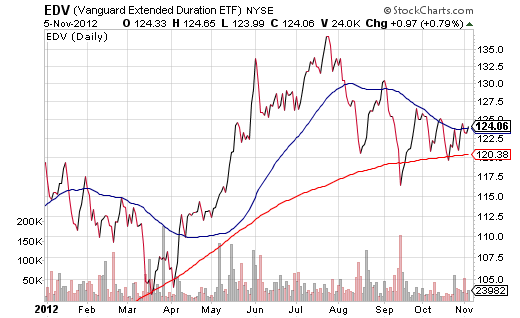

For example, in the April-July period of uncertainty about the European Union’s commitment to the euro, the Vanguard Extended Duration Treasury Bond ETF (EDV) rallied roughly 33%. Shortly after Mario Draghi pledged to do whatever it takes to save the eurozone, EDV (July-September), lost -15%.

In mid-September, the U.S. Federal Reserve formerly launched its QE3 plan to buy $40 billion of mortgage-backed bonds every month. A week earlier, the European Central Bank (ECB) offered precise details for bailing out any member country requesting financial assistance.

Not surprisingly, once the details of the developed world easing expeditions became public, Treasury bond bulls returned. Specifically, Treasury bond bulls are now focusing on the prospect of a messy election in the U.S., a game of chicken on the fiscal cliff and additional bargaining by Spain prior to asking for an official bailout.

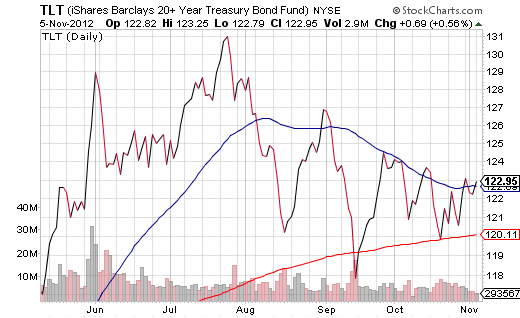

Is Treasury bond bullishness really back? Consider iShares 20+ Year Treasury (TLT). In the aforementioned period of bond price depreciation (July-September), TLT demonstrated a distinct pattern of “lower highs.” That pattern may be in the process of reversing itself, as October and November appear to be hitting “higher lows” that would be bullish for Treasury bond buyers.

In truth, there may be more than a chance of thunderstorms before the clouds begin to dissipate. And I wouldn’t be surprised to see investors sell Stock ETFs and buy Treasury Bond ETFs during that brief period.

In my estimation, however, both the election and the fiscal cliff will be resolved. What’s more, with leaders around the globe demonstrating strong biases toward fiscal and monetary easing — both conventional and unconventional — risk assets will find a way to move higher.

If the markets do pull back sharply, individual investors with high cash positions should consider ETFs like SPDR Retail (XRT) and Vanguard Dividend Appreciation (VIG). Buying the pullback ensures a lower entry point, and stop-limit loss orders protect against extreme downside risks from there.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Is Treasury Bond Bullishness Back?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.