Not a very merry, indeed a rather dour Season's Greetings that. But 'tis what 'tis. On this day wherein as viewed from Earth the Sun reaches it southernmost degree of travel, we clearly have arrived at the Winter of Gold's discontent. After penning a mere two missives ago "Gold To Trade Higher Into The End Of The Year", 'twas admittedly annoying to finish yesterday morning's (Friday's) Prescient Commentary with the following phrase:

"...Gold's MACD on the daily bars confirmed a negative cross implying a re-test of the year's low (1179)..."

The Market Rhythm associated with Gold's daily MACD (moving average convergence divergence) study has shown price to directionally follow-through by at least 27 points in 9 of the last 10 crossings, making it a powerfully profitable trading rhythm to track, (albeit we do not condone shorting the negative crossings). Given that the MACD's negative cross was confirmed upon the Thursday COMEX settle, the expected minimum follow-through is then measured from the opening price of the next session, which for Friday was 1189. Should that Market Rhythm be maintained, subtracting 27 points therefore implies Gold ought trade at least as low as 1162, (in spite of price's reclamation of 1200 to close out the week), prior to the next confirmed positive MACD crossing.

The following chart displays Gold's daily bars from just over a year ago-to-date. When price's colour changes to green, the MACD study has confirmed a positive crossing ... and vice-versa upon changing to red; now observe the rightmost price bar, which is Friday:

'Twould appear that despite fear of the Terrible Taper having already been well built time-and-again into the descending price of Gold throughout 2013, at the end of the day, 'twas apparently not priced in after all, for 'tis the Taper that's being blamed for the furtherance of down tilt. Terrifique...

Out of sheer happenstance, on Wednesday I strolled by a TV, riveted in front of which was a most esteemed Investors Roundtable member, poised and fully attentive to the imminent policy announcement by the FOMC. "Are you really gonna watch that?", I asked without pausing. "Of course!" Sheer guts. Then behind me as I passed into the corridor I heard the TV announcer say "The Fed will taper its purchases..."

Returning past the TV a bit later, my friend still there, I asked "Did Gold hit zero yet?" The reply, "No, but the market's up 130..."

Just as the unconscionable rise in the S&P has been 180° out of phase with real earnings this year, so have I been with Gold. That being said, I've nonetheless been assessing some asset liquidation, (by deftly delving deeply into sofa crevices toward scraping together lost change), so as to score a Gold coin for my own holiday gift before prices return to higher levels.

For as we glide toward year's end, 'tis not the decline in the price of Gold -- now -37% below its All-Time High level of 1923 (06 September 2011) -- that is of concern; rather 'tis the amazing ascent of the S&P -- now +173% above its Black Swan low of 667 (06 March 2009) that is so dizzyingly daunting. To wit, on Thursday morning I replied as follows to a valued reader who had written in, asking what my market thoughts were post-FOMC:

"...What I gleaned from yesterday's FOMC decision is two-fold: 1) The Fed is to further debase the Dollar at a rate of $75bn/month; and 2) The S&P is gliding ever-higher through "earningsless" crash territory ... Whilst I do have some concern that Gold is not tracking higher as it ought, (but far and away will), my far greater concern is the fallout from the next stock market crash. Retirees will outlive their liquidity and the fiat powers will have to print dough like mad to keep the old folks going... Unless: they enforce the law of Logan's Run..."

Specific to the market's lowly pricing of Gold, as you gather amongst family and friends at this otherwise festive time of year, should the occasional nabob set upon you about it being "all over" for the yellow metal, you might cheerfully offer this analysis: from 31 October 1980 through today -- despite Gold en route having plummeted from the 600s to the 200s, and more recently from the 1900s to the 1100s -- the "least squares regression" comparison of the net rise in the price of Gold versus the growth in our StateSide money supply as measured by M2 is at this very writing: $103.76/ounce per $1 trillion of M2. Then leave it to them to both imbibe in another ladle of party punch and do the extrapolative math on Dollar debasement, EuroCurrency debasement, AsiaCurrency debasement and GoldPaperClaim debasement (vs. actual supply) ... after which they too just might be persuaded to pick up a Gold coin or two on the cheap.

Nevertheless for the present, the reality remains that the market is never wrong, the year-over-year sleigh ride for Gold having been an unhappy journey:

And to be sure, the patience of the broadest-based Bowsers has been put to the test:

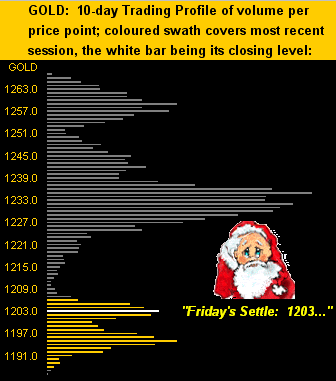

Meanwhile from the trader's perspective, yesterday's recovery of 1200 hardly warrants a sigh of relief given the confirmed negative MACD crossing as was detailed at the outset; moreover per the following Market Profile for Gold, its overhead trading resistance apices stand in the way as shown here:

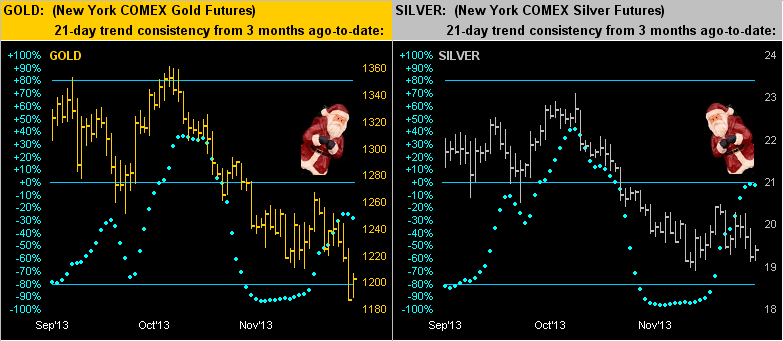

Moving on to the linear regression trend consistency measures for both Gold and Silver, these three-month views of their daily bars and "Baby Blues" are suggesting further downside cues, as the dots are just now kinking lower:

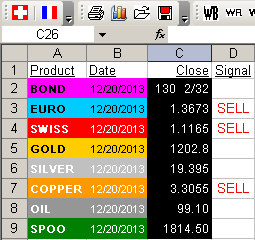

With respect to such trend consistency for the BEGOS markets at large, the two EuroCurrencies and Copper all fired off sell signals per this partial screenshot produced during yesterday's end-of-day computer runs. For each case wherein "Sell" appears, 'tis because the baby blue "regression consistency" dots have dropped below the +80% zones on their respective charts, (which you can view as updated daily at the website's Market Trends page):

A rolling stone may gather no moss, however a debasing Dollar garnering strength against the EuroCurrencies baffles the brain and redounds negatively for Gold. Oh such a Gloomy Goldmas indeed, given all the foregoing negativity. But perhaps this is a bad news-to-good news setup:

The Bad News is that somewhere within these last eight trading days of 2013, should the MACD's Market Rhythm play out and/or the Baby Blues move lower still, we'll witness the final Gold Scare in a re-test of the 1179 low (28 June) and be done with it.

The Good News in turn will be a renaissance of substantive logic within the banking, investing and trading environs that Gold is not going to zero, that as has been the case since Ötzi the Iceman: 'tis money, and 'twill be well worth owning by that evening whilst many are asleep that the S&P 500 futures find themselves "locked limit down" and the "Look Ma No Earnings Crash" commences. (More on that in a week's time for the year's final missive).

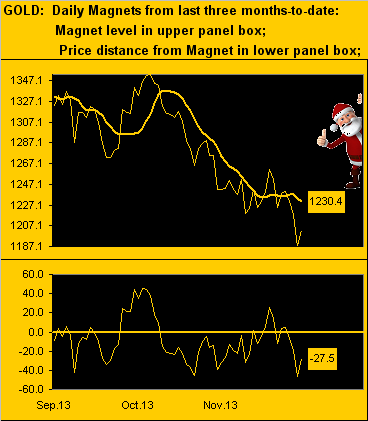

But in putting a positive wrap on this week's Gold Update, here's a short-term "thumb's up" view showing us price having already strayed quite far below its Market Magnet, (per the oscillator in the chart's lower panel), albeit the slower-moving magnet itself (thick line) tipping lower is hardly a positive. Still, price's tendency is to snap back to the magnet:

Finally, this quick exit quip: Have you read that the Old Lady of Threadneedle Street plans to introduce "wipe-clean" plastic £5 banknotes in 2016? From Pound Sterling to Pound Plastic? Blimey!

In transitioning from Gloomy to Merry, I remain forever grateful for your interest and support. Hang in there: Gold will out!

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Is This The Winter Of Gold's Discontent?

Published 12/23/2013, 01:03 AM

Is This The Winter Of Gold's Discontent?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.