Market Vectors Gold Miners (ARCA:GDX) is up nearly 6% this week, which begs the question -- Is this rally for real? From all indications, the answer is a resounding 'YES'! Here’s why:

- The chart pattern breakout from the multi-week ascending triangle is the real deal and targets a move to at least $22

- The bottoming process that began in November is now 6 months mature and the trend is clearly in transition from messy oscillation to nascent uptrend as indicated by the series of higher lows and shallower pullbacks

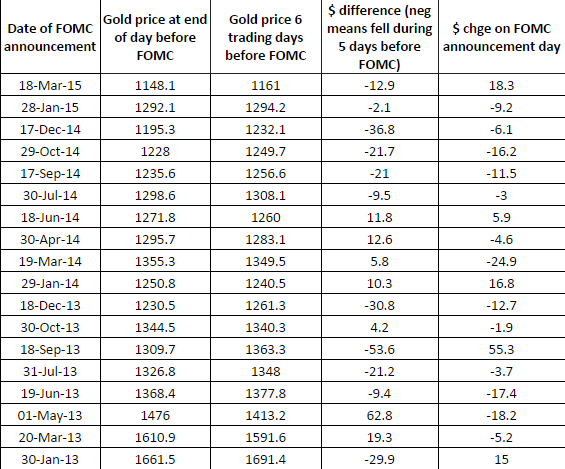

- Steve Saville over at The Speculative Investor Blog compiled some data showing that gold has had a solid downward bias in the days leading up to Federal Reserve Open Market Committee announcements, especially recently…

This data makes the upside reversal we have witnessed in gold this week all the more noteworthy given Wednesday's important FOMC announcement -- this week’s rally, if it continues, could be a sign of a major trend change in both gold and the gold miners.

- As I pointed out a few weeks ago, GDX has churned a tremendous amount of volume and spent a great deal of time at the $20 support/resistance level. It's becoming increasingly likely that the next directional move away from the $20 level will be a large and lasting one.

Wednesday is shaping up to be a very intriguing trading session for the markets.