Summary- Gold, silver and the cryptocurrency market went wild this past week.

- The dollar may have bottomed in the near term.

- Geopolitical tensions are dominating these markets as Trump fights for survival.

Everyone has their opinion on how gold (SPDR Gold Shares (NYSE:GLD)) and silver (iShares Silver (NYSE:SLV)) trade. In my four-plus years of blogging and the ten years watching the metals before that, I think I may have heard them all. With the latest move upward everyone will have a reason as to why this is or is not the ‘big move.’

And nearly everyone will be wrong. Why? Because almost everyone watching correlations between gold and interest rates or currency-baskets are missing the forest for the trees.

The precious metals are inherently political markets whose sustained directional moves only coincide with shifts in public perception about government’s handling of the currency we do our business in.

So, that said, do I have an opinion on this sustainability of this move? Yes. But, that’s for later.

The Technical Move

This past week we saw a dramatic breakout in both metals alongside Bitcoin (Bitcoin Investment Trust (OTC:GBTC)) and the cryptocurrency market in general. It started last Monday morning, an option on futures expiration day, and did not let up despite some very hincky intra-day trading in the metals.

But, then again, what else is news?

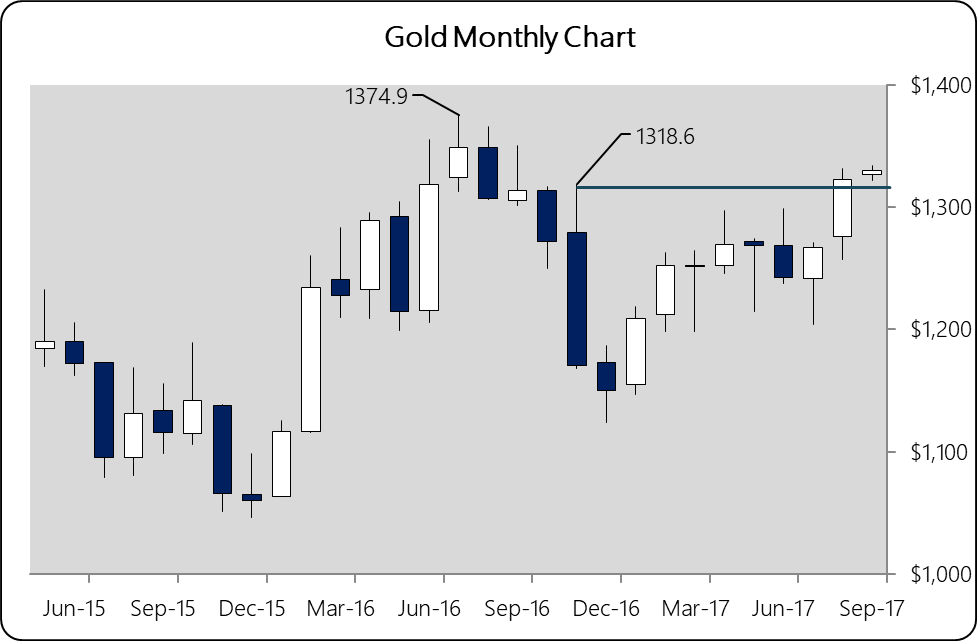

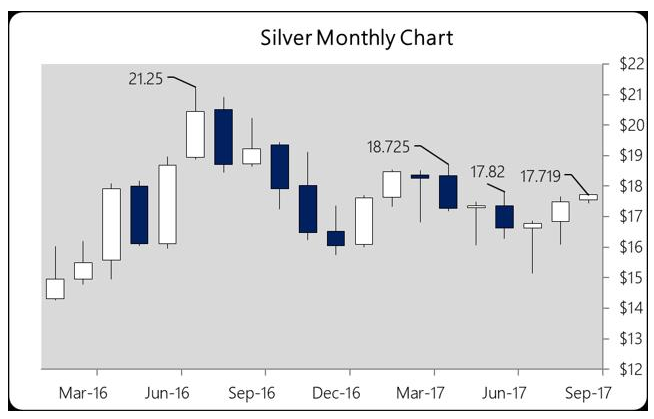

Gold closed the week just shy of $1330 and silver just shy of $17.75. These are very important closes, both from the weekly perspective and from a monthly closing one (August closed on Thursday).

Both metals looked stymied by strong resistance at $1300 and $17.32, respectively, in the past few weeks, but burst through on Monday to unleash a vicious short-covering rally that kept up all week. But with a surprisingly strong August close it sets up a run in gold to the post-Brexit high of $1377 in September.

Silver has a lot more work to do. It first needs to clear $17.82 before it can even consider a move back to the post-Brexit high. And this tells me that gold is responding far more as a political asset than silver is, which is still weighed down by commodity concerns.

Resistance for silver in September starts at $17.82, the June high. That should be no problem, especially since Friday was an upside violation of the August high. Resistance then moves up to $18.72, April high.

That would need to occur for silver to put in a quarterly reversal, whereas gold simply needs to hold above $1318.60, the November high, to setup for a continued move higher.

The metals have been setting up for this breakout for weeks now thanks to a weaker U.S. dollar (PowerShares DB US Dollar Bullish (NYSE:UUP)). But, that’s the interesting part. The USDX was also up for the week.

It looks like we may finally have a spike-bottom in the USDX and an interim top in the euro (Guggenheim CurrencyShares Euro (NYSE:FXE)). Even the weak U.S. jobs report couldn’t stave off euro selling on Friday.

Is market positioning simply lopsided in the short term and that needed correcting? Possibly. Have the headlines played up the chaos surrounding President Trump’s administration? Yes.

Is the market worried about a nasty debt ceiling fight that could create even further chaos in the last half of September? Yes.

Is there a threat of war in the air? Yes.

All of these things point strongly towards the results we saw in the markets this past week, including further safe-haven buying in cryptocurrencies with Bitcoin flirting with $5000 on Friday evening and Ethereum pushing back to challenge its all-time high at $400. Litecoin exploded to over $90 as well.

The Geopolitical Picture

It is pretty obvious to me now that in recent weeks President Trump made a deal with GOP leadership to cede foreign policy to the ‘grown-ups.’ Friday’s diplomatic escalation with Russia is yet another example. On Thursday, we gave Russia 48 hours to close the San Francisco consulate and then we said we were raiding the compound.

This, like the seizing of the embassy property by the Obama administration in December, is in clear violation of the Vienna Convention and international law. This is not an act of a government interested in improving relations.

And this is exactly not what Trump signaled coming out of his meeting with Russian President Vladimir Putin on the sidelines of the G-20 in July. The only rational conclusion is that Trump is no longer in control of foreign policy.

In recent weeks since Trump signed the expanded sanctions bill, I cannot think of one single geopolitical event that squares with Trump’s first six months in office with respect to Russia. Not one.

But, now we’re talking tax cuts and a new budget again. Now, Obamacare repeal is back on the table. But the border wall is still shelved. So, the trade has become pretty obvious. Trump gets some of his domestic policy through a hostile Congress and gives up as the leader in foreign policy.

In effect, nothing in Washington has changed.

And since that is most likely the case, the war drums against North Korea start up again. Trump is no longer telling everyone to calm down, that there will be peace eventually. Those days are long past.

With the BRICS Summit this week, Vladimir Putin made it clear the main topic of discussion will be to challenge directly the dollar reserve standard. And that means relations between us and the Russia/China/Iran (not India) will only worsen.

This is part of what is putting a bid under the metals, a stronger bid than a top in the euro and a bottom in the dollar. Gold and silver are simply more complicated than this.

Bottom Line

That said, what’s happening in the crypto market is also not sustainable in the short-term. The correction in Bitcoin and Ethereum may already be underway with a near 10% drop since Friday evening.

My recommendation here is not to chase the metals higher. Despite an impressive rally both gold and silver from a medium-term technical perspective are still bearish. Things have improved, but this move, like the move up in the euro is not sustainable if the political situation in Europe worsens and the one in the U.S improves.

The Q3 close will tell us a lot about where things stand for 2018. 2017 is setting up to be a major bull trap for metals investors unless somehow, magically, the EU is able to cure its sovereign debt and political issues in the next three to six months.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I own some gold and silver, a handful of cryptos including LTC and ETH, a few guitars and too many goats.