Do you still eat at Chipotle Mexican Grill Inc (NYSE:CMG)?

Consumers tend to have one of two opinions on the chain after the foodborne illness scandals of last year. Some people say that the fast-casual Mexican grill is dead to them. They insist they’d never risk a brush with E. coli for a burrito. Others say that the food is too good to pass up over a couple of isolated sanitary incidents.

To be honest, I’m in the latter camp. Call me reckless... I just can’t say no to those carnitas.

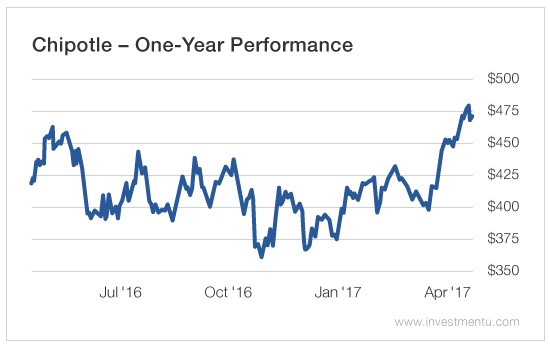

You can see the division between former and ongoing consumers in a graph of Chipotle stock. The chain still has lots of loyalists like me, and we’ve given it some small sales upticks throughout the last year.

Now, after this week’s earnings beat, investors are betting that there are more Chipotle loyalists out there than there are naysayers. Is this the beginning of a big comeback for Chipotle stock?

The Numbers Behind the Earnings Beat

The big headline behind this earnings beat is the same-store sales growth. Chipotle’s growth of 25% surpassed analyst expectations for a double-digit increase. This is largely believed to be the result of promotional efforts and good weather.

Chipotle’s share buyback program also helped bolster its earnings numbers. The firm devoted $1 billion to repurchases at the onset of the food poisoning scandal. It added another $100 million to that war chest back in January.

The firm is also in the process of raising prices to compensate for higher avocado-related expenses. (The green delicacies are largely grown in Mexico, where farmers and exporters are worried about the risk of Trump interfering in their export industry.)

That might have negative effects on the chain in the long term, if Chipotle’s entrees become too pricey for consumers. But in the short term, it equates to more revenue to cover those costs.

Is Chipotle Stock a Good Value?

Chipotle stock went from $750 a share to $350 a share over the course of the E. coli scandal, so it could be very cheap.

Here’s the problem - the most popular metric for this kind of valuation is price-to-earnings ratio (P/E). Chipotle’s earnings have been at or below zero for much of the last year, which means P/E has been undefined. You can’t have zero or below in the denominator.

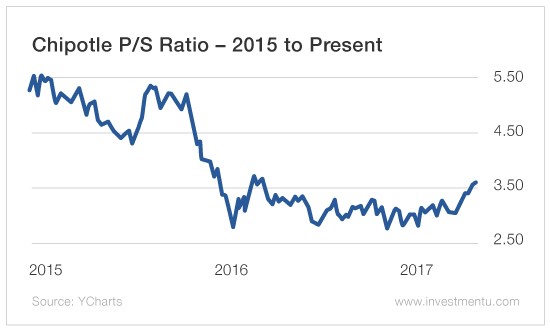

Another popular valuation multiple is price-to-sales (P/S). In circumstances like Chipotle’s, this can serve as a more reliable indicator of stock pricing. Negative sales aren’t a thing; Chipotle hasn’t been paying people to eat its burritos.

But it has rolled out a laundry list of sales and marketing initiatives. They released a mobile game that offered winners a free burrito, introduced new menu options, and added some sales-driven directors to its board.

As you can see below, these efforts have been fairly successful in terms of P/S: 3.5 is still a bit high, but it’s better than it used to be.

Given that the chain reported growth in same-store sales this week, this long-term decline in P/S is certainly a bullish signal for Chipotle stock.

Has the Mexican fast-casual chain finally recovered from the stomach bug that has dogged it for the past couple of years? It's a little too early to say based on Chipotle’s Investment U Stock Grader results...

Earnings per Share (EPS) Growth: Chipotle reported a recent EPS growth rate of -74.89%. That's below the hotel and restaurant industry average of 43.75%. That's not a good sign. We like to see companies that have higher earnings growth.

Price-to-Earnings (P/E): The average price-to-earnings ratio of the hotel and restaurant industry is 38.46. And Chipotle’s ratio comes in at 359.07. Its valuation looks expensive compared to many of its competitors.

Debt-to-Equity: The debt-to-equity ratio for Chipotle stock is 0. That's below the hotel and restaurant industry average of 252.42. The company is less leveraged.

Free Cash Flow per Share Growth (FCF): Chipotle’s FCF has been lower than its competitors over the last year. That's not good for investors. In general, if a company is growing its FCF, it will be able to pay down debt, buy back stock, pay out more in dividends and/or invest money back into the business to help boost growth. It's one of our most important fundamental factors.

Profit Margin (PM): The profit margin of Chipotle comes in at 1.54% today. And generally, the higher, the better. We also like to see this margin above that of its competitors. Chipotle’s profit margin is below the hotel and restaurant average of 13.14%. So that's a negative indicator for investors.

Return on Equity (ROE): Return on equity tells us how much profit a company produces with the money shareholders invest. The ROE for Chipotle is 1.3%, and that's below its industry average ROE of 24.23%.

For now, the outlook for Chipotle stock is still pretty bad. But based on this week’s quarterly results, it may finally be turning around.

In the meantime, I’ll still be chowing down on those burritos.