Investing.com’s stocks of the week

(From A Few Good Men:)

Col. Jessup: [refering to Santiago] I felt his life might be in danger.

Kaffee: Grave danger?

Col. Jessup: [sarcastically] Is there another kind?

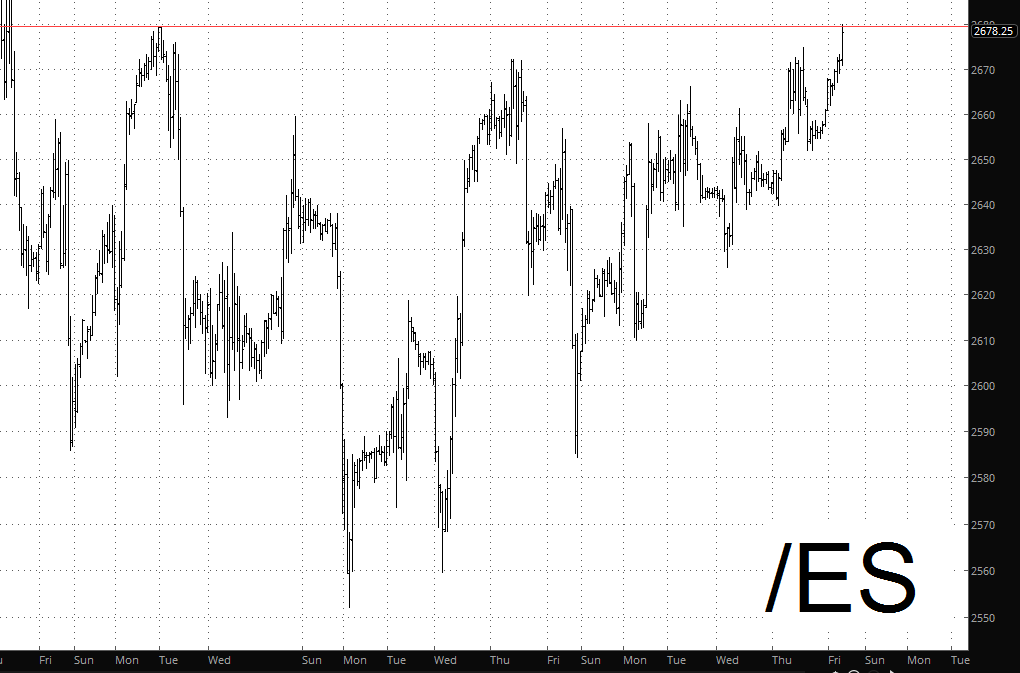

I think the bears could be in “grave danger” for two related reasons. First, we have either filled or are about to fill some important price gaps, and second, there is a fairly well-formed basing pattern over the past several weeks, as shown here on the S&P 500 futures:

Looking at the same base in a larger context, you can see how it could power the markets back into that thicket of activity between 2680 and 2820. That overhead supply would slow things down, yes, but today could set the tone for the next week or two, depending on its outcome.

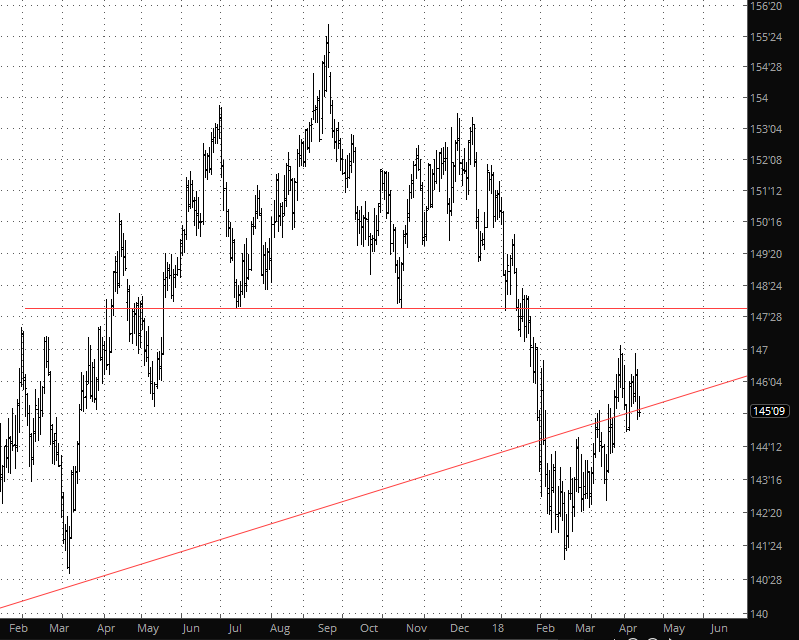

One ally I have left is bonds, which helped me yesterday. They have been succumbing to an important topping pattern, and as they (hopefully) continue to weaken, interest rates will raise, which will weaken my real estate shorts and my puts on IYR, XLU, and TLT. Here is the continuous contract on the /ZB:

With trade war fears easing, it seems investors are getting their boldness back. We’ve been in a terribly uncertain state for almost three months now, and only a definitive earnings season, which is going to start in earnest next week, will clarify the longer-term.