There is a lot of talk now about the yield curve flattening. A flattening curve is commonly viewed as bad for gold, and according to Mark Hulbert, in Why you should care about the yield curve, is an indicator of a coming recession.

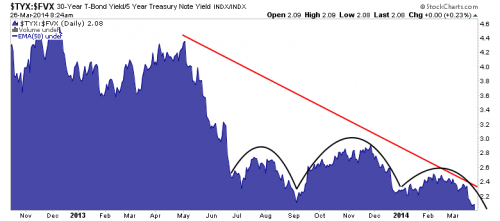

But is the curve really flattening or is this all hype based on Janet Yellen’s press conference comments? Here is a chart the likes of the type we have been using for many months now, comparing the U.S. 30-Year Treasury bond vs. the U.S. 5-Year bond's yield.

MarketWatch shows a similar chart in this article.

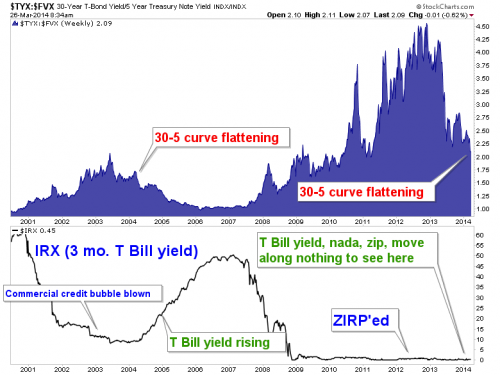

Here we should lend some perspective. Okay Beuller, what is different this time from the last flattening?

I am not going to pretend to sit here like some genius blogger and post all the conclusions so that we all know exactly what is going on (according to one guy’s imperfect world view). But what we do know is:

- In 2004 Alan Greenspan began to get the memo that his ultra lenient monetary policy had instigated a growing bubble in commercial credit.

- As the stock market and economy began to show favorable signs, this policy was incrementally withdrawn, which in normal times would be the thing to do. The curve flattened in line with policy making goals (of tamping down inflation expectations).

- Unfortunately, it also tipped the leveraged system into a domino effect of high profile corporate financial failures, that resolved into the crash of 2008.

- Enter ZIRP in December 2008. This was a brave new policy decreed by the will of man and endures to this day.

- The curve has been flattening for over a year now.

- Some Fed jawbone “you know”, flapped about a withdrawal of ZIRP sometime well out in 2015, “that sort of thing”.

- There is a distortion built into the system. This is not opinion, it is a fact presented by the chart above. How it will resolve is up for debate among various eggheads.

But there is a running distortion on the fly and not you nor I know how it will resolve. It is not normal and it (in my opinion) belies desperation on the part of those promoting it. To me, it looks like the latter stages of an ‘all or nothing’ operation that was put in play years ago. ‘All or nothing’ implies all in and totally committed. Otherwise, why has ZIRP not already (and long ago) begun to be incrementally phased out?

One conclusion that can be made is that this alignment continues to be favorable to whomever it is that borrows from the Fed Funds window exclusively. That is of course due to the beneficial (and again in my opinion, immoral) ZIRP. They can lend out at any other point on the curve for a favorable spread.

The curve is not flattening when ZIRP is used as the short term measurement point, as it is when the U.S. 5-Year, U.S. 3-Year or U.S. 2-Year yields are measured.

And people wonder why the rich get richer. They should stop looking at politics and start looking at finance (okay, the post rambled a little).