Hello Gaugers. Happy holidays to you all. It is rare that three major religious holidays are all celebrated on the same weekend: Easter, Passover, and Ramadan.

Everyone at MarketGauge wishes you and your families an enjoyable holiday. No matter what you observe (or not) we wish much peace, joy and fairness for you and your extended families. More importantly, we pray for calm and unity among all people of this world.

Dollar Falling, Gold Rising. What's the Plan?

The U.S. dollar has taken center stage in the world's economy as major countries are reaching agreements to stop trading with the U.S. dollar and use their own currencies instead.

As the world's reserve currency, the U.S. dollar is essentially the default currency in international trade and a global unit of account. Because of that, every central bank, Treasury/exchequer, and major firm on Earth keeps a large portion of their foreign exchange holdings in U.S. dollars. And because holders of dollars seek returns on those balances, the ubiquity of dollars drives a substantial portion of the demand for U.S. government bonds in world financial markets.

Perhaps not anymore.

China, the Superpower Wants Things Their Way.

Two weeks ago, the Brazilian government, the largest economy in Latin America, revealed that they had reached an agreement with China, the prime opponent to U.S. economic power. Brazil wants to settle its immense trade with China in Chinese Yuan. As part of their arrangement, the two countries will be able to exchange their currencies directly. "The expectation is that they will reduce costs…promote even greater bilateral trade and facilitate investment," the Brazilian Trade and Investment Promotion Agency said in a statement.

Last year, an unprecedented $150.5 billion in two-way trade occurred between China and Brazil, and China is engaged in similar activities with other nations, including Russia and Pakistan. Today, Brazil is the largest recipient of Chinese investment in Latin America, driven by spending on high-tension electricity transmission lines and oil extraction.

In the past, due mainly to the U.S. position as the global economic power, Brazil would first convert their purchases and trade to U.S. dollars before a transaction would occur with China. Not anymore. The idea that Brazil will transact with China directly without the U.S. intervention is just one of many countries, that no longer trust the U.S., to begin doing the same thing.

Times have changed around the world.

The U.S. no longer looks as socially or economically stable as it was just a decade ago. Now an increasing number of nations are eager to find alternative financial systems to insulate themselves from Washington's willingness to use sanctions as political leverage. "Joint efforts to decimate the U.S. dollar are also being discussed by Brazil, Russia, India, China, and South Africa, known as the BRICS," says Atlantic Council senior fellow and Professor of Political Science at the University of Toronto Carla Norrlof.

They're also encouraged to dodge the Euro and find alternatives to the U.S. dollar-dominated SWIFT secure messaging system global banks use to transfer funds. Earlier this month, South African Foreign Minister Naledi Pandor told the media she had 12 new nations expressing interest in joining the cash alliance. "Saudi Arabia is one," she said, "along with the United Arab Emirates, Egypt, Algeria, Argentina, Mexico and Nigeria." And Brazil's new deal with China is another sign the informal cooperation behind BRICS is taking effect.

In the meantime, Saudi Arabia, Iran, India, and the United Arab Emirates have begun exploring alternatives to the U.S. dollar when paying for oil. They have cause to do so. "The vast majority of energy (oil and gas) contracts are invoiced in U.S. dollars, so energy prices typically move together with the U.S. dollar," Henckel writes for the Australian Institute of International Affairs (AIIA). "For energy-importing countries, this means that measured in their own currency, the adverse impact of higher energy prices is exacerbated by an appreciating U.S. dollar."

"China has made some concerted efforts to expand the use of the renminbi (yuan), for example, through the Belt and Road Initiative, but progress remains slow." But Russia's invasion of Ukraine and China's aggressiveness towards Japan, Taiwan, the Philippines, Malaysia, Vietnam, Indonesia, and India is forcing the world to choose sides. "As the world becomes more divided by this war, the Chinese yuan may become the safe haven for Russia and other like-minded countries," says Henkel.

Henckel believes the Chinese yuan will continue to rise as a global currency "but only to a point."

According to Peter Earle, an Economist with AIER (American Institute of Economic Research, "The dollar, in some shape or form, will be around for a long time. Perhaps very long. But by weaponizing dollar dominance and permitting expanding mandates to disorient U.S. monetary policy, the dollar's fate as the ‘lingua franca’ of world commerce over the long haul may already be sealed.”

However this plays out over the coming years, this scenario appears to be another in a series of recent blows to the central role of the dollar in global trade.

The Impact to Our Financial Markets Due to the Recent Decline of the Dollar

In previous Market Outlooks we have frequently commented on the correlation between the U.S. stock market to the U.S. dollar. U.S. (and foreign) stocks tend to go up in sync with the fall of the U.S. dollar. Why?

As we have also gone to great lengths, more than 50% of the revenues (and therefore earnings) of the S&P 500 are generated overseas. When Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT) or any large multi-national company converts their overseas revenue to earnings, a lower U.S. dollar portends greater earnings. This is due to the fact that their sales in another currency, such as the euro, is an appreciation of revenue before it is converted back to U.S. dollars for earnings computations. A lower dollar also means Europe can purchase more goods at lower prices due to their higher currency price.

The fastest way to get the U.S. dollar to rise is by raising rates and attracting capital from around the world into our debt offerings priced in U.S. dollars.

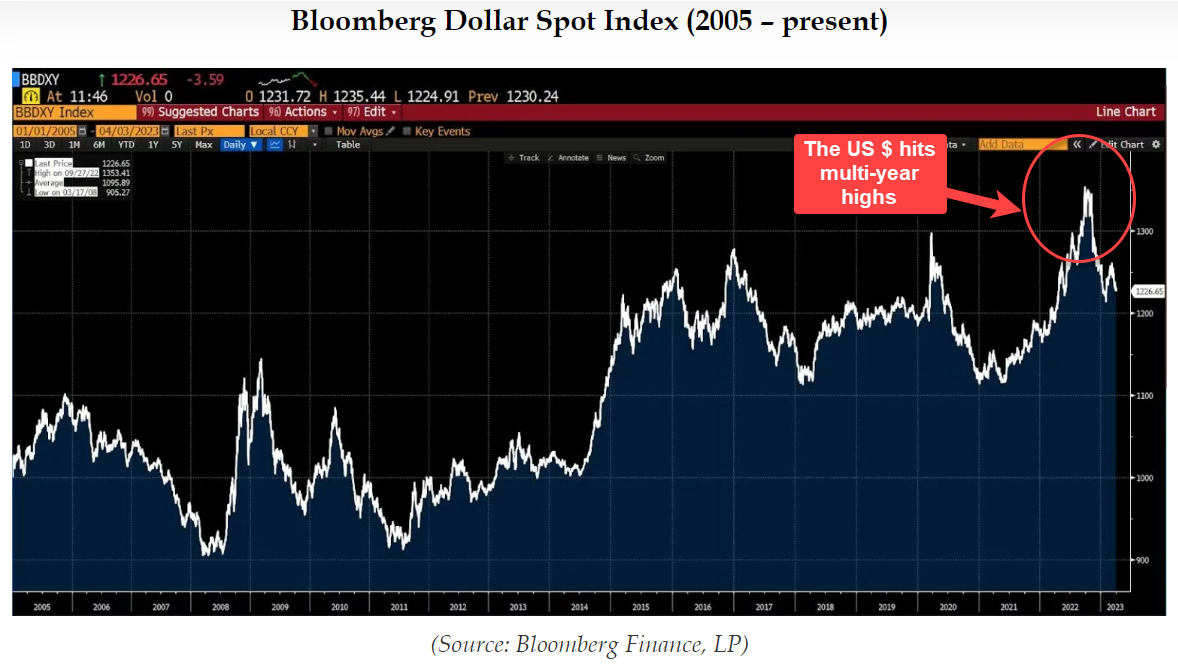

After hitting new multi-year highs during 2022 as our interest rates were going up, the dollar began to decline in the fall (2022). Coincidentally it was also when interest rates were temporarily topping out. See multi-year U.S. dollar chart below:

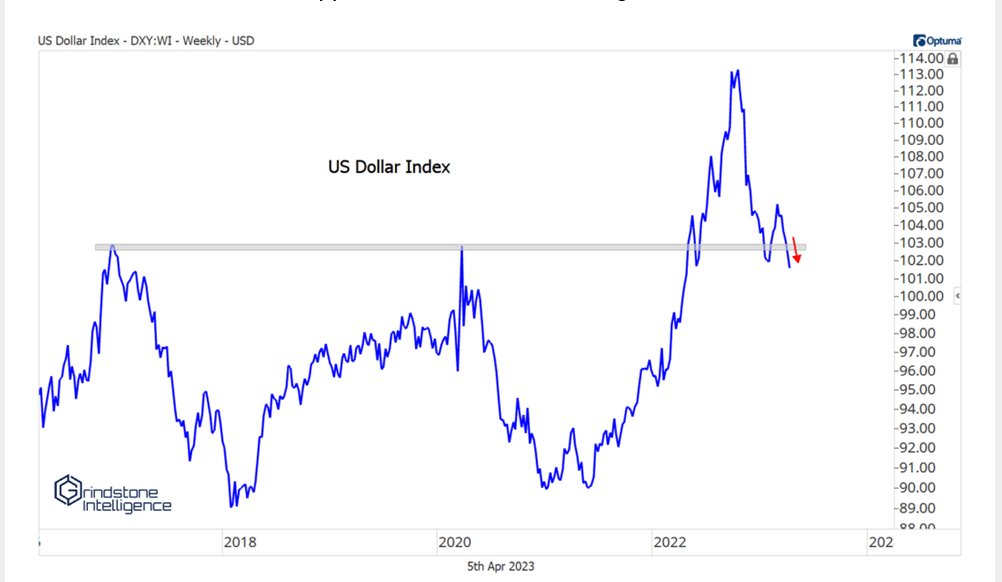

Here is a clearer view of the U.S. dollar beginning its decline in October 2022:

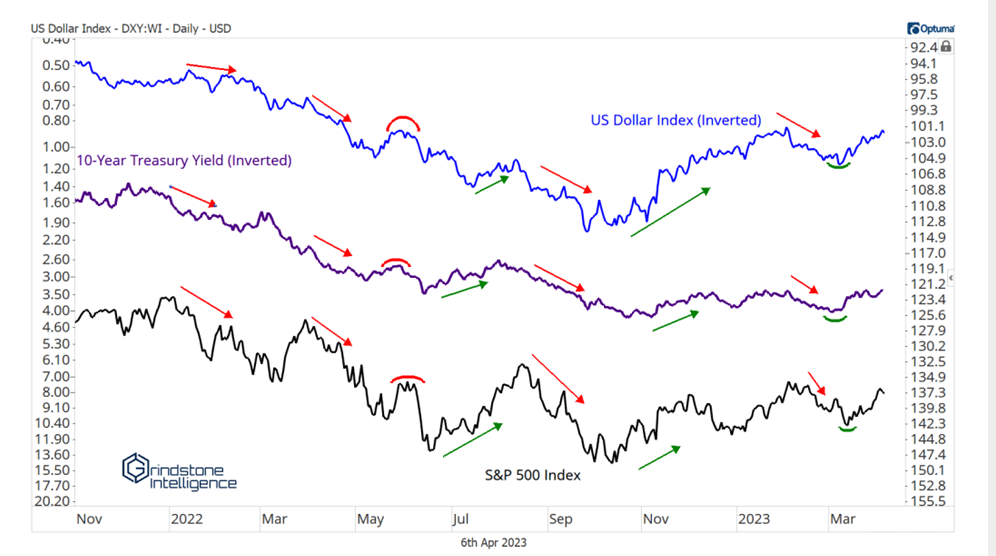

There was an immediate benefit to our stock market as well as many commodity markets, including Gold and Silver. See the inverted table below showing how the decline of the U.S. dollar has benefited the other markets:

The U.S. dollar tends to go in cycles.

The top was last October. And now, with the events of the past month (highlighted at the beginning of this Outlook), the fundamental picture for the dollar is clearly negative. So, if we assume this extraordinarily long bull cycle for the dollar ended in October, we are just six months into a new bear cycle.

It's very, very early. And the average change in the value of the dollar (in the prior five cycles), from extreme to extreme is > 50%. So, in this case, this bear cycle would portend a better than 50% decline in the global purchasing power of the dollar (relative to a basket of major currencies).

According to Bryan Rich of Pro Perspective, the U.S. dollar tends to operate in distinct 15-year cycles. The past 15 years we have seen a less bullish/bearish cycle and one that drifted up and then sideways.

However, during this time, we did encounter some "different" economic scenarios which may have influenced the dollar more than typical economic cycles. These included the Great Financial Crisis of 2008-2009, the COVID Pandemic and now an extremely hawkish and aggressive Federal Reserve policy. As we said previously in this article, times are changing. See chart below:

If the U.S. dollar declines further, what asset classes benefit?

As previously noted, U.S stocks have benefitted already since the low reached in October 2022. Treasury yields across the spectrum have declined, and bond prices have rallied. But both stocks and bonds continue to weigh the impact of an economic slowdown and are rangebound. See examples below:

The biggest beneficiary of the decline of the U.S. dollar has been technology stocks. See chart below:

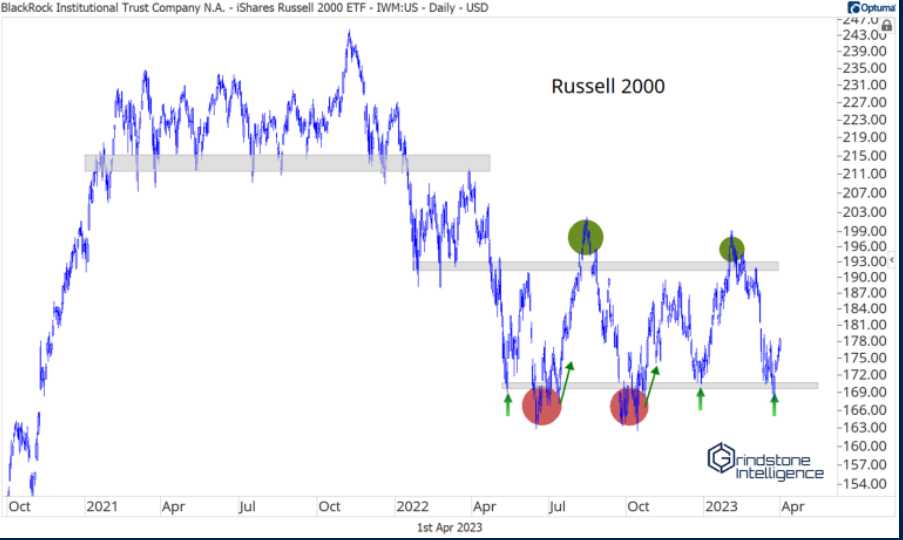

Large-Cap Stocks have recently benefitted much more than small-cap stocks

As we have repeated in recent months, large-cap stocks with pristine balance sheets and significant multi-national exposure have benefited far greater during this recent rally in stocks since October of last year.

Small-cap stocks have been having a difficult time recently. This is due in large part to a) higher interest rates, b) less revenue that positively benefits from the recent decline in the U.S. dollar's value, c) a more dramatic slowdown in business for smaller companies, and d) much of the regional bank weakness are with publicly traded banks that are in the smaller capitalization categories.

More importantly, the small-cap index, the Russell 2000 (smallest 2000 publicly traded companies) is barely hanging on to its longer-term trend. If this should falter, watch out below. This does not necessarily bode well for the overall stock market. As they say on Wall Street, without soldiers, the generals may not continue to sustain leadership. See charts below:

With the U.S. dollar decline, metals - gold, silver, and miners, maybe the biggest beneficiaries.

Last year Mish as well as several of our investment strategy algorithms began to identify a potential dollar decline. Today several of our investment strategies are invested in gold, gold miners and other commodity related ETFs and companies.

Gold is closely tracking the U.S. dollar (decline) and is close to reaching a triple top. Quite often when the underlying securities/commodities break through a triple top, it is off to the races. See chart below:

Moreover, if you look at the long-term movement of gold's consolidation, you will see what appears to be a cup and handle formation. The breakout from a "cup and handle" tends to be very bullish. See chart below:

Another positive development in the "invest in gold" theme is that this past week 3 GOP Congresspeople introduced a Gold Standard Bill to stabilize the U.S. dollar.

Rep. Alex Mooney, R-W.Va., joined by Reps. Andy Biggs and Paul Gosar, both Arizona Republicans, introduced H.R. 2435, the Gold Standard Restoration Act, to facilitate the repegging of the volatile Federal Reserve note to a fixed weight of gold bullion.

Upon passage of H.R. 2435, the U.S. Treasury and the Federal Reserve are given 24 months to publicly disclose all gold holdings and gold transactions, after which time the Federal Reserve note "dollar" would be formally repegged to a fixed weight of gold at its then-market price.

This would be very positive for gold and gold mining stocks and give additional ammunition for a rally higher in this sector.

Here are the other important highlights we have gleaned from BIG VIEW:

Risk-On

- There has been a clear improvement in volume patterns across the major indices, with far more Accumulation than Distribution days over the past 2 weeks. The Diamonds (DIA) and S&P 500 (SPY) have had zero distribution days over the past 2 weeks. (+)

- The 1-month vs 3-month volatility ratio (VIX / VXV) continues to improve. (+)

- Cash volatility ($VIX.X) remains in a bearish phase and is sitting at its range of lows, a positive sign for equities. (+)

- Growth stocks (VUG) continued to lead while Value stocks are lagging. (+)

- Regional Banks (KRE) may have flushed themselves out to the downside for now if they can manage to hold on to recent lows and the potential double bottom that is forming. (+)

Risk-Off

- Despite the market holding up, speculative sectors were down the most over the past 5 trading days with Semiconductors (SMH) and Consumer Discretionary (XLY) down while risk-off plays such as Consumer Staples (XLP) and Utilities (XLU) were up the most. (-)

- Precious metals including Gold Miners (GDX (NYSE:GDX)), Gold (GLD (NYSE:GLD)), and Silver (SLV) were strong leaders this week, and Gold has finally reclaimed the psychological $2,000/oz. Level. (-)

- Large Caps (DIA) are outperforming Small and Mid-Caps by a wide margin. (-)

- Soft Commodities (DBA) made a golden cross right as they are running into multi-month technical resistance and are already at potentially overbought levels on both price and momentum according to Real Motion. However, if DBA takes out the $21 level, then it would signal a breakout of a multi-year base. (-)

- Due to the cutback on oil production from OPEC, Oil (USO (NYSE:USO)) gapped up this week and is now sitting right at its 200-day moving average. (-)

Neutral

- On a shortened week it was a mixed bag for indices while the markets digested their recent gains. Large caps are slightly up, small caps keep going down, and the S&P 500 and Nasdaq remain unchanged. (=)

- Consistent with what we saw last week, market internals were in fact running a bit rich according to the McClellan Oscillator and look to have backed off from overbought levels while remaining in a positive area. (=)

- With the bond market strengthening relative to equities, Risk Gauges have backed off from Bullish to Neutral this week. (=)

- The number of stocks within the S&P 500 and Russell 2000 indices that are above their 10-day moving averages has rolled over from overbought levels this week. (=)

- Interest rates have eased along the yield curve, with TLT closing at its best levels since the beginning of the year. It is unclear how the market is going to react to Friday's employment numbers, which were a bit of a mixed bag. (=)

- Semiconductors (SMH) remain bullish and Biotech (IBB) moved into its bull phase on the week, while Retail (XRT) and Transportation (IYT) remain in distribution phases, providing a mixed bag altogether for Mish's Modern Family. (=)

- For the most part, European stocks have continued to outperform the U.S. market, while Asian markets have lagged. (=)