The USD/JPY is facing the ultimate crossroads, as sellers start to line up against the pair ahead of trading this week, and the risk of a collapse towards the key 105.00 handle now becomes likely. However, the looming risk factor is the Bank of Japan, and whether the central bank intends to intervene within the market.

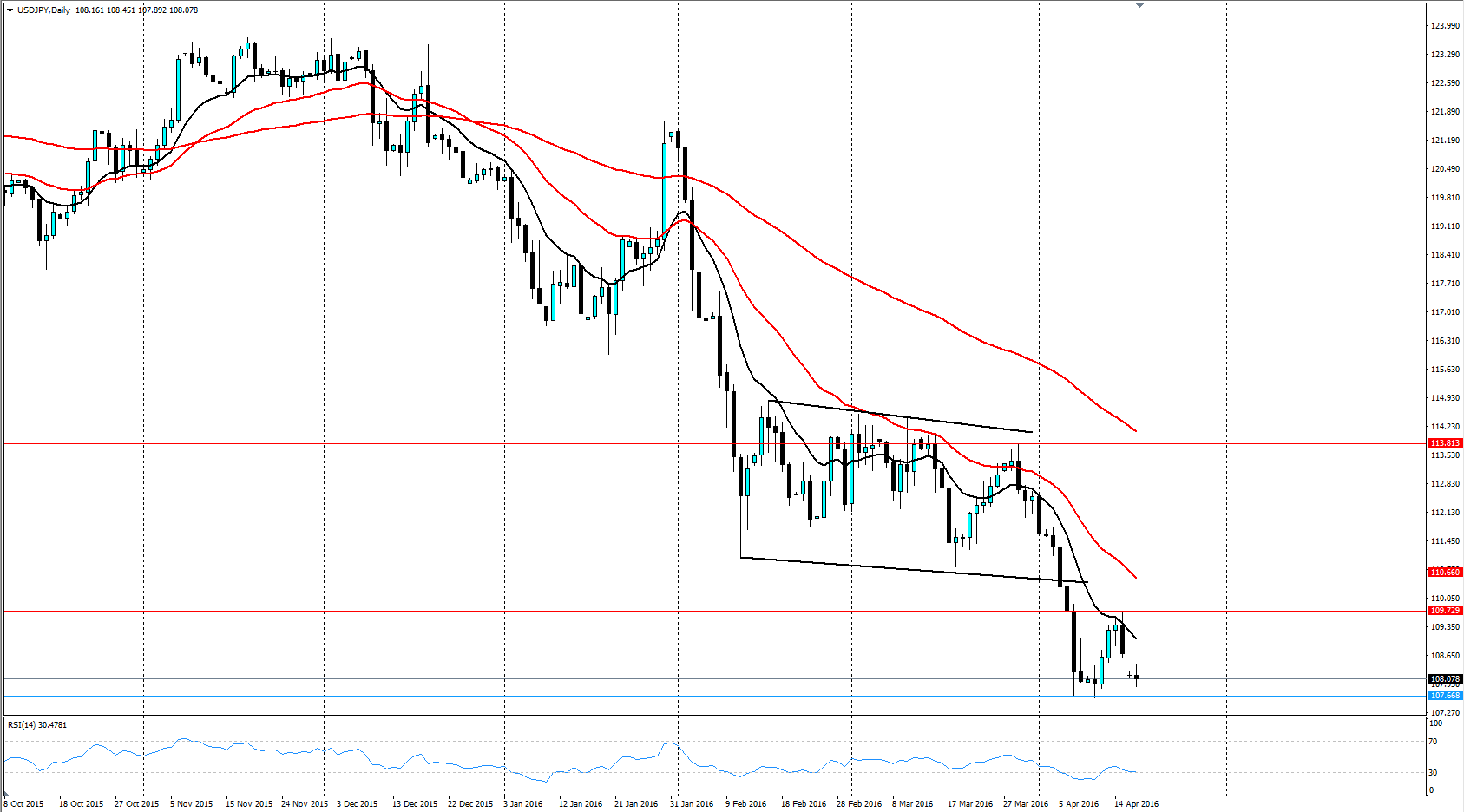

The week remained a difficult one for the USD/JPY as the pair initially managed a small rally to 109.40 before falling sharply to close the week out around the 108.70 mark. The short term rally was largely cut short by a broad sentiment swing towards the US dollar late on Friday which erased any chance of the pair staging a move above the 110.00 handle. In addition, the BoJ has been largely attempting to jawbone a weaker yen by suggesting that nothing within the current G20 agreement restricts them from a short term currency intervention. Regardless, the move appears to have failed and the pair gave back nearly half of the gains.

Looking ahead, markets will largely be awaiting the US Unemployment Claims and JPY Tertiary Industry Activity results for the short term trend. In particular, an increase to US Unemployment Claims could see the pair again plunge to challenge the 107.00 handle. However, there is a risk that further USD depreciation could bring the Bank of Japan to the table in the form of an intervention. Subsequently, watch for the central bank ringing around to obtain currency quotes from dealers.

From a technical perspective, the USD/JPY remains largely bearish as the pair fails to break through the 12 EMA. In addition, it appears that there is some strong support between 110.00 and 111.00 which would make any bullish move difficult. However, our bias remains neutral given the current oversold status of the RSI oscillator. Look for the pair to consolidate before attempting a break of the 107.00 handle in the week ahead. Support is currently in place for the pair at 107.66, and 106.63.

Ultimately, there is likely to be plenty of pain for the yen moving forward both technically and fundamentally. However, despite the largely bearish forward view, everything could turn on a dime if the Bank of Japan enters the market to depreciate the yen. At what level that is likely to occur is anyone’s guess, but I would suggest that the 105.00 handle might very well turn out to be a key level in the very near future.