Key Points:

- USD/JPY rallies due to an uptick in US Bond Yields.

- Pair reaching a key reversal point.

- Watch for a break of 106.20 to confirm a bearish bias.

The global capital markets have been awash with volatility over the past 24 hours as the world continues to digest the recent U.S. Presidential election result. We have seen some sharp swings but, ultimately, the greenback has proved buoyant and there has been some significant gains across most of the cross pairs. In fact, the USD/JPY has rallied strongly and is nearing a challenge of the 107.00 handle. However, there are some concerning technical signals starting to appear which could see the pair tumble in the coming days.

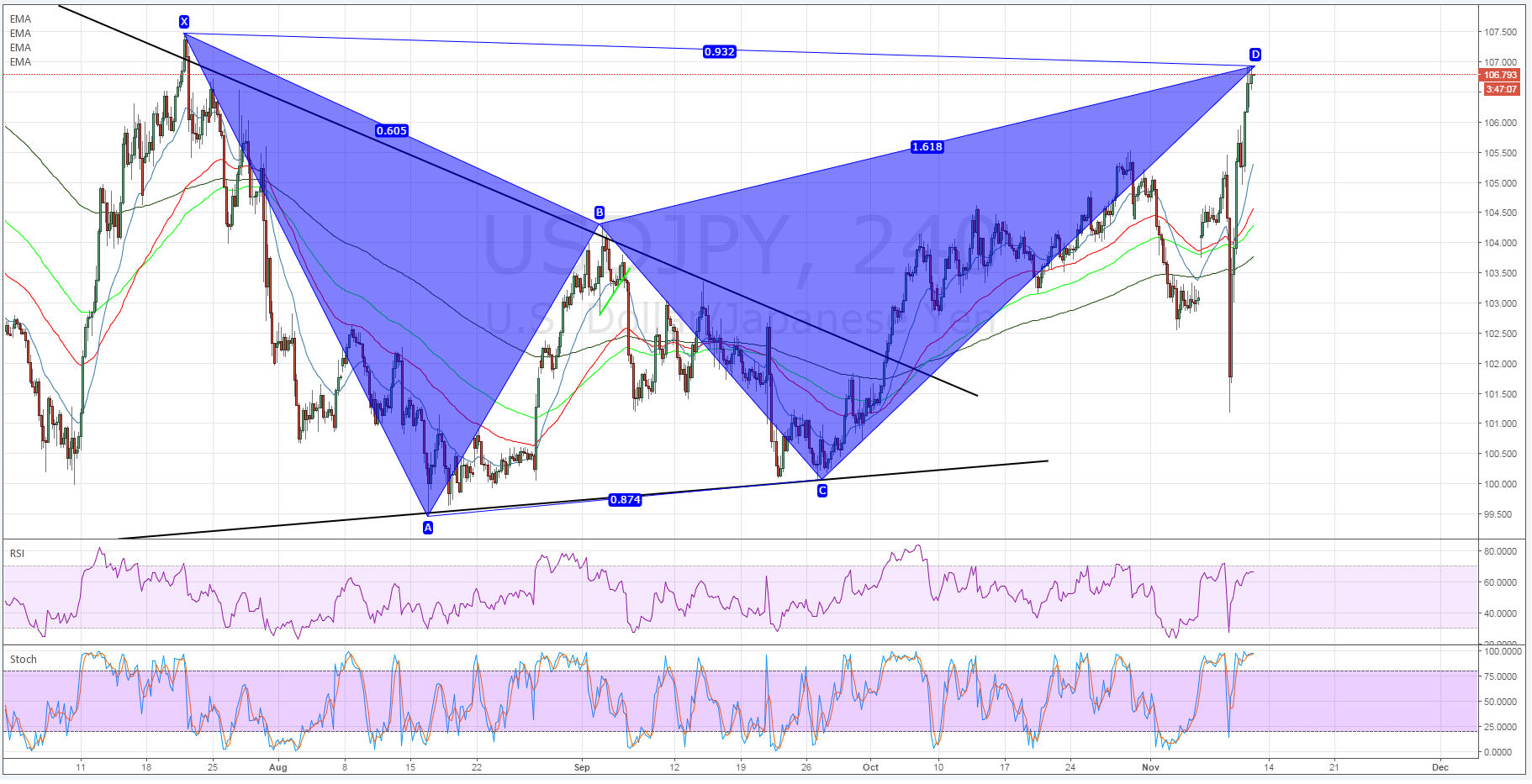

In particular, the 4-hour timeframe is relatively illuminating in that it is clearly showing the recent completion of an XABCD pattern around the 106.80 mark. Additionally, the Stochastic Oscillator is now strongly overbought and RSI is also not far behind on the same timeframe. Subsequently, there are plenty of technical factors to suggest that the pair will enter a corrective phase, especially given the overbought status of the Oscillators and the recent completion of the “d” leg.

A realistic forward looking scenario for the USD/JPY would be a failed attempt to breach the 107.00 handle and then a relatively swift decline back below 106.00. The key entry point is likely to be around the 106.20 mark with the downside target around support at 104.24 which puts it right within a key liquidity zone. However, given the inherent volatility that currently exists within markets, effective money management will be critical in trading the coming swing.

Fundamentally, much of Thursday night’s bullish drive was due to an uptick in US bond markets and the subsequent flow of capital out of the yen. In particular, the 30-year treasury bond yields rose to 2.902% and this has clearly exacerbated the capital flows. Additionally, the greenback has also strengthened overnight as the market has taken a positive view of news that Trump plans to repeal the Dodd-Frank financial regulation which may help to again buoy the banking sector.

Ultimately, there have been confluences of fundamental and technical factors that have led to the USD/JPY’s recent rally. However, the technical indicators are now turning and we are likely to see the currency pair come back to earth over the next few sessions. Keep a close watch on the pair for a break of 106.20 as this is likely to signal the start of the slide.