The USDCAD has enjoyed a relatively decent move over the past few weeks as the greenback has rallied in response to some robust US job figures and a depressed oil market. Subsequently, price action has rallied from a low of 1.2829 to its current position just above the 1.31 handle. However, the pair is now flirting with a reversal zone that could see it taking a dive in the coming days.

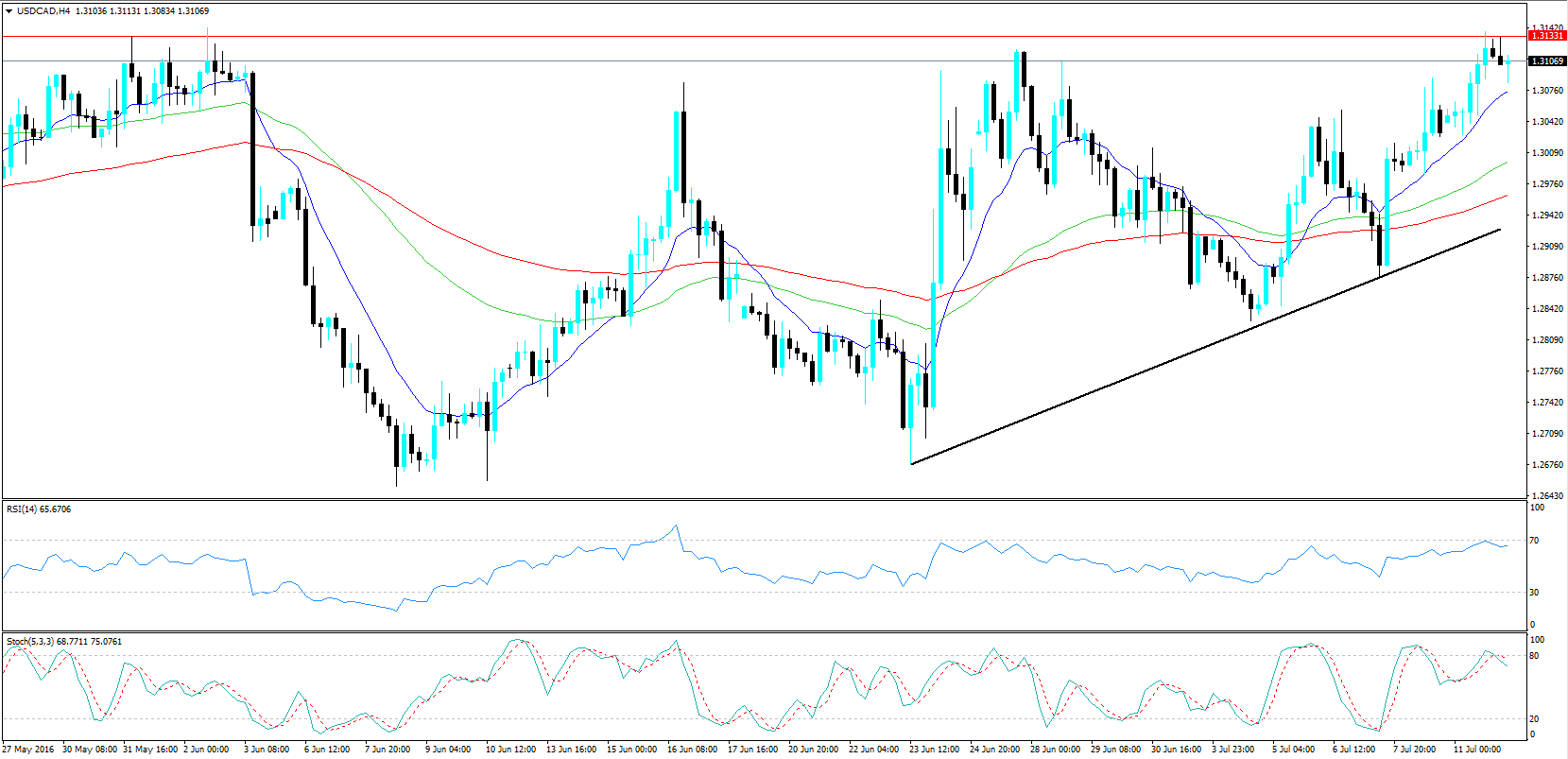

In fact, the 4-hour chart shows the pair’s current conundrum best as price action has clearly reached its zenith at 1.3133. This level has been a key reversal zone over the past few months with the last entry and pullback occurring in late June. In addition, the RSI Oscillator is also flirting with the overbought territory whilst Stochastics has already started its decline. Subsequently, there is a very real risk of a corrective pullback in the coming days given the technical indicators and where price action currently lays.

On a short term basis, the USDCAD can be seen to be bearish below the 1.30 handle which represents the 61.8% Fibonacci level. Any move below this level is likely to kick of a significant slide targeting the swing lows from the earlier part of the month. Subsequently, watch for a sharp correction if that level is penetrated with likely stop positions placed above 1.3150.

Fundamentally, the Canadian Dollar could also be in for a shot in the arm if oil prices reverse their current losses. This is looking ever more likely considering that there is likely to be a fairly sharp supply disruption following a major strike within the Nigerian crude oil industry. Given the Canadian dollar's direct connect with the commodity price it’s realistic to expect those price gains to flow through to some provide the CAD a much needed boost.

Ultimately, any pullback is likely to target the 1.2875 low from early July and the 1.2842 mark in extension. However, it should be stressed that a retracement is likely to be short term corrective and a return to its meandering rise in the medium term is all but guaranteed.