Investing.com’s stocks of the week

For years it has seemed that many thought interest rates would move higher, yet they haven’t. Well they sure have lately, at a record pace as interest rates this week experienced the sharpest 1-day rise in rates ever.

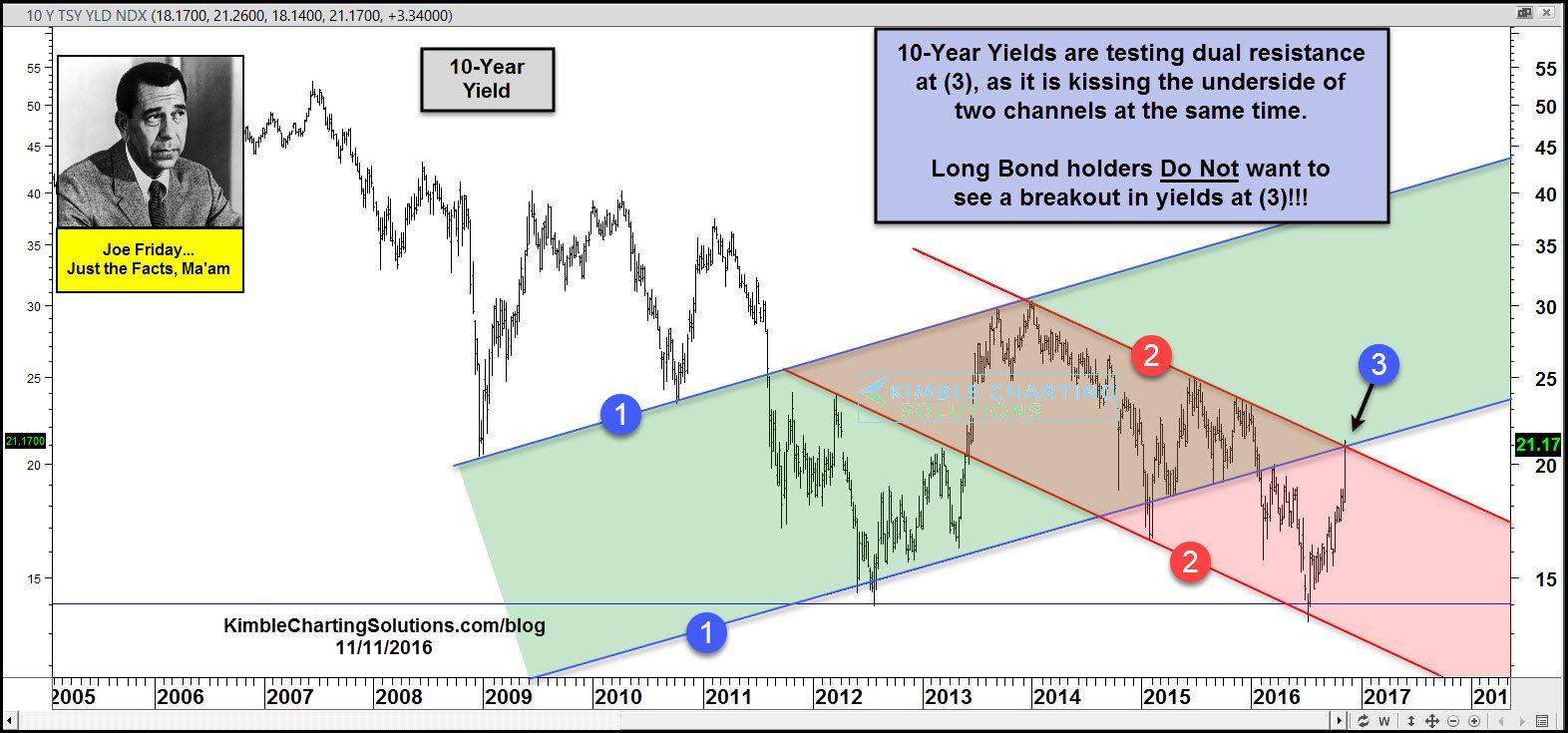

Is the rate rally over or just getting started? We look at an update on the yield of the 10-year note below.

The 10-year yield is testing dual resistance at (3) above, after experiencing a historical rise in rates of late.

Long bond holders DO NOT want to see yields breakout at (3). If rates would happen to breakout at (3) and run back up to the top of rising channel (1), would be painful for bonds.

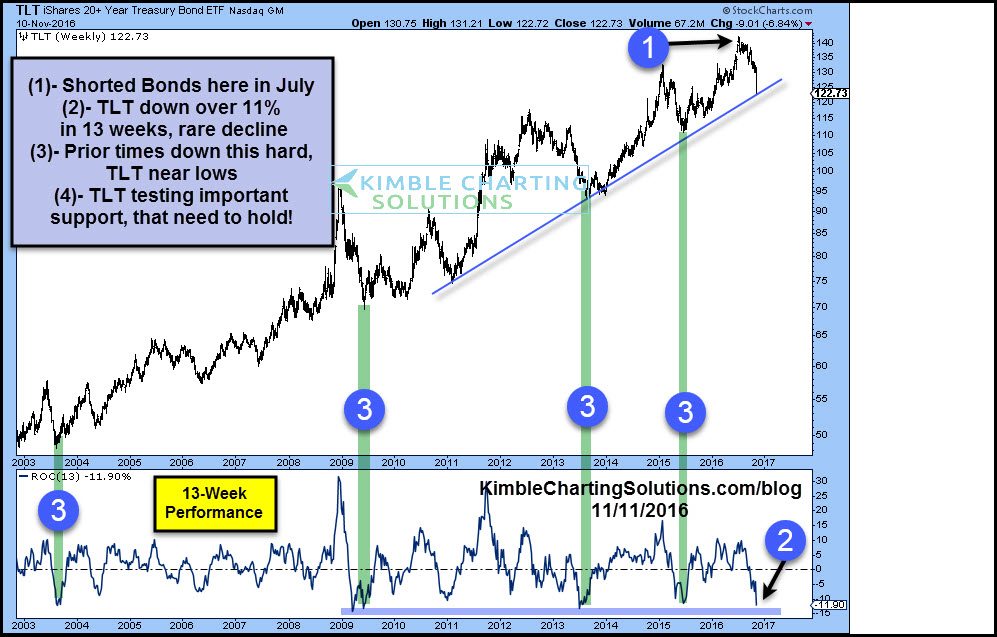

Below shows how rare the large decline in bond ETF TLT has been.

The lower portion of the chart above measures TLT's 13-week performance over the past 13 years. It has declined nearly 12% recently at (2). Most of the times that TLT has fallen this hard over such a short period, TLT was closer to a low than a high.