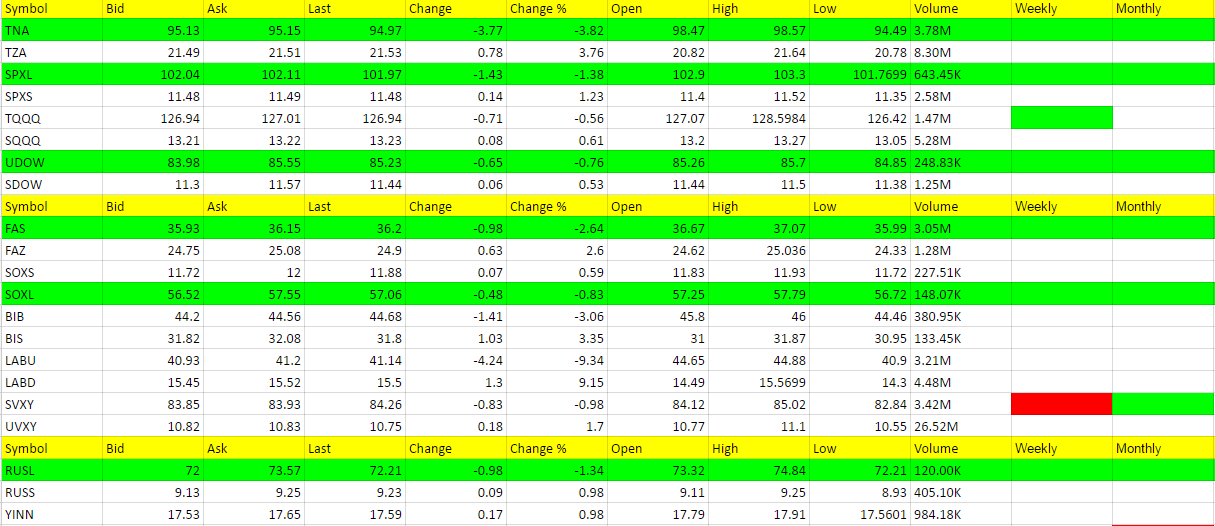

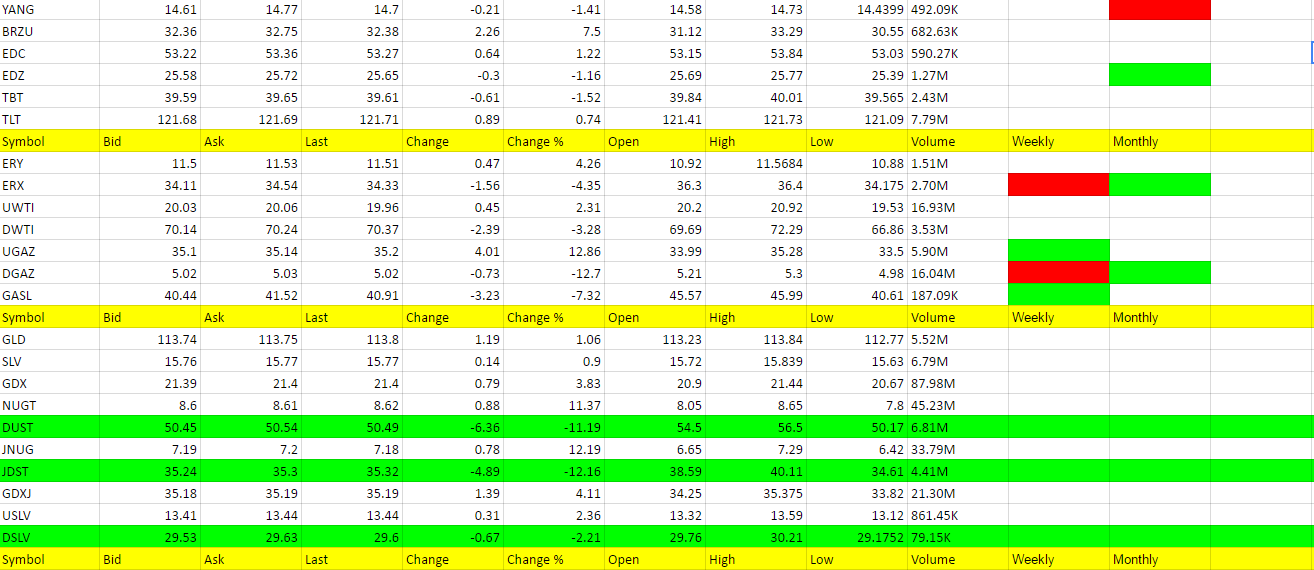

Of late, we have been buying the dips of Direxion Daily Junior Gold Miners Bull 3X Shares (NYSE:JNUG) and Direxion Daily Gold Miners Bull 3X Shares (NYSE:NUGT), two gold stock mining ETFs, and before that profiting nicely on shorting the metals (buying Direxion Daily Junior Gold Miners Bear 3X Shares (NYSE:JDST) and Direxion Daily Gold Miners Bear 3X Shares (NYSE:DUST)).

We have to wonder at this point, is the Trump bull over for stocks? And is gold ready to rise from the beat down it has taken to below $1,200? We’ll find out soon.

ETF Trading Research 11/28/2016

Coming back from a long holiday weekend, I wanted to be a little cautious and started us out with some scalps yesterday. We really didn’t get normal moves in the morning. It was as if market makers were still half asleep. Even after lunch we barely got anything. I don’t think they want to shock the markets lower, but feel a move lower is in the works and that is where we concentrated yesterday.

While we did scalp, we also are carrying home JNUG, Direxion Daily S&P Biotech Bear 3X Shares (NYSE:LABD), Direxion Daily Financial Bear 3X Shares (NYSE:FAZ) and Direxion Daily Small Cap Bear 3X Shares (NYSE:TZA). I’m looking for a gap down in the market and move higher in gold for now, along with more of a dollar sell-off.

We sold the last 1/2 shares of VelocityShares 3x Long Natural Gas (NYSE:UGAZ) if anyone carried it over the weekend. I know one of you bought UGAZ a couple times and wrote and told me they cleared 17% twice and 13% on JNUG from Friday entry (they might have bought when I gave out my mock mutual fund as that is about where 13% comes from 6.30 to 7.15).

One thing you have to know with these fast moving leveraged ETFs, is there is plenty of time to catch a trend and profit. I would rather be conservative and miss a little run in the beginning, but catch the bulk of the run that can still come. We have done that playing both sides of gold miners with JNUG and JDST. I don’t see that changing. I don’t like getting a stop that is one penny before I say to stop out though. Sometimes I am a little too conservative.

LABD, FAZ and TZA all finished at their highs of the day yesterday. JNUG within 6 cents.

I stayed away from oil yesterday as I don’t have a good substitute for VelocityShares 3x Long Crude (NYSE:UWTI) and VelocityShares 3x Inverse Crude (NYSE:DWTI) and don’t want readers in those ETFs right now being they are going to be pretty much obsolete soon. I looked at some alternatives but they are not following oil well.

I just feel a market turn coming is all, which does as you’ll see in this report go against the weekly/monthly green trend on the metals. As always, keep stops. We have a long few weeks before the next run-up to the Christmas holiday.

JNUG 6.30 Now 7.24LABD 14.48 Now 15.53UVXY 10.61 Now 10.77I still like all 3 plus the ones I mentioned above, FAZ and TZA if we are going to get more market weakness. ProShares Short VIX Short-Term Futures (NYSE:SVXY) turning red has me eyeing ProShares Ultra VIX Short-Term Futures (NYSE:UVXY) now too.

Today's Economic Data

8:30 AM: U.S. GDP

Stock Market

On Sunday night I wrote: “Still think the market is overheated and due for a pullback” and yesterday we took advantage of it. We will see what the GDP report says, but I will lean short for the time being after the holiday hooplah.

Foreign Markets

Nothing worth trading on these yesterday so ignored them.

Interest Rates

Sunday night's report I said “iShares 20+ Year Treasury Bond (NASDAQ:TLT) should be in play if we get the market reversal for a bit. A conservative way to go (slow moving).” It was green and is a buy now at 121.70 I think. But I’ll wait to add on more of these until after the GDP report.

Energy

Oil got a reversal again with more news out of OPEC. Multiple reasons to ignore it right now, but with the biggest reason being our trading vehicles UWTI and DWTI are disappearing. We will find substitutes that qualify. Direxion Daily S&P Oil & Gas Exp & Prod Bull 3X Shares (NYSE:GUSH), and exploration ETF did not move with oil yesterday. It’s like Direxion Daily Natural Gas Related Bull 3X Shares (NYSE:GASL) which you don’t see me talk about with UGAZ. Both GUSH and GASL are low volume too and difficult to play. I prefer more volume ETFs and will have to do some homework.

UGAZ topped out pre-market and we sold remaining shares at 34.19, and it continued south to the low 33’s before rising again to move over 35 a couple times yesterday. I didn’t want to trade what I thought would be a volatile day for it, but we could have maybe had one more trade from it. Yesterday was a busy day for me, looking at other opportunities that were short the market where I felt the risk vs. reward was easier for you.

Precious Metals and Mining Stocks

In Sunday night's report I said about JNUG price action that it was “a bullish setup" which is why I wrote in my closing alert on Friday the following;

“I am taking some JNUG shares home with me but not going crazy. Is this the beginning of my cost averaging into a long JNUG position? I prefer that starts under 6 for JNUG but for whatever reason I don’t want to miss this run higher should we somehow get a reversal over the weekend. In other words, I want exposure and am willing to take a hit if wrong, sell Monday for a loss but know full well I am 1000% going to get back in and ride JNUG up for a bit. ”

I did get a little too conservative with the 4% move up from Friday, but finally got us back in. Then I got conservative with the stop. After locking in a little profit and seeing the dollar go green, I didn’t want a complete whipsaw with the market makers coming back looking for ways to profit. But they surprised me yesterday by being so dang lazy.

Disclosure: Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with capital you can’t afford to lose. This is neither a solicitation nor an offer to Purchase/Sell futures or options. No representation is being made that any account will or is likely to achieve gains or losses similar to those discussed in this outlook. The past track record of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc. discussed in this outlook and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author.