On Tuesday, the transportation sector closed in the green, while the rest of the Economic Modern Family closed red.

The most prominent break of support came from the Russell 2000 (IWM) and the Regional Banking sector (KRE).

IWM fell under support at $218 and KRE fell below its 50-Day moving average at $66.

Tuesday's market also brought a rotation into commodities like gold (GLD), Corn (CORN), Sugar (CANE), and the Invesco Agricultural ETF (DBA).

Investors flocking into commodities could be viewed as a weakening market signal.

It can also be seen as a sign of inflation or at least worry of rising inflation.

While the Federal Reserve is watching inflation based on criteria which does not incorporate food and energy, the agriculture sector tells a different story as food commodities have steadily been rising.

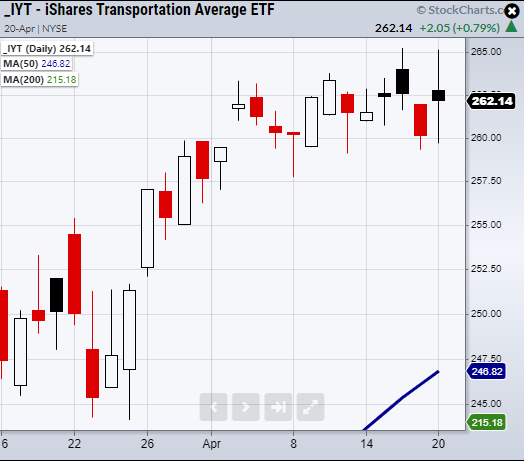

On the other hand, if the transportation sector can hold its current price area, this will show that the demand side of the market is strong.

This makes IYT the silver lining of Tuesday's market and an important indicator to watch going forward.

Therefore, we should watch the transportation sector to add strength to the market if it holds its current price level.

If not, watch for investors to continue to rotate into commodities as fear of a weak market and inflation rises.

ETF Summary

S&P 500 (SPY) 412.31 pivotal area.

Russell 2000 (IWM) Broke 218.83 support. Next support 213.14

Dow (DIA) Flirting with 338.12 the 10-DMA.

NASDAQ (QQQ) 330.32 next support area.

KRE (Regional Banks) Broke support at 66.18. Next support level at 63.38

SMH (Semiconductors) 242.33 the 50-DMA.

IYT (Transportation) Needs to hold 259.

IBB (Biotechnology) 146 support. Resistance 155.65

XRT (Retail) next support 86.50 the 50-DMA.

Volatility Index (VXX) Needs to hold over the 10-DMA at 10.20

Junk Bonds (JNK) 108.59 support.

XLU (Utilities) 67.93 high to clear.

SLV (Silver) 24.16 resistance.

VBK (Small Cap Growth ETF) Would look better if it can hold over 276.

UGA (US Gas Fund) 31.55 support.

TLT (iShares 20+ Year Treasuries) Needs to clear 139.75 the 50-DMA.

USD (Dollar) Doji day.

MJ (Alternative Harvest ETF) 19.51 next support from low of 3/05.

LIT (Lithium)Failed to confirm bullish phase over the 50-DMA at 61.97.

XOP (Oil and Gas Exploration) Watching 69.82 as next support area.

DBA (Agriculture) New Multi month highs