- Natural gas faces limits near January’s peak

- Technical signals flag some weakness

- Improved trend signals suggest bullish continuation

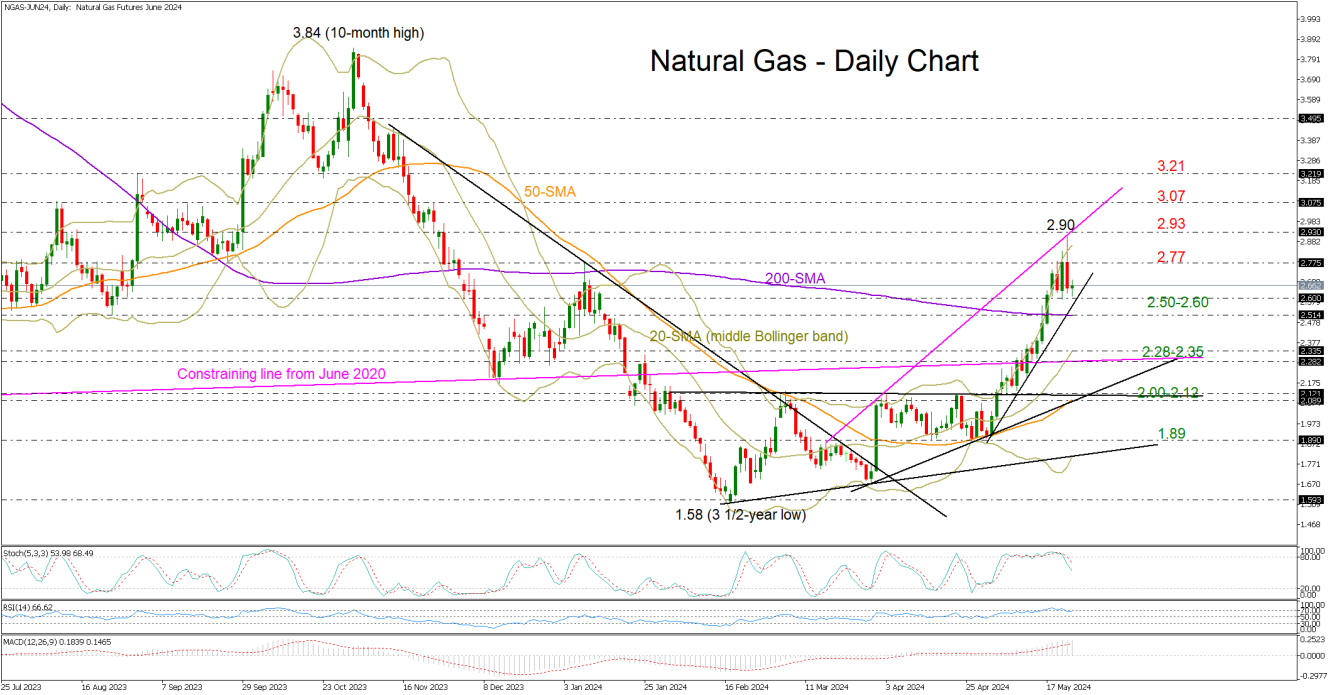

Lower-than-usual storage increases, improved demand forecasts, and a summer season ahead boosted natural gas prices above the key 200-day simple moving average (SMA) and more recently to a four-month high of 2.90.

The price, however, eased immediately to close again below January’s peak of 2.77, making investors wonder whether the upward pattern, which started from the well-known support region of 1.50, is nearing its peak.

Given the overbought signals coming from the RSI and the stochastic oscillator and the widened Bollinger bands, some softness is likely. Though a potential rebound within the nearby support region of 2.50-2.60, where the 200-day SMA is flattening, could resurface buying interest. Failure to pivot there might dampen sentiment, causing a quick decline into the 2.30-2.35 constraining zone, while lower, the 2.00-2.12 trendline territory could be more important to watch. A violation there and a step below the 50-day SMA would wipe out hopes for a bullish trend continuation, bringing the 1.89 base back into view.

Historically, the period from March onwards is flourishing for natural gas prices. Excluding the delayed rebound during the pandemic and the neutral spring phase in 2019, the market has been exhibiting significant upward tendencies every single year for more than a decade. The positive cross between the 20- and 50-day SMAs is in line with this narrative, though a golden cross between the longer-term 50-and 200-day SMA is not in sight yet.

Nevertheless, with geopolitical risks looming in the background, the bulls might seek to retain their advantage. In the short-term, an acceleration above the 2.77 border could stall near the resistance line at 2.93 which joins the April and May highs. If the bulls knock down that wall, they might run straight to the 3.07 barrier and then surge up to 3.21.

Summing up, natural gas could take a breather after its recent significant appreciation. Yet, considering the improved trend signals, a potential pullback or a sideways move could be just a temporary break in the upward trajectory.