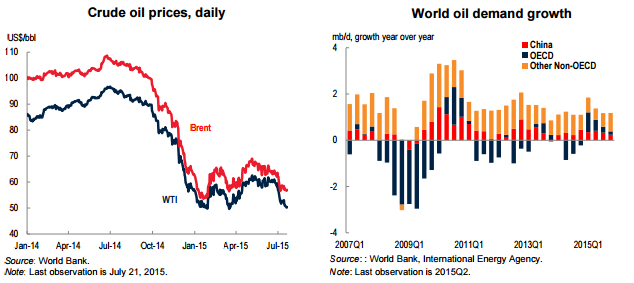

As WTI Crude Oil prices continue to find downward pressure, the oil industry is facing structural change as some producers find difficulty in repaying debt and may face exiting the sector altogether.

As the price of West Texas intermediate has continued to slide, and subsequently reached the lowest levels in over six years, many are now questioning how the smaller producers will meet their upcoming bond repayments.

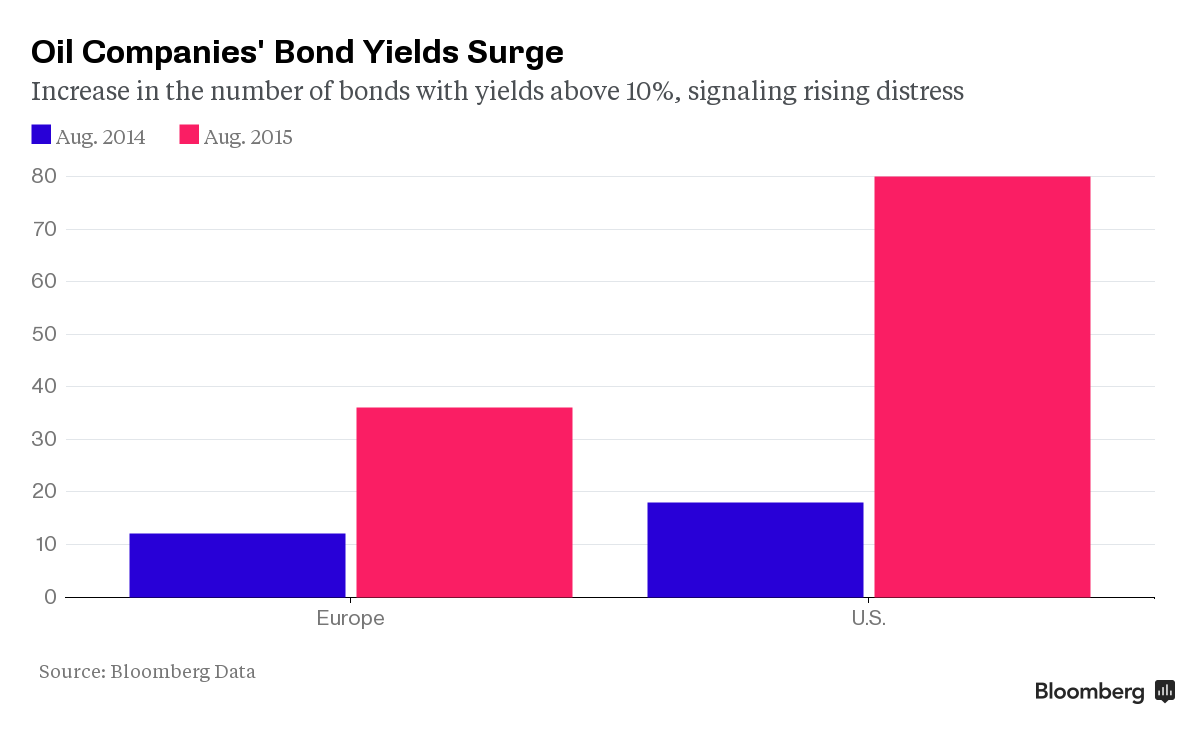

The number of oil and gas sector defaults is on the rise and bond yields are rising across the board for the sector. In fact, the number of bonds falling into the `distress’ range (exceeding 10% yield), has increased markedly over the past year. Whilst the price of crude oil remains below the $40.00 a barrel level the number of corporate bond instruments moving towards junk status will only increase.

Subsequently, the pressure upon small producers is likely to increase as the lacklustre oil prices and increasing bond yields start to eat into their cash flow. Considering that medium term modelling shows WTI prices remaining within the $30’s, the number of distressed bonds and resulting corporate insolvencies can only increase. In fact, according to BMI research, debt repayments are likely to top US$72 billion this year alone.

It is clear that the oil and gas sector is facing a reshaping and consolidation of epic proportions as producers, without the large cash reserves required to survive, will face an increasingly hostile debt market. This is also a global problem, given that Brent producers are suffering much of the same pricing pressures as their American counterparts.

This potential market rationalisation has been expected for some time but the artificial nature of the bond markets have extended out the rebalancing phase. However, as credit ratings continue todegrade, and firms start to face a steepening yield curve, cash reserves for the smaller producers are starting to run short.

In the long run, the larger explorers and production companies are likely to experience net gains from the market rebalancing. Ultimately, a diverse global portfolio of interests and strong balance sheet is likely to provide larger firms with continued access to debt markets and the required capital to survive the slump.

So in closing, keep a close eye on the oil industry, as things are about to get very interesting as a range of distressed bond holders find nothing but pain when it comes time for coupon payments.