S&P Profits

Are corporate results improving or is the stock market rising based purely on technicals? From The Fat Pitch:

The headline numbers for 2Q17 financial reports are good: S&P profits are up 19% year-over-year; sales are 6% higher; profit margins are at new highs. This is in stark contrast to early 2016, when profits had declined by 15%.

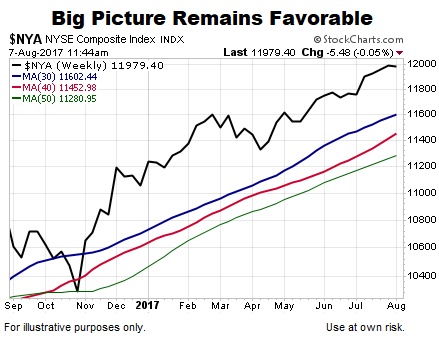

Simple Can Be Powerful

The chart of the NYSE Composite above can be powerful based on its simplicity. This week’s video reviews the three basic types of markets in the context of risk vs. reward in 2017. The present-day charts reveal a great deal when viewed in the proper context.

Economy Has Room To Run

Those who lived through the dot-com and housing bubbles know that the present day shares very little with those excessively euphoric periods. From The Wall Street Journal:

Expansions tend to get tripped up by boiling excesses, like a housing bubble in the 2000s, a tech bubble in the 1990s and inflation in the early 1980s. But this economy appears to have some more room to run as it enters its ninth… Compared to six months ago, the global economic outlook has certainly shifted in a positive direction,” said John Silvia, chief economist at Wells Fargo (NYSE:WFC). In the U.S., “there are more jobs, and better jobs, and that’s a confidence builder.”

As Long As The Trends Remain Favorable

The markets started telling us to be open to better than expected long-term outcomes in August 2016. Given that the long-term facts in hand continue to favor good things happening relative to bad things happening, we will continue to run a growth-oriented allocation until the facts shift in a material manner.