Yesterday, the hope that the Economic Modern Family held coming into the week waned a bit as the stimulus talks stalled once again.

After the close, more headlines emerged as the Senate is back and both sides know that politically, some stimulus package should be passed.

Unless the stimulus comes through and is perceived as enough, the Family could be showing possible exhaustion as we are now 15 days away from the election.

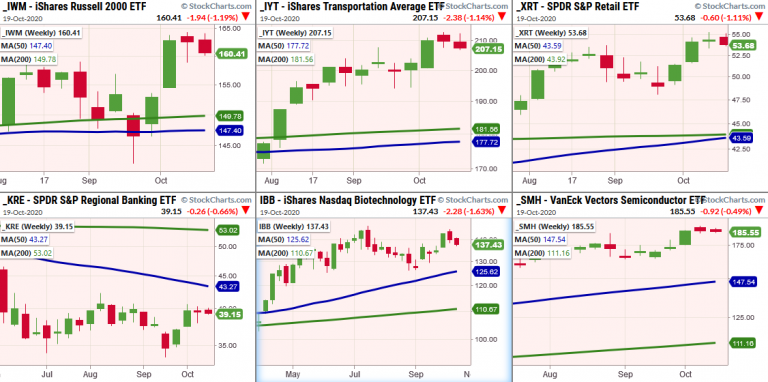

Above are the weekly charts of the Modern Family.

Grandad Russell (NYSE:IWM), who has been leading, opened Monday inside the trading range of last week. At this point, price tells us digestion rather than failure.

Could that change?

Absolutely. If IWM fails last week’s lows, we could see a move closer to 155.

Transportation (NYSE:IYT), another leader as last week it made new all-time highs, already broke last week’s lows so this has to regain the 208 level or could visit 203.00-204.00 quickly.

As we wrote about over the weekend, Granny Retail (NYSE:XRT) actually started the ball rolling on this most recent rally. Consumer spending though is now outpacing consumer income. With the holiday season coming, this could be an issue. Stimulus will help of course. However, other factors will come into play here more than anywhere-particularly, sentiment and confidence. Can consumers remain optimistic?

Technically, XRT is about to enter a weekly bullish phase with a golden cross of the weekly moving averages. Yet, the price of the MAs is way lower. Any bigger correction will have us looking at the support closer to the MAs.

The good news is that at this point, half of the family will be in a bullish weekly trend with IWM and IYT looking to join in soon.

Regional banks (NYSE:KRE), also starting out inside last week’s range, continues to hover close to resistance at $41-42. As a laggard, money rotation here would be a healthier sign.

With vaccine issues, the biotechnology sector is either forming a double top pattern or a right shoulder to an inverted head and shoulders bottom. Either way, that could lead it back to a test of the 50-WMA.

Lastly we have sister semiconductor SMH, who is currently having an inside week as well. Even after the late selloff, SMH held up and with earnings on tap, is also a clue for whether the market is coming to a head or not.

Just like our head of Bosque beer, the market has foamed up to some lofty levels.

With still more time between the election and stimulus to spare, we could see prices settle lower as the Family sips their ale and waits for the next big piece of news.

S&P 500 (SPY) Looking to test the 50-DMA at 339

Russell 2000 (IWM) 155 best underlying support.

Dow (DIA) 285 Pivotal area with 278-280 support

Nasdaq (QQQ) 290 now resistance

KRE (Regional Banks) Holding for now. Resistance at $40-41

SMH (Semiconductors) 185 to 190 a good trading range.

IYT (Transportation) Maybe a visit to 200 in the cards, but over 212 looks great

IBB (Biotechnology) 130 major support with pivotal support at 134-135

XRT (Retail) Best news is that it closed above last week’s lows. If fails looking at 50.00