Key Points:

- The long-term trend line is likely to encourage a reversal.

- Numerous technical reading suggestive of a near-term rally.

- Fundamental outlook is also rather bullish.

The loonie is poised to have yet another bump in buying pressure as the week closes which could see it back up at around the 1.3554 handle within a week or so. Indeed, the recent decline is already beginning show signs of slowing which is due, in part, to the weaker Canadian economic news. However, the technical bias is also signalling that a change in momentum is now warranted which could really set a fire under the pair.

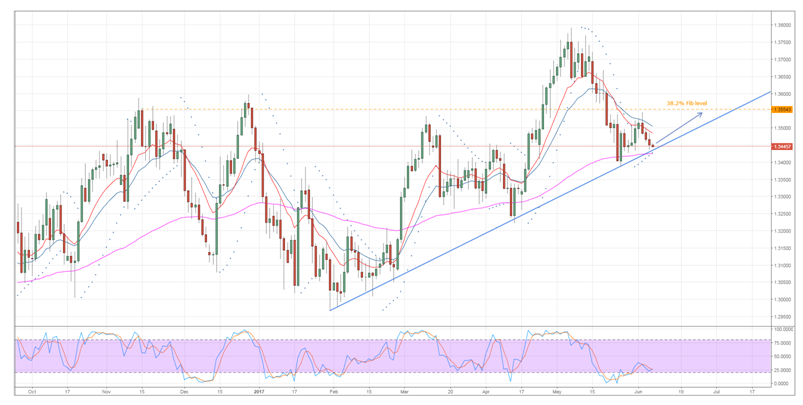

Specifically, if we take a look at the daily chart, that same trend line that saw the pair reverse only a week or so ago is once again making its presence felt. As a result, we have sound reason to suspect the pair to make a push higher once again. What’s more, the 100 day EMA – an average that has reliably been a source of dynamic support – is well positioned to cap downside risks significantly moving ahead.

In addition to these technical readings, the Stochastics and Parabolic SAR are both indicating that buying pressure should return in short order. Importantly, whilst not currently oversold, the stochastics oscillator is flirting with the vital 20.0 level which will help to put a pin in the bear’s plans to remain in control of the USD/CAD. Similarly, the Parabolic SAR reading is yet to invert to bearish which will help to rally the bulls once a green candle is finally seen.

As for the fundamental outlook, this is pretty much in line with the technical bias which comes, primarily, as result of the forecasted Canadian employment data. In particular, the unemployment rate is expected to jump to 6.6% (up from 6.5% previously) which should see the USDCAD receive a bid. Notably, this uptick would come in the wake of an anaemic Ivey PMI figure of 53.8 which could exacerbate buying pressure.

Ultimately, due to both the technical and fundamental biases, we expect to see the Loonie reverse in the very near future. Nevertheless, gains will likely be limited to the 1.3554 mark which is not only a historical high point but also the 38.2% Fibonacci retracement. If gains do extend beyond this level in the near-term, it will likely come as a result of a major fundamental upset – the kind that is notoriously hard to predict.