Real Estate is one of the biggest purchases anyone will make in their lifetime. It can account for 30x to 300x one’s annual income and take over 30 years to pay off. After you’re done paying for your property, now you have to keep paying to maintain it and to support the property taxes to keep it. What has happened to the US Real Estate market since the 2008-09 global credit market collapse and is the US Fed behind the curve?

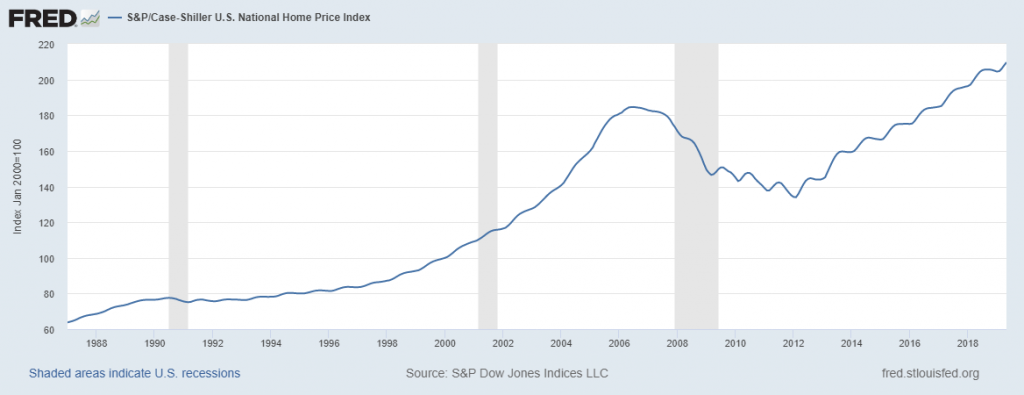

Case-Shiller Home Price Index

One of the most common indicators used to measure national housing affordability and price trend is the Case-Shiller Home Price Index. In this chart, we are displaying the Case-Shiller National Home Price Index – including all markets in the US. It is fairly easy to see that in last 2016, on a national level, the Case-Shiller index had reached the 2006 peak level. After that, the new Trump economy pushed it even higher where we now near 210. This is a very uncommon level for this index and because we are in uncharted territory with this 210 ranking, it should concern everyone that a reversion maybe somewhere in our future.

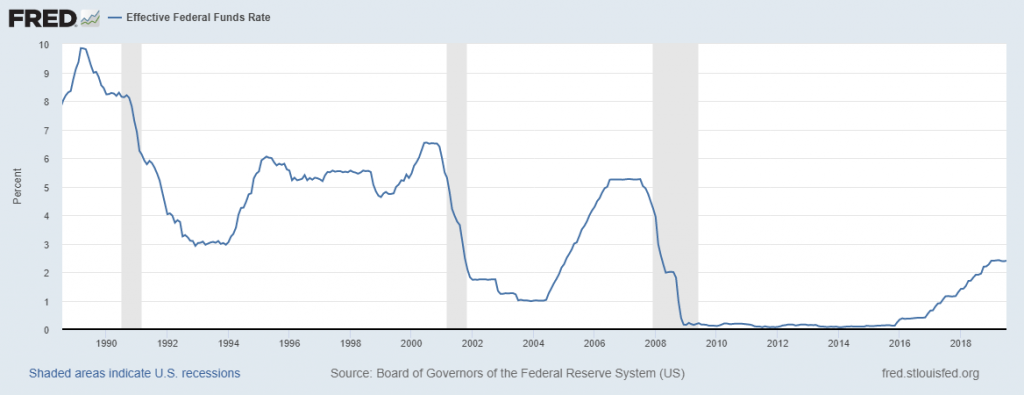

Fed Funds Rate data from early 1990 till now

The question we’ve been asking our research team is “Is the US Fed behind the curve in the markets and how will that translate into the US/Global equity markets?”

When we consider the recent Fed rate increases (starting in 2016), our research team compared these levels to a modeling system we build back in 2013. This modeling system suggests what the US Fed should have been doing based on certain GDP, Population and other factors. The chart below is the Current Fed Funds Rate data from early 1990 till now. The rise in valuation on the Case-Shiller index can almost be directly correlated to the amount of money available in the global markets and the US Fed rate levels. More money and lower interest rates mean everyone was stampeding into housing expecting it to increase in value (which it did). But what is next with the US Fed turning cautious recently?

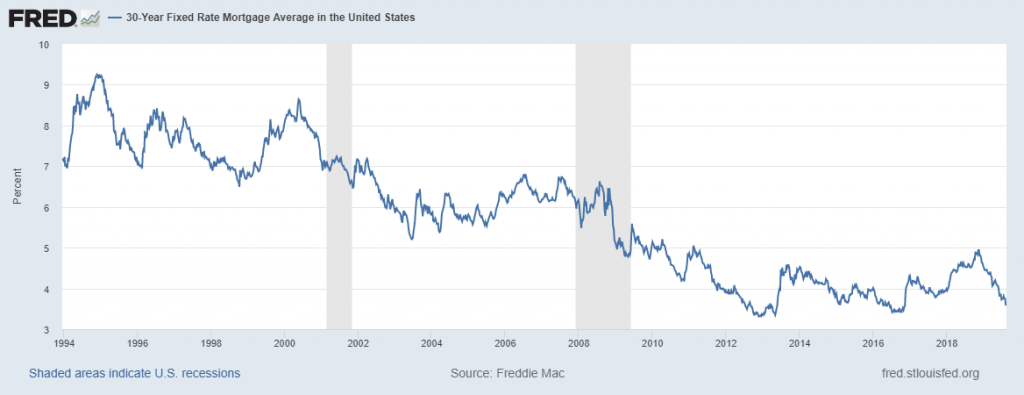

US 30 Year Mortgage Rate

The US 30 Year Mortgage Rate has continued to rotate between 3.5% and 5% (on average). We all know these rates vary depending on the borrower’s credit rating and other factors. Yet we believe any rates above 4% (on average) are dangerous for the markets and once lenders start to tighten requirements for loans while sellers start to aggressively decrease their asking price in order to attract buyers, we could see a massive shift in the market within a matter of months, not years.

CONCLUDING THOUGHTS:

The global markets are setting up for some type of event. Capital is being pulled out of the markets as investors/traders wait to see what happens with the US/China trade issues, the EU as well as the US Presidential election in November 2020. Many economists and researchers believe a recession is fast approaching and are waiting for any signs that it is starting.

Are the turmoil sets up in the global stock market about to fracture into the global real estate market as well? As investors and consumers engage in risk aversion processes, how will that result in continued economic activity in certain sectors of the global market? Could it be that we are about to experience an economic contraction/reversion event that many analysts have failed to comprehend?

In part II of this article, we’ll show you our US Fed proprietary modeling system’s data and show you why we believe something big is going to unfold over the next 3 to 5+ years. We’ll also highlight some very interesting data regarding the US real estate market that you should be preparing for right now.

Real Estate has already run through the price advance cycle and the price maturity cycle. There is really only one cycle left to unfold at this point – the “price revaluation cycle”. This is where the opportunity lies with a select real estate ETF I am keeping my eye on.

I can tell you that huge moves are about to start unfolding not only in real estate, but metals, stocks, and currencies. Some of these super cycles are going to last years. Brad Matheny goes into great detail with his simple to understand charts and guide about this. His financial market research is one of a kind and a real eye-opener.