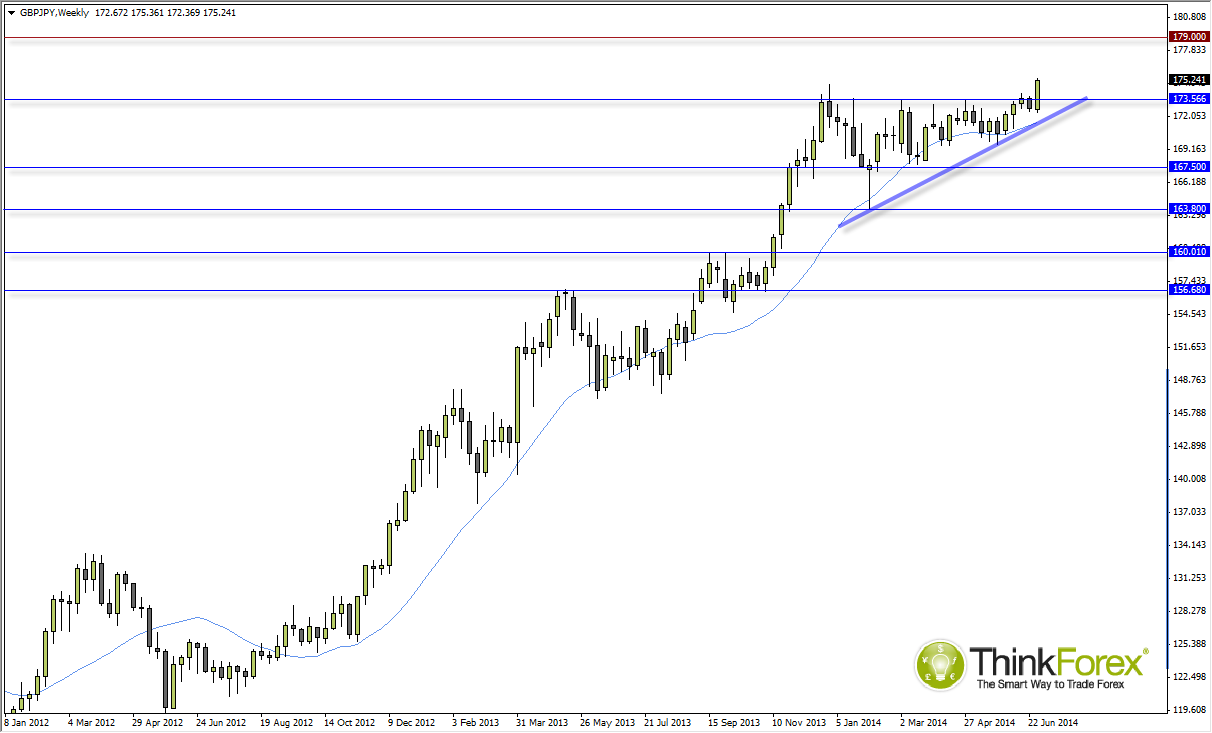

The GBP/JPY breakout appears to have confirmed a bullish triangle, so we appear back en route to 179 target.

Originally I had been calling for an Inverted H&S continuation pattern to target 179, and after many false breaks, retracements, readjustments and so forth I slow gave up on the pattern unfolding. However, recent price developments (and the break above 174.83 high) now confirm the pattern to be an ascending triangle. Keep note that this is a weekly chart we have to allow for wider price swings, and the potentiel for a retest of 174 support, or a deeper retracement towards the bullish trendline (which remains to be confirmed until tested).

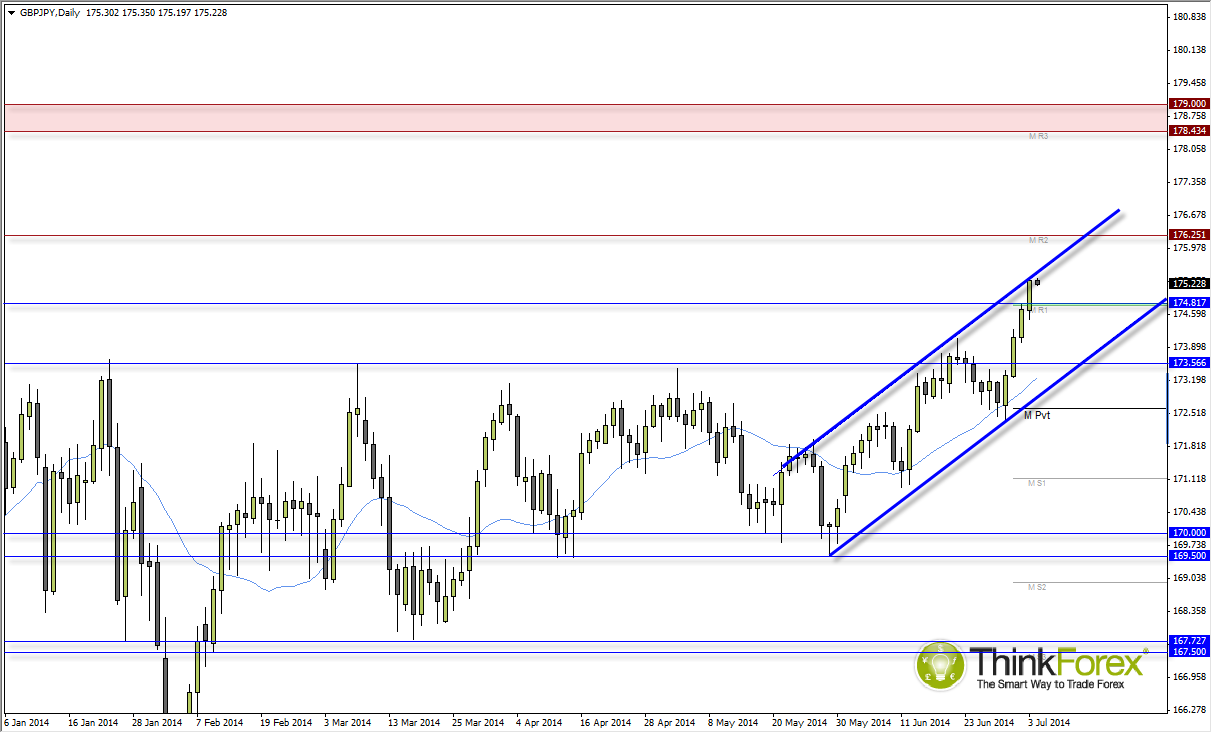

While the daily timeframe is clearly bullish we are approaching the upper channel and approach the end of a trading week on a US Bank Holiday. Therefore, I am waiting to see where we close this week and in hope of a retracement towards 174.80 to see if support builds before continuing with the breakout.

In the event that 174.80 break then this does not invalidate the analysis, as we may find better buying opportunities around 173.50 where we have S2 and the lower channel.