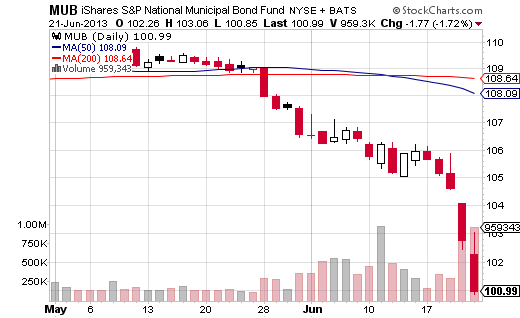

The familiar pattern of May-June gloom for stocks only led to a 5% sell-off in 2013. Bonds, however, witnessed a repricing that many had not seen since 1994. Intermediate-term treasuries lost 7% to 8%. Munis fell more than 10%. Meanwhile, investors trampled emerging market bonds for 12%-14%.

Why did people redeem assets from bond funds so quickly? Why did the pace of those redemptions create liquidity issues for the fixed income marketplace? In brief, the Federal Reserve had hinted that it might slow down the rate of its quantitative easing experiment of buying bonds to push rates lower. Consequently, the 10-year yield nearly doubles from 1.6% to 3.0% in an extremely short time frame.

Many are now suggesting that a future crash in bond funds is a near certainty. They maintain that when rates rise — not if they rise — bond mutual funds and bond ETFs will not be able to handle the selling due to a lack of liquidity in the underlying assets. Indeed, during the height of this year’s chaos, municipal bond ETFs like PowerShares National Muni (PZA) and iShares S&P National Muni (MUB) were trading at net asset value discounts of 300 basis points for at least a week. In the world of exchange-traded investing, premiums and discounts are supposed to be negligible.

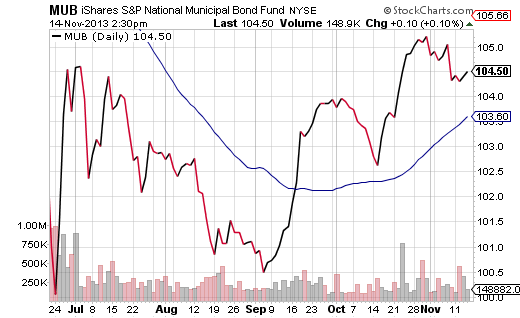

It is probably accurate to say that an erratic jump in fixed income yields would cause trouble for bond funds yet again. As investors liquidate fixed income fund positions, the huge number of bonds hitting the marketplace would likely overwhelm bond dealers and the liquidity of the bonds themselves. On the other hand, the Federal Reserve walked back “taper talk” in late June as it became clear that bond selling had been getting away from their control (and manipulation). Volatility notwithstanding, muni price depreciation has abated and muni tax-free income has been valuable ever since.

It follows that the central bank of the United States is aware of its power, not only to cause panic, but also to quell panic. In fact, in a world where nearly all of the major banks are fostering exceptionally low interest rates — in a global environment where the low-rate trend is likely to push forward into 2016, 2017, and 2018 — a bond fund crash is unlikely. Rising interest rates? Sure. An overnight spike where rates nearly double (the way they did from 1.6% to 3.0%)? Not probable.

Central banks like the U.S. Federal Reserve did underestimate the magnitude of the lack of liquidity in mortgage backed securities in 2008; for that matter, they were not even able to see the recessionary pressures of real estate or the problems with interest-only loans until the crisis began hitting epic proportions. On the other hand, the Fed successfully suppressed market fears in the 1998 Asian currency crisis. Similarly, since October 2011, the “do what it takes” Draghi-led European Central Bank (ECB) has provides a multi-year lifeline to the beleaguered euro-zone.

Do central banks really succeed when they bail out countries and regions? Should they even engage in rescue operations to squash rapid depreciation in asset classes? Those are philosophical questions with answers that may not become evident for decades, or even centuries. From my vantage point, though, the U.S. Fed continues to inflate a balloon that will be challenging to deflate slowly over the next five years. In fact, I doubt whether the Fed will ever decide to deflate the balloon at all; rather, as long as the dollar holds up, as long as foreign investors do not dump U.S. debt, I expect “tapering” to be replaced with yet another round of quantitative bond-buying easing (a la QE4).

Granted, Janet Yellen is claiming in testimony that they realize QE cannot last forever. Nevertheless, with such a remarkably low tolerance for recession, and zero fiscal stimulus coming down the pike, QE is going to be a saving grace for stocks and for bonds for years to come; that is, while a stock or bond bear is always a possibility in the near-term, an epic collapse will not occur unless investors everywhere lose confidence in the rescuing capabilities of the world’s central banks.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Is the Fed Capable Of Slowing An Exodus From Bond ETFs?

Published 11/14/2013, 11:54 PM

Updated 03/09/2019, 08:30 AM

Is the Fed Capable Of Slowing An Exodus From Bond ETFs?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.