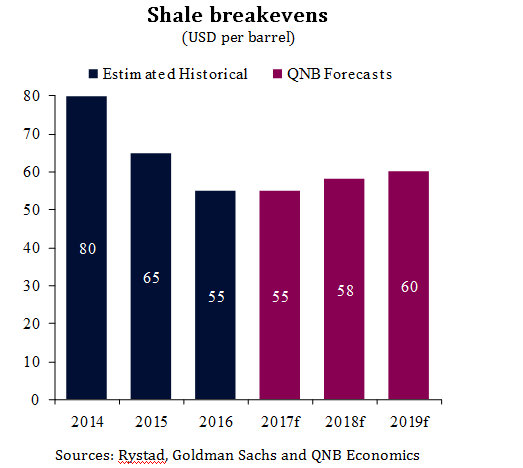

The global oil market is expected to shift from being oversupplied in 2016 to being under supplied in 2017. As we highlighted in a recent report (Oil after OPEC — range-bound at USD55-60), in isolation, the under supply in the market should be sufficient to lift oil prices above the USD60 per barrel (/b) level. However, US shale oil producers are able to ramp up substantial volumes of production once prices rise above their cost of production, currently estimated to be USD55/b, effectively capping oil prices at this level. Therefore, the key determinant of oil prices going forward is likely to be the evolution of US shale breakeven prices. Having fallen from around USD80-90/b in 2013-14, we think that US shale breakevens have bottomed out and are likely to rise to around USD60/b over the next two years.

Shale breakevens (USD per barrel)

Sources: Rystad, Goldman Sachs and QNB Economics

There are four drivers that are likely to lead to higher US shale production costs. First, the cost of equipment, materials, oil services, fuel and labour are all rising and expected to rise further. The fall in shale break evens since 2013-14 coincided with a cyclical downturn in the oil sector and in commodity prices in general. Cutbacks in the oil sector led to falling costs for oil services as well as lower employment and wages. Furthermore, the rental of drilling rigs is a major cost for shale producers. In the downturn, the utilisation of drilling rigs dropped leading to an excess of idle rigs and lower rents. With the recent recovery in the oil sector and commodity prices, production costs of US shale producers are rising and expected to rise further. Costs of extraction are expected to rise 20% over the next year, still below 2013-14 levels.

Second, additional production will come from fields that are more expensive to develop. To cut costs when oil prices fell in 2014, shale producers focused operations on the lowest cost oil fields. Now that US shale oil production is rising again, the additional output will come from fields that are more expensive to develop, pushing up breakeven costs.

Third, maintenance capex at shale oil fields is expected to increase. The nature of shale oil fields allows production to ramp up quickly, but the rate of decline of production is also steep. The geology of shale oil fields and the techniques used to develop them means there is a surge in production from the initial wells, but subsequently extraction gets harder. To maintain production requires larger investments in drilling rigs and infrastructure than in conventional oil fields. This means ever higher investments will be needed to maintain production, putting upward pressure on breakeven prices.

Fourth, interest costs for US shale oil producers are expected to rise. Many US shale oil producers are highly leveraged and will require additional debt to develop new fields. As a result, interest makes up a significant chunk of their costs. With the US Federal Reserve in the middle of a tightening cycle, interest costs are set to rise, which will further elevate breakevens.

On the other hand, there are two factors that could lower breakeven prices, but they are unlikely to be significant. First, productivity gains were critical to reducing shale production costs in the past. Since 2014, deeper and more lateral drilling have driven a significant increase in average production per drilling rig. However, productivity gains have been moderating and are expected to stabilise going forward.

Second, new pipelines could lower transportation costs. On coming to office in January 2017, President Trump signed an executive order to advance the construction of two pipelines, the Dakota Access pipeline and Keystone XL. The first started operation in June 2017 and should help reduce transportation costs. However, the cost benefit will likely be small and take time to materialise. A start date for construction of the Keystone XL project has not even been announced, therefore operation is not expected for at least three years. Both pipelines will be limited to transporting oil from the Bakken oil field in Montana and North Dakota, which accounts for only 19% of US shale production. Furthermore, transportation costs are a relatively small part of the total costs of shale oil production.

In conclusion, the shale costs of production is expected to rise going forward after years of decline. This will lead to a progressively higher oil prices. As a result, we retain our forecast for oil prices to average USD55 in 2017, USD58 in 2018 and USD60 in 2019.