Key Points:

- Challenging upside constraint of bearish channel.

- Bullish EMA crossover in progress.

- Parabolic SAR retains bullish bias.

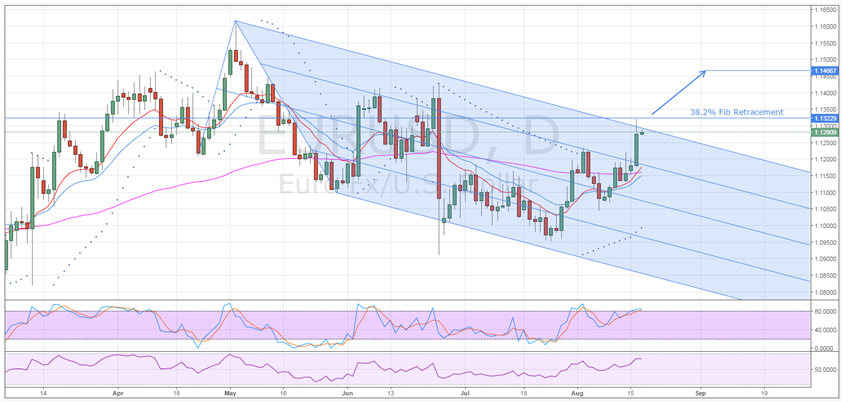

A strong market swing against the Greenback has seen the EUR/USD move against the recent downtrend and it now threatens to break free of its channel. With a number of technicals providing upward momentum, the EUR could move back to pre-Brexit levels so long as there are no further fundamental surprises in the coming week. As result, eyes will be on the pair as it tests the key zone of resistance around the 38.2% Fibonacci retracement as, if broken, a rally could eventuate.

First and foremost, as is shown by the below pitchfork analysis, the EUR has been in decline since even before the Brexit vote. What’s more, the pair has remained relatively well constrained by the structure, with the notable exception of the long lower shadow cast by the candle generated amidst the EU Membership referendum. However, after yesterday’s bullishness, the Euro is now poised to seriously challenge the integrity of the descending channel which could result in a breakout.

This being said, there remains some substantial resistance to overcome if the EUR is truly going to stage a strong rally in the coming days. Aside from the upside channel constraint, the 38.2% Fibonacci retracement is exerting its significant depressing influence around the 1.1322 level. As a result, there is a sizable possibility that the pair could reverse at this point and resume the bearish trend seen over the past number of weeks.

However, there are a range of technical indicators currently supplying upward momentum to the EUR which could see resistance broken and a change in trend direction occur. Most notably, the daily EMA activity is presently completing a bullish crossover which is sure to be getting the bulls ready to make another push. In addition to the moving averages, the Parabolic SAR readings are currently providing further indication that the EUR may not be done climbing just yet.

One Indicator that could actually be working against the bulls, however, is the Stochastic Oscillator which is currently reading as overbought. Although, it’s worth noting, the RSI oscillator is yet to reach the same conclusionand this could provide enough doubt to see the EUR reject a reversal and subsequent decline. Additionally, the overbought signal is not present on shorter timeframes which should prevent the pair from having gains capped too significantly.

Ultimately, there is building evidence that the EUR/USD is readying itself for a shift in momentum from bearish to bullish. Pushing through the 38.2% Fibonacci level will likely prove to be the point at which this shift occurs but the pair will probably have to close up above the 1.1466 mark before a medium-term uptrend is confirmed. Furthermore, keep an eye on the Eurozone CPI data going forward as it could prove to be the kick the bulls need to come out in force.