Talks of looming stagflation in the European Union have intensified over the past month as the region suffers from what many describe as the worst conflict in the continent in decades, threatening skyrocketing inflation, supply shortages, and job losses.

Worst Economic Shock Since WWII

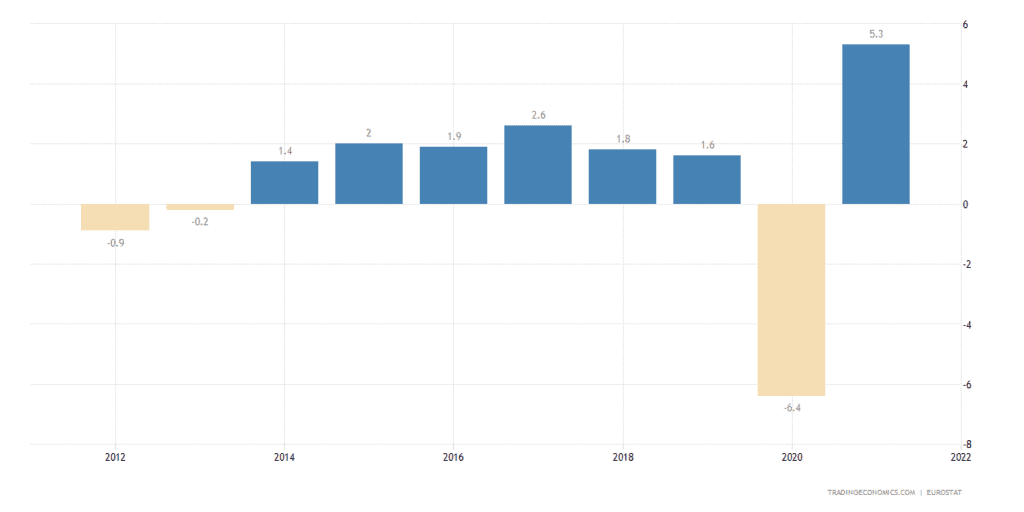

Even before the Ukraine invasion began, European countries had already suffered the worst economic shock since World War II in 2020 when the disruptions caused by the COVID-19 pandemic led to a 6.4% drop in the EU’s real GDP. That was worse than the GDP drop during the global financial crisis. The EU region rebounded in 2021, posting 14.09 trillion euros in GDP, up 5.3% from pandemic-hit 2020.

However, just as the EU’s economic recovery was gathering pace, the region could now plunge into recession, or worse, stagflation — a period of high inflation, elevated unemployment, and slow economic growth rate — as the region is caught in between the Russia-Ukraine conflict.

Worsening Diesel Shortage Sparks Rationing Concerns

As the Ukraine invasion drags on, the global oil trade remains in disarray as sanctions against Russia have prevented it from selling crude to some of its overseas customers. Although oil prices have fallen in recent days due to upbeat developments surrounding peace talks between the two warring countries, oil prices remain high as the absence of Russian crude continues to be felt in global markets.

This sparked concerns about rationing in many markets, particularly in Europe, the top buyer of Russian oil, as many European leaders have scoffed at Vladimir Putin’s demand to pay for natural gas and oil in rubles.

John Cooper, director-general of Fuels Europe, a unit of the European Petroleum Refiners Association, was quoted by Reuters as saying,

"Governments have a very clear understanding that there is a clear link between diesel and GDP because almost everything that goes into and out of a factory goes using diesel,”

Germany, Poland, Turkey, Britain, France, and Spain are the countries that are most dependent on Russian diesel, the news outlet added, citing data from energy consultancy FGE.

Worst Global Food Crisis Since WWII

In addition to the shortage of oil, the Ukraine war has also exacerbated the global food shortage at a time when many countries are already struggling with poverty and hunger during the COVID-19 pandemic.

On Tuesday, David Beasley, executive director of the UN World Food Program, warned that the war in Ukraine has led to “a catastrophe on top of a catastrophe” that "will have a global impact beyond anything we’ve seen since World War II.”

According to the FAO Food Price Index, global food prices jumped to an all-time high in February. Beasley said high prices mean more people globally will fall into hunger.

Pandemic’s Impact on EU Labor Markets

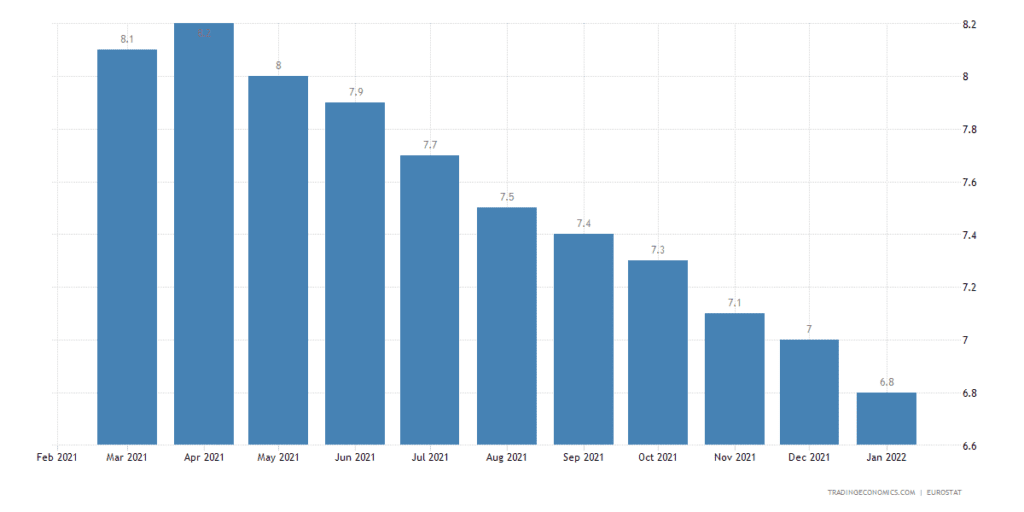

Employment levels in the EU have declined since the pandemic, while the total hours worked also slumped, reflecting supply and demand factors, according to a recent report by the International Monetary Fund.

As economies reopened before the war, labor markets have recovered from the pandemic-induced slump, with the EU unemployment rate shrinking to a historic low of 6.8% in December 2021, the IMF noted.

However, as inflation continues to soar, wages will likely follow the trend, prompting more rate hikes by central banks.

Playing Down Stagflation Concerns

Against the many signs that point to possible stagflation in the EU in the near term, Christine Lagarde, chief of the European Central Bank, said at a Wednesday conference that no data suggests Europe will fall into stagflation.

Although inflation will “no doubt” increase this year, conditions remain “quite fluid,” Lagarde was quoted by the Associated Press as saying.