As the US federal reserve might soon start raising interest rates and the ECB is about to begin quantitative easing plans, some see this divergence as a potential source of a large fall in the value of the euro which might have already started over the last days.

In the past, given that we have witnessed similar episodes of divergence in monetary policy (or at least monetary policy moving at very different speeds), it is interesting to check what happened during those past episodes.

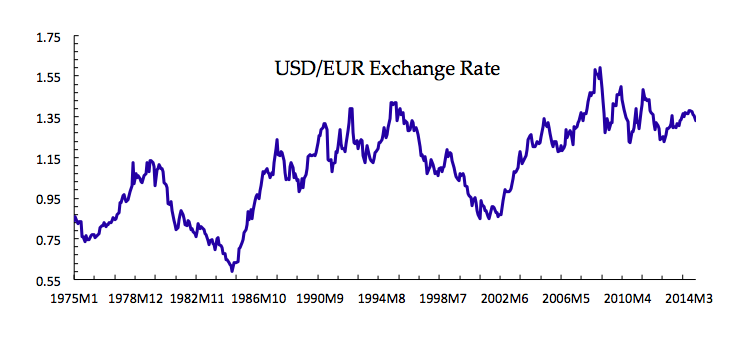

Below is the evolution of the USD/EUR exchange rate since 1975. Of course, the euro did not exist before 1999 but what I have done is to replace the euro with the German mark (converted at the mark/euro rate that was fixed at the time the euro was launched).

So the chart is really a combination of the German/US exchange rate before 1999 and the euro/USD exchange rate post-1999. For simplicity's sake, I will refer to the euro even for the earlier years.

In addition to the trend, we see two episodes where the dollar strengthened substantially relative to the euro, then reversed in the opposite direction at a similar speed to go back toward its trend. The first episode was in the early '80s when a combination of tight monetary policy and large budget deficits in the US put upward pressure on interest rates and started a persistent swing upwards of the US dollar. The US dollar reached a value that was clearly above any reasonable estimate of fundamentals and led to the Plaza Accord in September 1985 where finance ministers from Europe, Japan and the US agreed to intervene to keep the dollar from continuing its appreciation. The reversal that followed was also very dramatic.

The second episode took place in the mid-to-late '90s and coincided with very strong growth rates in the US that also attracted the interest of investors. Monetary policy itself was not that different but growth rates were. In addition the launch of the euro in 1999 was viewed by some as a source of uncertainty and potential bad news for the euro economy and its currency. That time, the appreciation of the US dollar was also stopped by a coordinated intervention of the US Federal Reserve and the ECB in November 2000.

Via these two episodes we do see a pattern of divergence in economic conditions between Europe and the US that triggers an appreciation of the US currency although not always related to monetary policy (and in both cases the appreciation led to overvaluation and large volatility). Are we supposed to expect the same thing now?

It is certainly a possibility but far from from guaranteed. Why? Because if we look carefully at some of the other years we will see that there are several other episodes during which US growth was also stronger than European growth and US interest rates were rising faster yet the US dollar did not appreciate. In fact, it depreciated significantly.

For example, in the period 2002-2003, Europe was in the middle of a recession with growth rates that were significantly lower than those of the US. Interest rates in Europe were coming down and remained at 2% until the Fall of 2005. At the same time, US interest rates were climbing from a low of 1% to 5.25% by the summer of 2006. During those years, the dollar not only did not appreciate but instead depreciated relative to the euro. In January 2002 the exchange rate was below 0.9 USD/EUR and by 2005 the euro had climbed to 1.30 USD/EUR.

It is also interesting to note that since the 2008 crisis started, the USD/EUR exchange rate has remained quite "stable" (compared to most other, previous years). It has fluctuated between 1.25-1.40 despite the dramatic changes that we have seen on both sides of the Atlantic. The sovereign debt crisis in Europe was forecast to have a significant effect on the value of the euro, but the currency remained stable all through the crisis.

If economic conditions continue to diverge between the US and Europe and the euro depreciates heavily relative to the US dollar, no one will be surprised. It will clearly look like a great textbook illustration of how interest rates and capital flows move currencies. But history tells us that there is no guarantee that this will happen. Exchange rates are a lot more volatile and unpredictable than what some theories would have you believe.

Regardless of the final change in the exchange rate, what is very likely is that we will witness a lot more volatility in exchange rates over the coming months and years, in direct contrast to the stability that we have enjoyed for the past years.