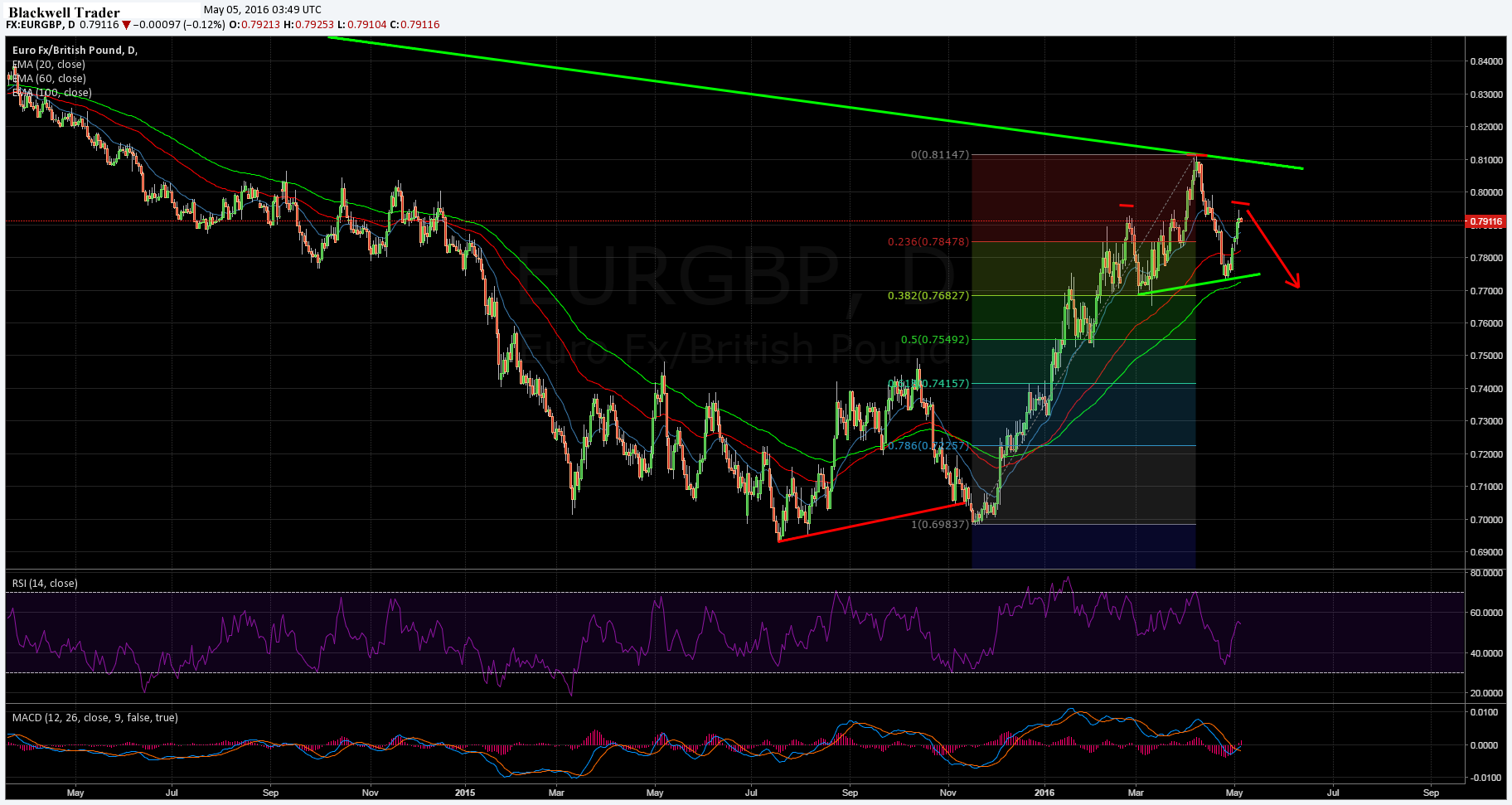

A renewed round of selling pressure has flooded into the GBP denominated pairs over the past 24 hours following a relatively disappointing UK Construction PMI result. In particular, the result has seen the EURGBP continue to extend its rally from the 0.7740 reversal zone. However, the recent rise is starting to look like a head and shoulders pattern which, if confirmed, could be signalling a return to the long run bearish trend.

Taking a look at the technical indicators shows an initial shoulder formation followed by a failed attempt at breaching the long run bearish trend line located at 0.8113. Subsequently, the pair retreated to form the unconfirmed right hand shoulder, which could be a harbinger of things to come.

However, the broader view is that price action is continuing to rebound from the recent 0.7734 low as it makes a concerted effort to challenge the long run bearish trend line. Unfortunately, for the bulls, that trend line happens to coincide with the 61.8% Fibonacci level at 0.8116 and a concerted breach remains relatively unlikely.

Subsequently, the next few days are likely to be critical for the pair as it will either rally towards the top of the trend line or alternatively confirm the next shoulder pattern and start its requisite decline towards 0.7700. Given that the RSI Oscillator is overbought on the 4-hour chart, and has started to trend lower, a downside move might be the most likely course of action in the near term. In fact, the MACD might just be predicting this very scenario as the 12MA signal line looks to bearishly cross on the downside.

In the medium term, the pair is likely to remain relatively bullish until it fails to take out the long term falling channel which would likely predispose it for a move towards the 0.7651 level. However, the short term intraday outlook is likely to be relatively bearish given the over-bought RSI Oscillator and the potential head and shoulders pattern.

Ultimately, it is advisable to wait and see if the right hand shoulder’s validity isindeed confirmedbefore taking a directional bias on the pair. However, regardless of the outcome, the downside is beckoning in the long term. In addition, monitor the UK Services PMI figures closely as a strong result, above the forecast of 53.5, could largely invalidate the current setup.

EURGBP – RSI/MACD 240