Emerging markets (EMs) have been surprisingly calm during the recent rise in US interest rates. Compared with past episodes, which were characterised by capital flight, collapsing currencies and plunging asset prices, EM financial markets have been relatively stable in late 2016 and early 2017—fears about capital flight appear to have subsided. It therefore seems a good time to ask whether the EM capital flight crisis is behind us. To answer this question, we examine the current fundamentals in the major EMs with unpegged currencies, compared with fundamentals during the taper tantrum of 2013. We find that EMs are more resilient now mainly due to improved external positions.

Recently, there has been a sharp repricing of US interest rates from early November up to the last meeting of the Federal Reserve (Fed) in mid-March.The rise in US treasury yields was driven by a strengthening global economy and the so-called “Trump trade”as markets anticipated fiscal stimulus in the US. More recently, the Fed was encouraged by the economic recovery and potential Trump stimulus to bring forward rate hikes to March, leading to a further jump in US rates. Overall, 2-year US treasury yields rose 57 basis points between early November (just before the US elections) to early March (when the latest Fed hike was fully priced in by markets).

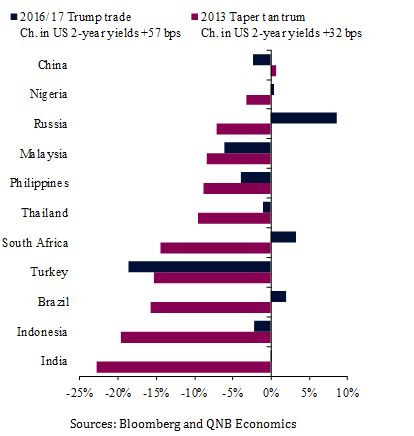

A broadly similar movement in US interest rates occurred during the 2013 “taper tantrum” after the chair of the Fed first broached the topic of cutting back on the quantitative easing programme. Between early May 2013 (just before tapering was initially announced) to early September (when US interest rates peaked), U.S. 2-Year yields rose 32 basis points. However, the decline in most EM currencies was far more severe during the 2013 taper tantrum than during the 2016/17 Trump trade episode. This occurred despite the fact that the change in 2-year yields in 2013 was almost half the change in 2016/17.

Impact on EM currencies of past increases in US interest rates (% change in currency)

What explains the stronger footing of EMs today versus 2013?Both reduced external risks and an improving domestic growth outlook appear to have made EMs less vulnerable to capital flight. Investors are primarily concerned with their risks and rewards. Improved external positions in EMs mean the risks have fallen, while rising growth means the rewards are increasing.

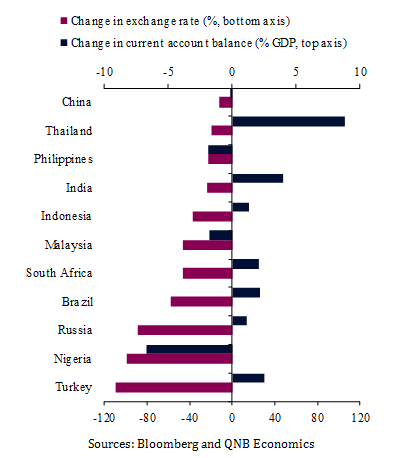

Externally, the current account balances of EMs have improved since 2013, which goes a long way to explaining the lower sensitivity of their currencies to higher US interest rates. The main reason behind the improved current account position are weaker exchange rates in all of the EMs under examination, which have helped these economies adjust by making their exports more competitive and imports more expensive.

External positions today compared with 2013 taper tantrum

(Changes from early May 2013 to early March 2017) Sources: Bloomberg and QNB Economics

Domestically, the growth outlook now is better than 2013. Growth in 2017 is expected to accelerate in eight of the eleven economies in our selection of EMs. In contrast growth slowed in six of the eleven countries from 2012 to 2013. The latest Purchasing Managers Index Surveys (PMIs, a forward looking indicator of economic activity) show that there has been a steady improvement in EM activity since mid-2016, rising from 50.0 in June 2016 to 52.1 in February 2017 (a reading over 50 signifies an expansion in activity), a 2.5 year high.

Improved current account balances and an upbeat outlook help explain the greater stability of EMs compared with past episodes of rising US rates. However, it is hard to give all EMs the all clear just yet. If the growth outlook were to turn sour, there are a number of EMs with high and rising external debt that could still face external pressures. In all the EMs we looked at, except the Philippines, external debt is rising. Furthermore, external debt is over 50% of GDP in Malaysia, South Africa and Turkey. These relatively high levels of external debt mean that there is still a risk that rising US rates and a stronger dollar could increase the costs for servicing and repaying external debt, leading to the re-emergence of capital flight.

To conclude, EMs are now more resilient to higher US rates than they were in 2013, thanks to the significant adjustments in currencies and external balances and the improved growth outlook. However, high and rising external debt means they are not out of the woods yet.