Key Points:

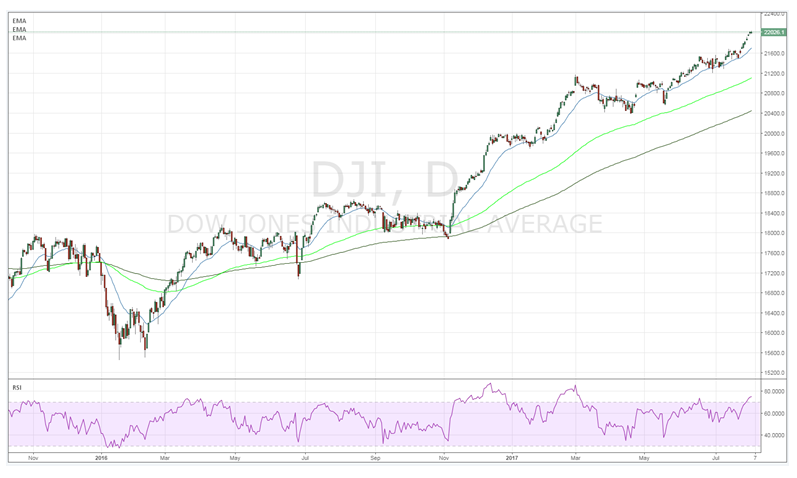

- DJIA breaches 22,000 level and continues to move higher

- Market may be underestimating the impact of either a tightening or tapering phase

- Keep a close watch on Federal Reserve policy and sentiment in the near term

The Dow Jones Industrial Average recently crossed the mythical 22,000 mark in open defiance of potential monetary tightening coming from the U.S. Federal Reserve. As many of you may know, there is a direct negative correlation between interest rates and equity prices so it’s especially surprising to see the Dow forging ahead despite all the expectation setting for either a rate hike or a taper. Subsequently, it begs the question as to whether equity investors completely lost their minds…or do they know something the rest of us do not.

At a guess, maybe equity investors have little faith in the Fed’s ability to follow through on their threats of a massive balance sheet taper given the lack of strong inflationary pressures. On this point, they may be correct given that the Fed has a poor track record of telling the truth when it comes to setting forward expectations.

However, although inflation has recently dipped, it was largely due to a fall in crude oil and energy prices and really didn’t impact the PCE Deflator or the Core very much. So there are still building inflationary pressures, as well as a strong disconnect between the public and the Fed, that provides a relatively dangerous environment for equity prices.

Subsequently, there is a real risk that if the Federal Reserve does indeed embark upon a cycle of either interest rate hikes, or balance sheet reduction, that a sharp fall in U.S. equities would soon follow. This presents a relatively real risk to U.S. equity valuations given the historically high levels that the DJIA currently resides at.

Ultimately, U.S. equity markets have been fuelled by loose monetary policy and a drive towards yields for some time and many working within the advisory space in this sector have never traded through a bear market. Subsequently, all the ingredients are there for a significant revaluation in the coming months.

The reality is that, without an economic shock, the central bank is likely to be under pressure to commence reducing their balance sheet overhang in the coming months. Given the amount of expectation setting that the FOMC has been doing this year it’s almost guaranteed that they will act decisively in some way lest their credibility become at risk. Subsequently, it’s a matter of when, not if, we eventually move towards lift off. So watch this space!