Clearly the US Dollar has been hitting the gym, trying to get buff for the Hampton’s season. But can this period of strength be maintained? Or is this just a feeble attempt to cram months worth of training into a few weeks in order to look good by the pool? Yes I know that the Dollar is not a Wall Street trader, but the analogy still holds up. It has made a quick bounce off of a low consolidation that has lasted since the beginning of the year.

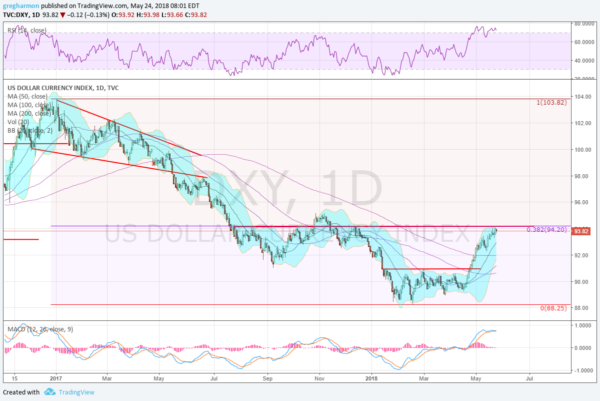

The chart below shows the consolidation at the start of the year and the move higher that started in April. It has now retraced 38.2% of the drop from the early 2017 high but is showing signs of stalling. Is this just a pause that it needs to work through or the end of a small bounce? It has moved over the 200 day SMA and the 50 day SMA is coming up to make a Golden Cross soon. Momentum is strong with the RSI holding around 70. These support a pause and continuation.

And there is clearly some inventory to work through as the Dollar traded near this level for nearly 6 months last year on the path lower. The MACD is a little troublesome with the indicator level at a spot where prior reversals have occurred. Keep an eye on the Dollar for now. A move over 95 would be a real show of strength continuing into the Hampton’s season. A fall back under 93 would suggest short term strength has faded.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.