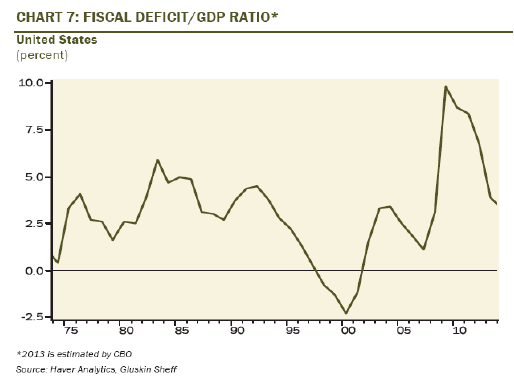

There has been quite a bit of discussion lately over the rapid reduction in the government's budget deficit as it relates to economic growth going forward. Just recently my friend David Rosenberg noted in his daily missive:

"The federal deficit, 10% of GDP just four years ago, is below 4% today and on its way to below 3% a year from now, largely on the back of tough spending cuts and a big tax bite (this is not just about the Fed's interest rate program though that too has helped.)"

There are 3 issues that will likely impede further progress on the deficit reduction in the months ahead; 1) lower rates of tax revenue, 2) weaker economic growth and 3) greater levels of spending.

1) Lower Rates Of Tax Revenue

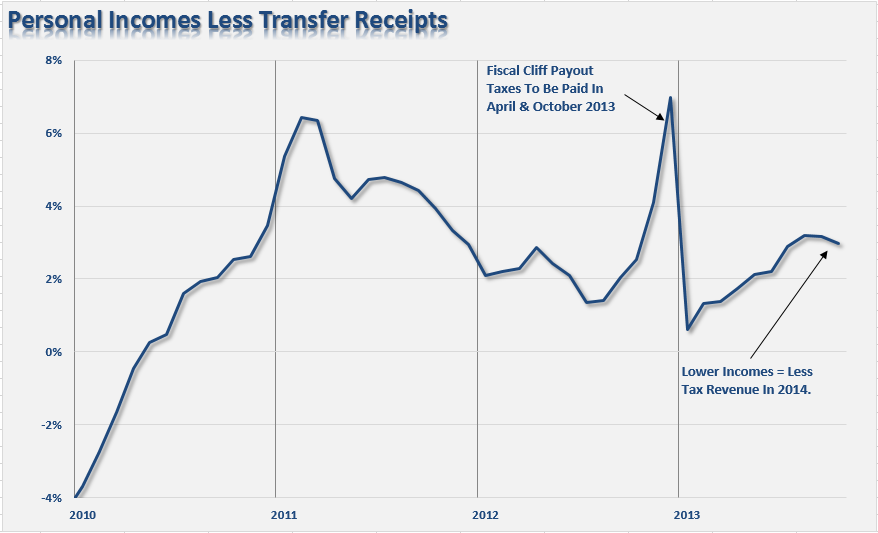

I have discussed previously that a big chunk of the tax revenue increase in 2013 was due to an artificial surge in incomes at the end of 2012 due to the "fiscal cliff" concerns. As I stated previously:

"The reality is that the surge in tax revenues was a direct result of the 'fiscal cliff' at the end of 2012 as companies rushed to pay out special dividends and bonuses ahead of what was perceived to a fiscal disaster. The large surge in incomes was primarily generated at the upper end of the income brackets where individuals were impacted by higher tax rates. Those taxes were then paid in April and October of 2013 and accounted for the bulk of the surge in tax revenue to date. Also, it is important to remember that payroll taxes also increased due to the expiration of the payroll tax cut from 2010."

You can visibly see this one time surge in the chart of personal incomes below.

However, the Rockefeller Institute recently wrote a research report entitled "Strong Growth In First Half, Softening Growth Through Rest Of 2013" which delved into this issue further stating:

"...preliminary figures for the third quarter of 2013 indicate that in many states strong revenue growth is not sustaining the momentum and states are reporting significantly softening revenue growth, according to the latest State Revenue Report from the Rockefeller Institute of Government.

State tax revenues were up 9 percent for the second quarter of 2013 compared to the same period of 2012. The Far West region reported the largest total tax revenue gains in the second quarter of 2013 at 14.9 percent. The strong growth in the Far West region is mostly attributable to a single state —- California —- where collections grew by $7.6 billion or 21.2 percent.

At the end of fiscal 2013, inflation-adjusted tax collections for the first time surpassed the peak levels reported in fiscal 2008 by 0.7 percent. However, most of the growth in fiscal 2013 was attributable to artificially boosted personal income tax collections. In fact, inflation-adjusted sales tax collections in fiscal 2013 were still 2.9 percent below the recessionary peak levels reported in fiscal 2008. Moreover, inflation-adjusted figures indicate that 28 states still had lower tax receipts at the end of fiscal 2013 compared to fiscal 2008.

Preliminary July-September 2013 figures from 47 early reporting states suggest revenue gains have been softening significantly. Overall collections showed growth of 6.1 percent in the third quarter of 2013 compared to the same quarter of 2012. According to the preliminary data, personal income tax collections grew by 5.3 percent and sales tax collections by 5.6 percent..."

Lower rates of tax revenue will lead to a slowing deficit reduction in the future.

2) Weaker Economic Growth

There are currently many expectations of stronger economic growth in 2014. However, such expectations have been the "hope" by mainstream economists over the past 3 years which have consistently failed to materialize. One of the major impacts to economic growth next year will be the onset of the "Affordable Care Act (ACA)" which is currently not being included in most economic analysis. This could very well be a mistake.

Just recently my friend Charles Hugh Smith did a cost/benefit analysis of his current healthcare plan compared to a equivalent "Gold" plan under the ACA. He states:

"Our grandfathered Kaiser Plan costs $1,217 per month. There is no coverage for medications, eyewear or dental. That is $14,604 per year for two 60-year old adults. We pay a $50 co-pay for any office visit and $10 for lab tests. Maximum out-of-pocket costs per person are $3,500, or $7,000 for the two of us...

The closest equivalent coverage under Obamacare is Kaiser's Gold Plan. The cost to us is $1,937 per month or $23,244 a year. The Gold Plan covers medications ($50 per prescription for name-brand, $19 for generics) and free preventive-health visits and tests, but otherwise the coverage is inferior: the out-of-pocket limits are $6,350 per person or $12,700 for the two of us. Lab tests are also more expensive, as are X-rays, emergency care co-pays and a host of other typical charges. Specialty doctor's visits have a $50 co-pay.

The Obamacare Gold Plan would cost us $8,640 more per year. This is a 60% increase...

The real unsubsidized cost of Obamacare for two healthy adults ($23,244 annually) exceeds the cost of rent or a mortgage for the vast majority of Americans. Please ponder this for a moment: buying healthcare insurance under Obamacare costs as much or more as buying a house."

However, the real economic problem is currently personal consumption expenditures comprise roughly 70% of gross domestic product. In other words, economic growth is almost entirely dependent on consumption by average Americans whose current median annual income is roughly $50,000 per year. If the cost of healthcare substantially increases it will further reduce disposable incomes. With roughly 72% of Americans currently living paycheck to paycheck there is little wiggle room to offset further cost increases.

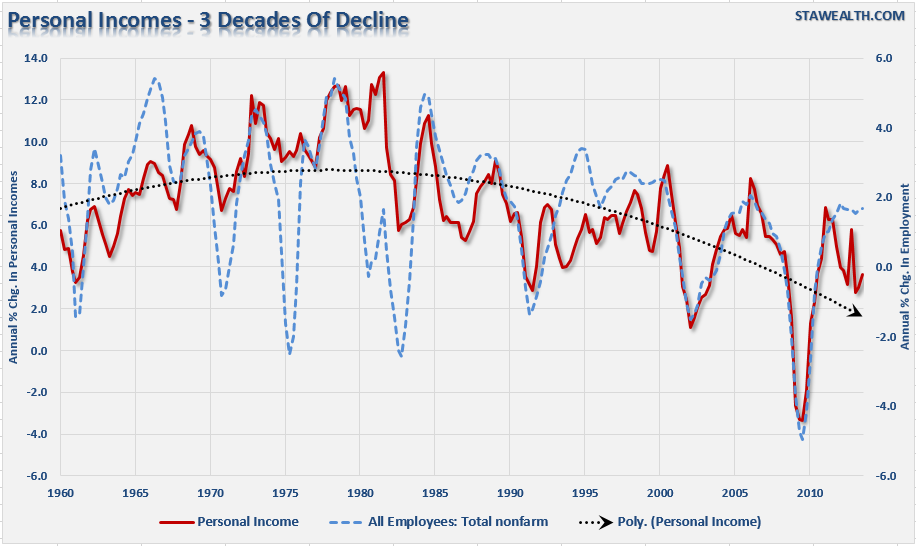

Of course, with wage growth primarily stagnant over the last five years, even as average costs of living continue to rise, it is not surprising to see personal consumption expenditures already on the decline as shown in the chart below. In turn, lower rates of consumption will likely lead to lower rates of economic growth in 2014 once again disappointing the majority of economists and keeping the Federal Reserve engaged in their ongoing monetary intervention programs.

3) Government Spending Will Rise

One other impact of the ACA will be increased government spending to support the new entitlement program. The Heritage Foundation recently stated the obvious for anyone paying attention:

"The nation’s long-term spending trajectory remains on a fiscal collision course. Total spending has exploded by 40 percent since 2002, even after inflation. Some programs have grown far in excess of that. Defense, however, has been slashed. Social Security, Medicare, Medicaid, and Obamacare are so large and growing that they are on track to overwhelm the federal budget. While the Budget Control Act of 2011 and sequestration are modestly restraining the discretionary budget, mandatory spending—including entitlements—continues growing nearly unabated. Without any changes, mandatory spending, including net interest, will consume three-fourths of the budget in just one decade.

Obamacare will add $1.8 trillion to federal health care spending by 2023. By 2015, health care spending will overtake Social Security as the largest budget item, including Obamacare’s coverage expansion provisions: a massive expansion of Medicaid and subsidies for the new health insurance exchanges."

The estimate of the impact of the ACA (Obamacare) is highly understated as almost all CBO projections tend to be. It is likely that the real costs of subsidies to support the new entitlement program will be at least double, if not ultimately more.

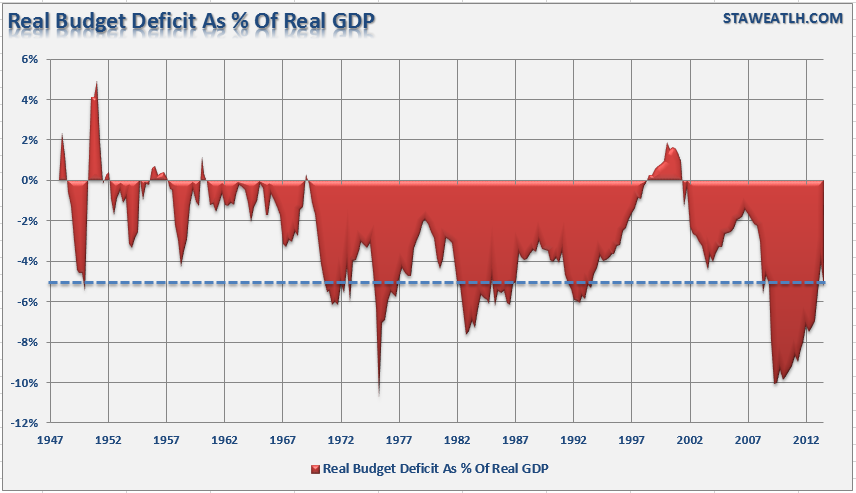

The Deficit Reduction Mirage

While expectations are high that we are rapidly approaching a point of acceleration in the economy; the reality is that the budget deficit has already started to reverse when adjusting for inflation. The chart below shows the inflation adjusted deficit as a percentage of GDP. Currently at -5.35% the deficit is well off its lows of -10% but has already reversed down from its recovery peak of -4.15% in the first quarter of 2013.

As the impact of the ACA weighs on consumptive spending, current entitlements continue to expand, and economic growth weighs on future tax revenues the deficit will likely to worsen in the future. There currently is no will in the Republican led Congress to push for actual spending cuts or policy reforms which means that spending is set to increase markedly over the next few years.

The good news for stock market bulls is that deepening budget deficits increase the amount of bonds that the Treasury will need to issue to cover the shortfall in spending. This will give the Federal Reserve more room to continue their current monetary interventions which have inflated asset prices sharply over the last year.

Of course, admitting that the Federal Reserve is responsible for creating financial instability and possibly brewing the next toxic asset bubble, Minneapolis Fed President Narayana Kocherlakota recently said they have to do more to stimulate the economy, as inflation is too low. However, inflation is running at low levels due to very issues of rising debt levels, weak economic growth and suppressed interest rates which retard productive investment. Creating financial instability to gain economic stability has been an elusive dream of the Federal Reserve since the turn of the century; yet someday it is hoped that they may just be able to "catch their own tail."

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Is The Deficit Reduction A Mirage?

Published 12/11/2013, 12:17 AM

Updated 02/15/2024, 03:10 AM

Is The Deficit Reduction A Mirage?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.