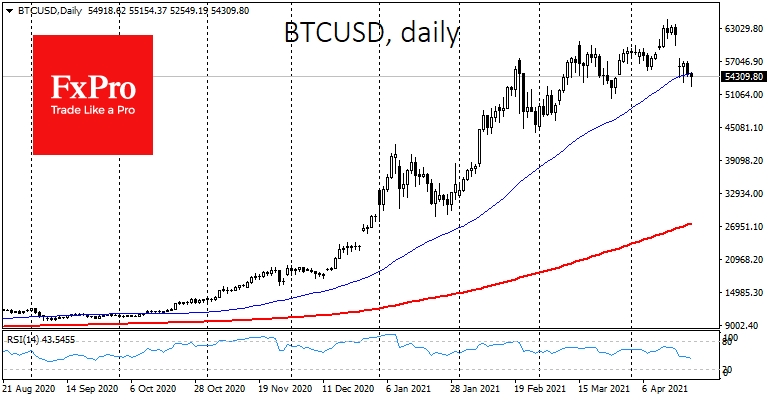

There is optimism in the crypto market, despite more frequent corrective pullbacks after new highs. Are most people now having wishful thinking towards BTC? Bitcoin has lost 4% in the last 24 hours and is trading around $54K. For the week, it is down more than 14%. You could consider what is happening at the moment a consolidation, but after setting an all-time high of $65K, Bitcoin has continued to decline. This is not an impulsive panic decline but a consistent pressure on the value of the asset.

As far as technical analysis is concerned, Bitcoin's decline looks increasingly problematic as the price has fallen below its 50-day average. If it consolidates below that line at the end of the day, we could see an intensified sell-off as some short-term speculators rush to the exit in anticipation of further failure. It is likely that broad investor optimism in the late stages of the rally is keeping the market at fairly high levels.

Bitcoin's capitalization is holding above $1 trillion, while the total capitalization of the crypto market is struggling to hold around $2 trillion. Bitcoin's dominance index continues its moderate decline, but it is far from the lows we saw during the altcoin season in early 2018 when it reached 32%.

The sentiment of crypto market participants is supported by prominent analysts like Willy Woo, who believes that investors will not let Bitcoin's capitalization fall below $1 trillion due to the influx of new users and other factors. Nevertheless, logic suggests that it will run out of new buyers sooner or later. Current cryptocurrency prices are too high and risky for many investors to open new positions. The sense of fear is considerably reduced if investors are witnessing a relentless continuation of price increases, but that has not been the case for some time. As for early investors, current price levels can be quite acceptable for taking profits.

Mahatma Gandhi once said: "First they ignore you, then they laugh at you, then they fight you, then you win...". The cryptocurrency market is now moving from stage two to stage three. The question of cryptocurrency regulation remains open. The courts between the SEC and Ripple are the best illustration of the lack of legal understanding of the nature of cryptocurrencies. This market has become too big to ignore. Today it became known that the U.S. House of Representatives approved the creation of a working group of the SEC and CFTC to develop regulation of the cryptocurrency sector.

The final documents will work through all the controversial issues. Will a set of rules for cryptocurrencies become a benefit that will allow it to develop on the same scale that we have seen in recent months? It's unlikely. It is more likely that the sector's regulation will coincide with the launch of their own national digital currencies, which will be given full discretionary power to develop, suppressing unnecessary "competition". And now the big question is whether independent cryptocurrencies will be able to defeat the states, as crypto-enthusiasts hope they will.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Is The Crypto Market Too Optimistic?

Published 04/22/2021, 07:55 AM

Updated 03/21/2024, 07:45 AM

Is The Crypto Market Too Optimistic?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.