2013 was a difficult year for the Canadian dollar. The "loonie" hit a 3-year low in U.S. dollar terms and lost about 10% of its value against European currencies. It outperformed the Australian dollar and Japanese Yen but only because they were severely battered. Aside from losing Mark Carney one of their best and brightest central bankers to the U.K., the country suffered from a severe discount in the price of Canadian oil versus U.S. oil. The Bank of Canada also dropped its tightening bias in October, setting USD/CAD on a one-way uptrend from 1.04 to 1.07. While growth is expected to accelerate in the coming year Canada faces a unique risk that could send the loonie on a downward spiral in a move that could take USD/CAD to 1.10.

The Biggest Risk for Canada in 2014 is the Housing Bubble

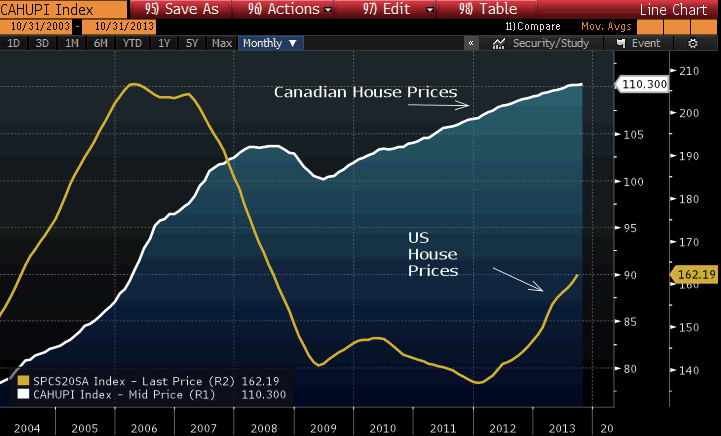

The biggest risk for Canada in 2014 is the housing bubble. According to a recent report from the OECD, Canada's house prices are 60% higher than their long term average on a price to rent basis. Rising prices pushed consumer debt levels to a record high of 163% with the average Canadian household spending more than 30% of their incomes on housing. Unlike the U.S. where house prices corrected steeply in 2008 (yellow line), the following chart shows that the pullback in Canadian house prices (white line / blue area) was shallow. Since the global financial crisis, house prices in Canada have increased another 20%. The amount of construction underway is significant and with more than 13% of jobs in Canada linked to construction, a crash in the housing market would have broad ramifications for the overall economy. Everyone from economists to rating agencies and the central bank have expressed concerns about the overvalued property sector. According to the BoC "the elevated of household debt and stretched valuations in some segments of the housing market remain an important downside risk to the Canadian economy." Prices could rise further before they come down but many economists are looking for as much as a 25% drop in prices over the coming years. According to a study by JPMorgan, a "sustained 3 year period during which real home prices declined would typically result in the CAD falling by 6.6 to 10.5%." Handicapping a pop in the housing market is always difficult and being aware of these risks, the Canadian government will do everything in their power to prevent a crippling crash. If the housing market remains frothy in the coming year, we won't see the surge in USD/CAD.

Keep an Eye on Western Canada Select and WTI Spread

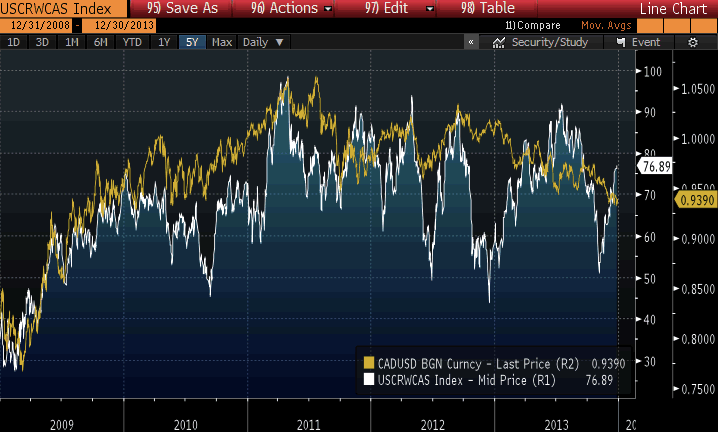

In 2013, the widening spread between Western Canada Select and Western Texas Intermediate oil put significant pressure on Canada's economy. Back in 2009 and even 2010, the spread between WCS and WTI was closer to 0 but on Monday the spread sats at -$23. Western Canada Select oil trades at a $23 discount to WTI because of infrastructure constraints in Canada. Limited refinery capacity and shipping bottlenecks have made it extremely difficult to move oil out of Canada and the huge discount puts significant strain on the country's terms of trade, which leads to less business investment, corporate profits, wage growth and government revenues. The combination of these factors has put pressure on Canada's economy and currency. In the coming year, the demand for oil is expected to rise to a new all time high according to the International Energy Agency. Production in the U.S. is tight and while Canada has capacity constraints, they will be the fourth most important driver of oil supply growth according to the IEA and this growth in energy exports should help to narrow the WCS - WTI spread. The approval of the Keystone Pipeline is also important. If the Obama Administration approves the Pipeline next year like many expect the value of Canadian oil would increase. The following chart shows the correlation between the Canadian dollar (USD/CAD inverted) and Western Canada Select oil prices. There was a divergence in late 2013 but given the long term relationship, the recent increase in WCS prices signal a cap in the USD/CAD rally. USD/CAD vs. Western Canada Select Oil Prices" title="USD/CAD vs. Western Canada Select Oil Prices" width="580" height="349" align="bottom">

USD/CAD vs. Western Canada Select Oil Prices" title="USD/CAD vs. Western Canada Select Oil Prices" width="580" height="349" align="bottom">

Bank of Canada will Leave Rates Unchanged in 2014

While the Bank of Canada could cool the housing market by raising interest rates, their grim forecasts for growth and inflation means they will keep monetary policy unchanged throughout the year. As a result, the government will have to tighten lending restrictions to deflate prices and the potential drag on the economy would ensure easy monetary policy from the BoC. Back in October, the BoC dropped their tightening bias, citing concerns about lower output, weak inflation and a delayed recovery in exports and investments. At the time, they also lowered their 2014 GDP forecast to 2.3% from 2.7%. This still represents a stronger pace of growth from their 1.6% forecast for 2013 but 2.3% means the U.S. will outpace Canada in the coming year. Faster U.S. growth is bullish for USD/CAD in the short term for bearish in the medium term because a stronger U.S. economy will boost the terms of trade for Canada. In the coming year, a new trade deal with the European Union and increased business investment will help offset lower residential investment and softer consumption. Portfolio managers are also expected to increase their exposure to the Canadian dollar as the global economy recovers.

USD/CAD Outlook

- Don't See Move to 1.10

- USD/CAD Rally to be Limited to 1.0850

- Revisit 1.05 in Second Half of 2014

With the Fed tapering and the BoC expected to leave rates unchanged, we are looking for USD/CAD to strengthen in the first half of the year and weaken in the second half. Unless the housing market suddenly collapses we do not see a move to 1.10 for USD/CAD. At most we think a USD/CAD rally will be limited to 1.0850 and before the end of the year, we expect USD/CAD to drop back to 1.05 and possibly even 1.04.

Kathy Lien, Managing Director of FX Strategy.