Investing.com’s stocks of the week

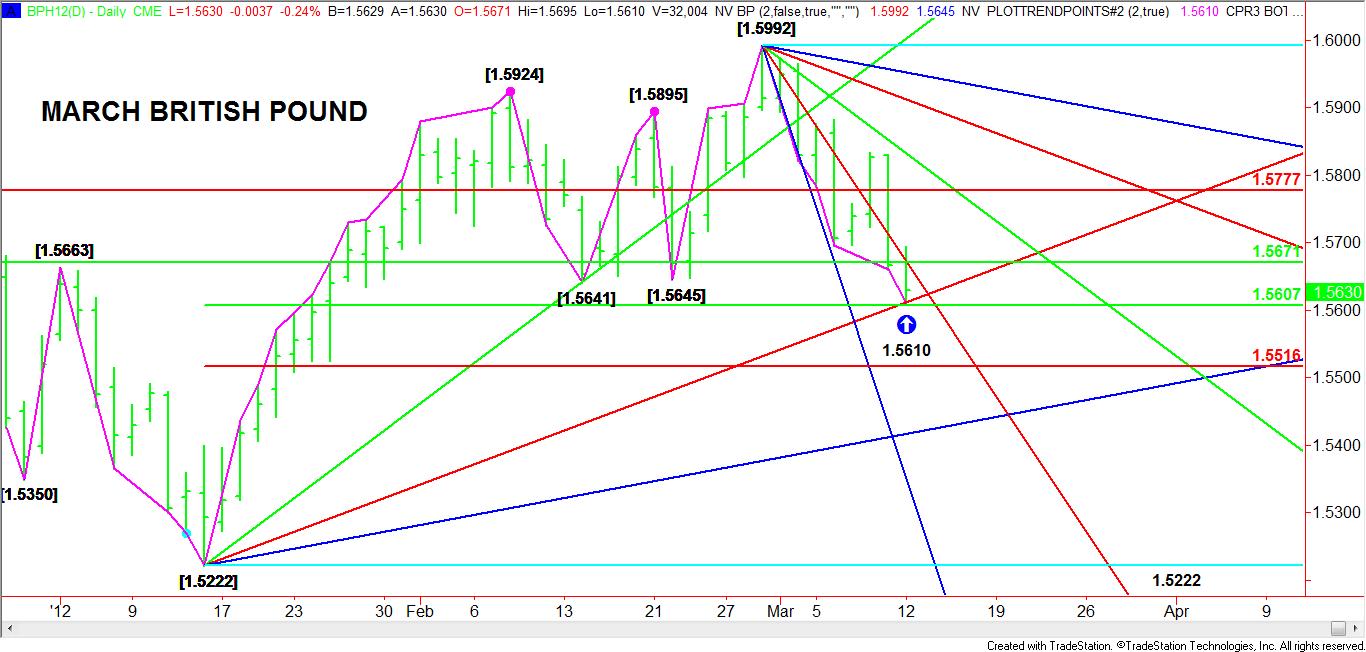

The March British Pound turned its main trend down on the daily chart when it took out a pair of swing bottoms at 1.5645 and 1.5641. Since the market appears to be slightly oversold, there was no acceleration to the downside which may mean the currency is setting up for a short-covering rally.

Standing in the way of a breakout to the downside was an uptrending Gann angle/50 percent retracement support cluster at 1.5612 and 1.5607. The actual overnight low is 1.5610, suggesting that short traders either took profits or counter-trend traders started to go long at the cluster.

Currently, the British Pound is ping-ponging between a pair of 50 percent price levels at 1.5671 and 1.5607. These prices should act as pivots with the market gaining strength over 1.5671 and weakening under 1.5607. Breaking away from either price level could trigger strong moves since the chart pattern suggests room to rally and room to break.

A breakout over 1.5671 could trigger the start of a rally all the way back to 1.5777 while a breakdown under 1.5607 could ignite a trade down to 1.5516.

An improving U.S. economy helped fuel last week’s late sell-off so additional positive economic news this week should be the catalyst that leads to further weakness. Technically oversold conditions may drive the market higher unless an unexpected weak U.S. economic report encourages short traders to pare their positions.