Traders and investors have such high hopes for a turn around in the Biotech sector (via iShares Nasdaq Biotechnology (NASDAQ:IBB)) that even a bottoming process gets major attention. The talk the last 10 days has been about a possible reversal higher. What with a higher low and good momentum. But there is no trend higher in Biotech. Not yet at least. And the move higher may be running out of energy before it happens.

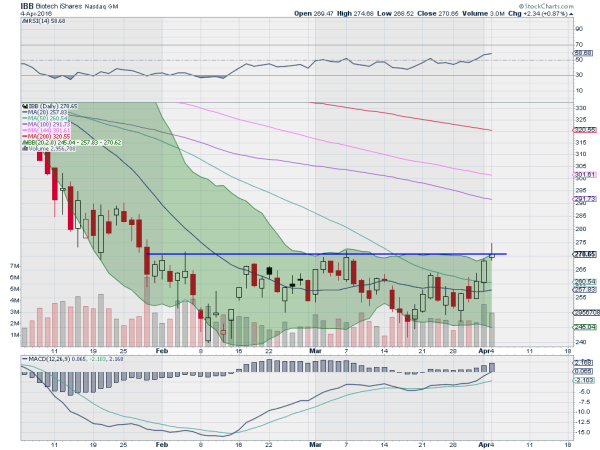

The chart below shows what could turn into a reversal, some day. But the one thing that is missing is a price movement higher. Often after a prolonged downward trend there is a desire to be there to buy when the bottom is made for that reversal higher. But perhaps even more often, that bottom takes a lot of time to develop. Just because a stock price is not going lower does not mean it will go higher. There is a third direction: sideways.

And with a bit of a broader perspective that is what has been happening for the last 2 months. A sideways consolidation in the Biotech ETF (IBB). Those that are buying for a reversal are not cray cray. There is a positive momentum divergence with the RSI rising towards the bullish zone and making a new high, and the MACD positive and moving higher. But momentum does not pay the bills, price does. And the price is yet to break out to the upside to confirm a reversal. Monday was close and maybe Tuesday will confirm. But until a close over 272.50 you are not playing the reversal in Biotechs. You are either early or just plain wrong.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.