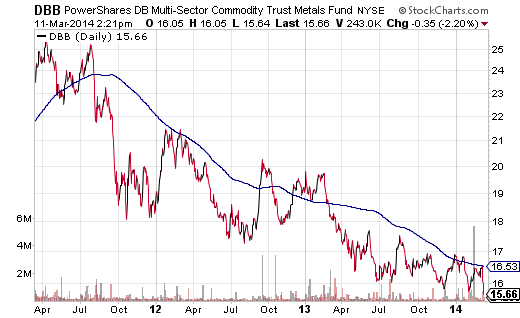

Non-residential construction, home building and manufacturing have been decelerating. Nowhere is this more evident than in the new 52-week lows being set by industrial metals like iPath Copper (JJC) and multi-sector metals investments like PowerShares DB Base Metals Fund (DBB). The latter ETF tracks a rules-based index composed of futures contracts in widely used metals like aluminum, copper and zinc.

Many attribute the commodity price declines to weakness in global economies such as China, Brazil and Russia. Granted, slowdowns in emerging market economies have had an adverse effect on industrial metal prices. Still, Americans may be foolish in ignoring economic warning signs on the home front. Mortgage applications and home sales have been declining precipitously. Services sector growth in the U.S. tumbled to a four-year low in February. And commentators routinely marginalize below-trend employment gains by tethering job vulnerabilities to the cold weather.

Erratic weather patterns may indeed be boosting some commodities, like livestock, grains and coffee. PowerShares DB Agriculture (DBA) is up nearly 14% on a month-over-month basis and close to 17% over three months. Meanwhile, United States Natural Gas (UNG) has rocketed as the need for heat has risen sharply. Even drought conditions on the west coast may be partially responsible for the recent relative strength in water companies via Guggenheim Global Water (CGW).

On the other hand, declaring emerging market woes as the singular cause for base metal price depreciation and/or extreme weather as the sole reason for agriculture or natural gas price appreciation seems myopic. There may be other forces that influence these and other commodities. In all likelihood, uncertainty about U.S. manufacturing, concerns about the well-being of the U.S. consumer as well as wariness of Federal Reserve monetary policy also affect the price movement of natural resources as well as the share prices of natural-resources-related companies.

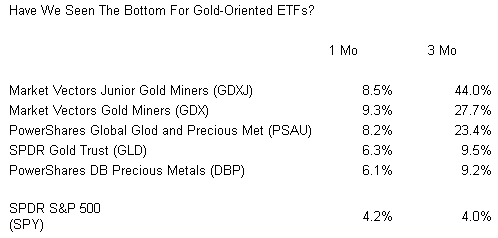

For example, the worst performing corporate shares of 2013 belonged to the precious metals miners. What’s more, the post-tapering consensus had expected dollar strength at the expense of gold prices. (Remember the numerous calls for the yellow metal to fall below $1000 per ounce.) Over the prior 3 months, however, SPDR Gold Trust (GLD) and a number of gold-oriented assets have significantly outpaced U.S. stocks.

Is it possible that gold has recaptured the imagination of safety seekers? The spot price has moved higher in conjunction with decreasing bond yields. (Lower rates, not higher rates, is another feature of 2014 that few seemed to anticipate.) Is it conceivable that exuberance for U.S. stocks is inspiring those who wish to hedge against that exuberance? After all, we have not seen stock margin debt this high since July 2007, nor have we seen three-quarters of the IPOs coming from unprofitable entities since the year 2000.

In the previous decade (2000-2009), both SPDR Gold Trust (GLD) and Vanguard Emerging Markets (VWO) contributed handsomely to portfolio growth. In contrast, U.S. equities via SPDR S&P 500 (SPY) annualized at -0.9% for the entire “lost decade.” Over the last two-and-a-half years, the tables have turned; exposure to GLD and/or VWO has dragged on portfolios that relied on them.

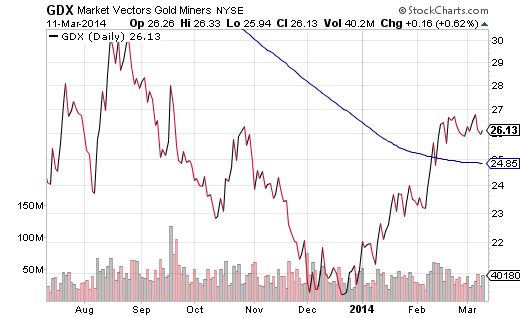

I am not ready to buy broad-based emergers on attractive fundamentals alone. The technical picture is ugly, the Federal Reserve’s policies have shaken faith in many emerging currencies, geo-political tensions are rising and economic expansion is slowing. On the other hand, ETFs tracking gold and gold-oriented miners offer an appealing technical picture, a “contrary-to-popular-opinion” asset class, and a desirable possibility for hedging against global turmoil.

Granted, the spot price for gold would need to move at least another 5%-6% to establish a new bull market off the current bear bottom. Nevertheless, if the renewed excitement in the gold mining space is any indication, a two-and-a-half year bear for the most popular precious metal may be in its final stages.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.