In the last few quarters, the USA has seen a fairly significant decline in headline productivity growth. Some have suggested there is a correlation to GDP - and of course there is as headline productivity is measured by economists using monetary means - and this methodology would correlate to GDP growth. This is not the way an industrial engineer measures productivity.

The reason productivity is measured is to understand if the effort required to produce products or services is improving or declining. In the private sector, these metrics are used to monitor our continuous improvement changes which in turn effect profitability. Productivity improvements should improve profitability and/or allow the product to be sold at a lower price point.

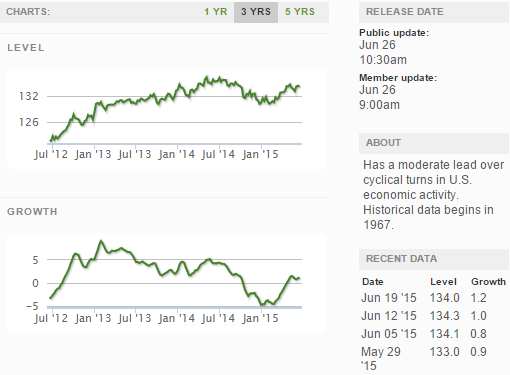

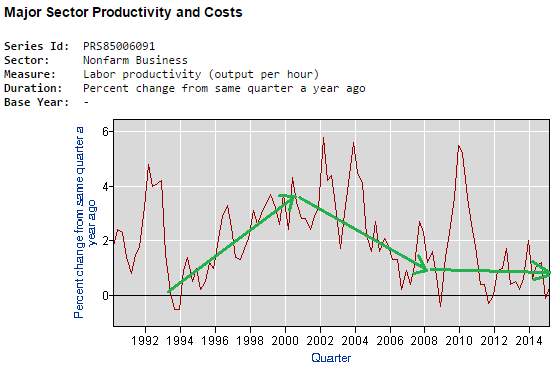

Here is the productivity chart for non-farm business - and my interpretation of the trend lines in green.

Headline productivity does not properly measure what is going on under the hood of the economy. Consider the following examples:

- If I were building a car, let's imagine I decide that the engine could be built at a lower cost by outsourcing (say overseas). Headline productivity methodology is that the engine is simple removed from the calculation. In theory, there was no change to productivity. But by outsourcing, usually the least productive growth elements are usually removed - and are left with the more productive growth elements which will now show this business has a higher productivity growth.

- At a certain point outsourcing slows. Headline productivity growth would begin to slow and productivity growth returns to historical norms.

- There is a quantitative analysis to determine where production facilities should be located, and what components should be directly produced or what should be outsourced. A simple change like energy prices or tax laws or worker costs or robotics changes this point of production.

- If the car manufacturer decides it is now better now to produce the engine internally (and say this product is now produced by 2,000 robots with 10 humans). Even though the previous engine was produced by 1,000 humans - there is no productivity improvement in headline productivity even though real labor productivity improved 10,000%

- If a business builds a state-of-the-art facility - there is no gain in productivity to headline productivity. Under most circumstances, only when an existing facility is upgraded is it counted in headline productivity.

Consider that in the:

1990s, productivity jumped because trade agreements allowed production to be moved offshore. In this period the worst productive segments of production were outsourced - while remaining segments streamlined and automated. After all, this was the period of the explosion of the internet.

2000s until the Great Recession, productivity declined as the rate of offshoring lessened - and productivity returned to historic mean levels.

Aftermath of the Great Recession, the effects of automation and other pricing components allowed return of exported product production. There was no productivity gain when you start producing again - and if your facility is full of non-humans - it is harder to improve HUMAN labor productivity.

In the 1990s, the headline productivity gains manifested as profits. This made GDP grow. Fast forward to today where real productivity gains are being used to lower product prices because of competition and the current deflationary environment. This is not good for GDP - and because headline productivity is calculated similarly to GDP using monetary inputs - both GDP and headline productivity are seen to decline.

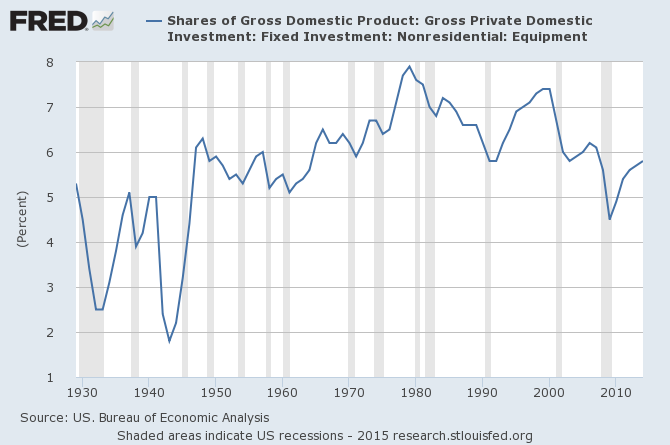

Some people believe business is not investing in the USA - but currently the trend is up - and investment is currently nearly in the range seen in the 2000s. Some of this investment will be used to buy robotics and automations.

It all boils down to HOW productivity improvements are used. In 2015 - real productivity growth is being used to lower costs so that products can be sold at a more competitive price. This is not good for GDP even though in the long term view it may be beneficial to the economy.

Other Economic News this Week:

The Econintersect Economic Index for June 2015 continues to weaken. Most tracked sectors of the economy are relatively soft with most expanding well below rates seen since the end of the Great Recession. When data is this weak, it is not inconceivable that a different methodology could say the data is recessionary. The significant softening of our forecast this month was triggered by marginal declines in many data sets which are dancing closer and closer to zero growth. Please note that most 6 month outlook forecasts are for a marginally improving economy.

The ECRI WLI growth index is now in positive territory but still indicates the economy will have little growth 6 months from today.

Current ECRI WLI Growth Index

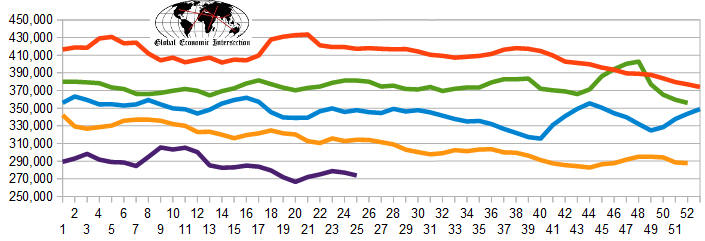

The market was expecting the weekly initial unemployment claims at 270,000 to 275,000 (consensus 273,000) vs the 271,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 277,000 (reported last week as 276,750) to 273,750. The rolling averages generally have been equal to or under 300,000 since August 2014.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line), 2015 (violet line)

Bankruptcies this Week: Midway Gold, Molycorp, Local

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: