Growth stocks can be some of the most exciting picks in the market. Not only do these types of stocks captivate investors’ attention, but they’re known for producing big gains as well. However, growth stocks can also lose momentum when a growth story ends, so it’s vital to find companies still experiencing strong growth prospects in their business.

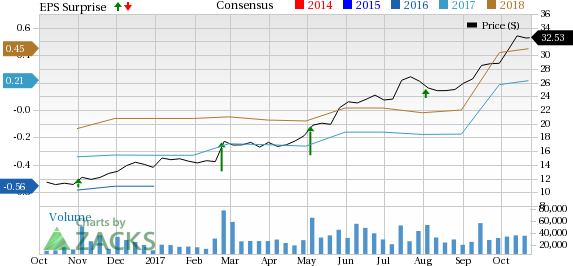

One company that might be well-positioned for future earnings growth is Square Inc. (NYSE:SQ) , a leading mobile-payments company founded by Twitter (NYSE:TWTR) CEO Jack Dorsey. This firm, which is in the Internet-Software industry, reported EPS growth of over 71% last year, and is looking great for this year, too.

In fact, current growth estimates for fiscal 2017 call for roughly 161% EPS growth. And, Square anticipates growth rates for the long-term to come in at 25%, suggesting impressive prospects going forward.

Shares of SQ have actually seen estimates rise over the past month for the current fiscal year by 1.14%; two analysts have revised their estimates upwards during this time frame compared to none lower. Thanks to this rise in estimates, Square is a Zacks Rank #2 (Buy), further underscoring the company’s potential.

Investors looking for a fast-growing stock that still has plenty of opportunities on the horizon, make sure to consider SQ. With double-digit earnings growth in its near future and an impressive Zacks Rank, this combination suggests that analysts believe even better days are ahead for the booming mobile payments company.

Square is set to report its third quarter fiscal 2017 results on November 8 after the bell. Current estimates sit at revenues of $573.81 million on earnings of six cents per share.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Square, Inc. (SQ): Free Stock Analysis Report

Twitter, Inc. (TWTR): Free Stock Analysis Report

Original post

Zacks Investment Research