Analytics Continues To Drive Growth

IS Solutions (LONDON:ISSL) continues to benefit from the strong demand for web/big data analytics, having established its position as a systems integrator and managed service provider in the web analytics market over the last 20 years or so. FY13 numbers were broadly in line with our forecasts, supported by a strong H2 performance, which was expected. However, we have eased our revenue and PBT forecasts, due to the declining USD/GBP, which reduces the group’s day rates in sterling terms. In our view, the c 14x FY15e P/E and 3.1% yield look attractive, due to the group’s increasing focus on the web analytics space, which management is seeking to expand beyond customer experience analytics (CXA).

Highly Sought After Web Analytics Expertise

Web analytics is about using internet data for optimizing e-commerce performance, and growing demand is coming from B2C companies seeking to improve their revenue conversion and reduce costs. According to ISL, a typical online business is now spending a third of its marketing budget on analytics, up from less than 10% in 2009. The market is expected to continue to grow at healthy mid-teen rates and is increasing in complexity, as new sophisticated solutions must be integrated with a multitude of technologies and back office systems. ISL has developed this know-how, having been involved in the internet sector since the mid-1990s.

Results and Forecasts: Sales And PBT Edged Back

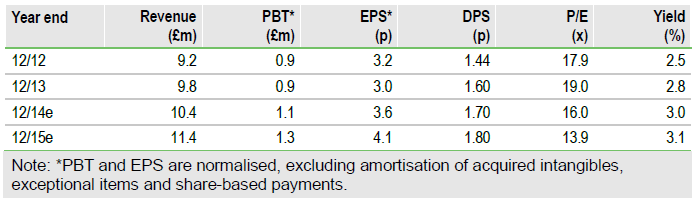

Revenues from Projects jumped 31% to £4.0m, driven by analytics business, which now represents over half the division’s business. The Recurring revenues segment dipped 10% to £4.2m due to the loss of a major analytics contract in December 2012, although the division’s contribution was stable due to strengthening gross margins. The group continued to generate healthy cash flows, with adjusted net debt falling by £0.3m to £0.2m over the year. We have eased our revenues by £0.5m in each of FY14 and FY15 to £10.4m and £11.4m respectively, due to the weakening US dollar, and a different business mix, with higher Projects and lower licence renewals in Recurring revenues. We reduce our adjusted EPS forecast by 0.5p to 3.6p in FY14 and by 0.4p to 4.1p in FY15.

Valuation: Modest, Given The Specialist Expertise

ISL’s market cap and net debt of £0.2m imply a £14.8m EV. Hence the shares are trading on about 1.3x our FY15e revenues and c 11.4x operating profit. In our view, these ratings look attractive given the group’s strong position in web analytics including key partnerships with SAS, EMC and Celebrus/Speed-Trap.

To Read the Entire Report Please Click on the pdf File Below