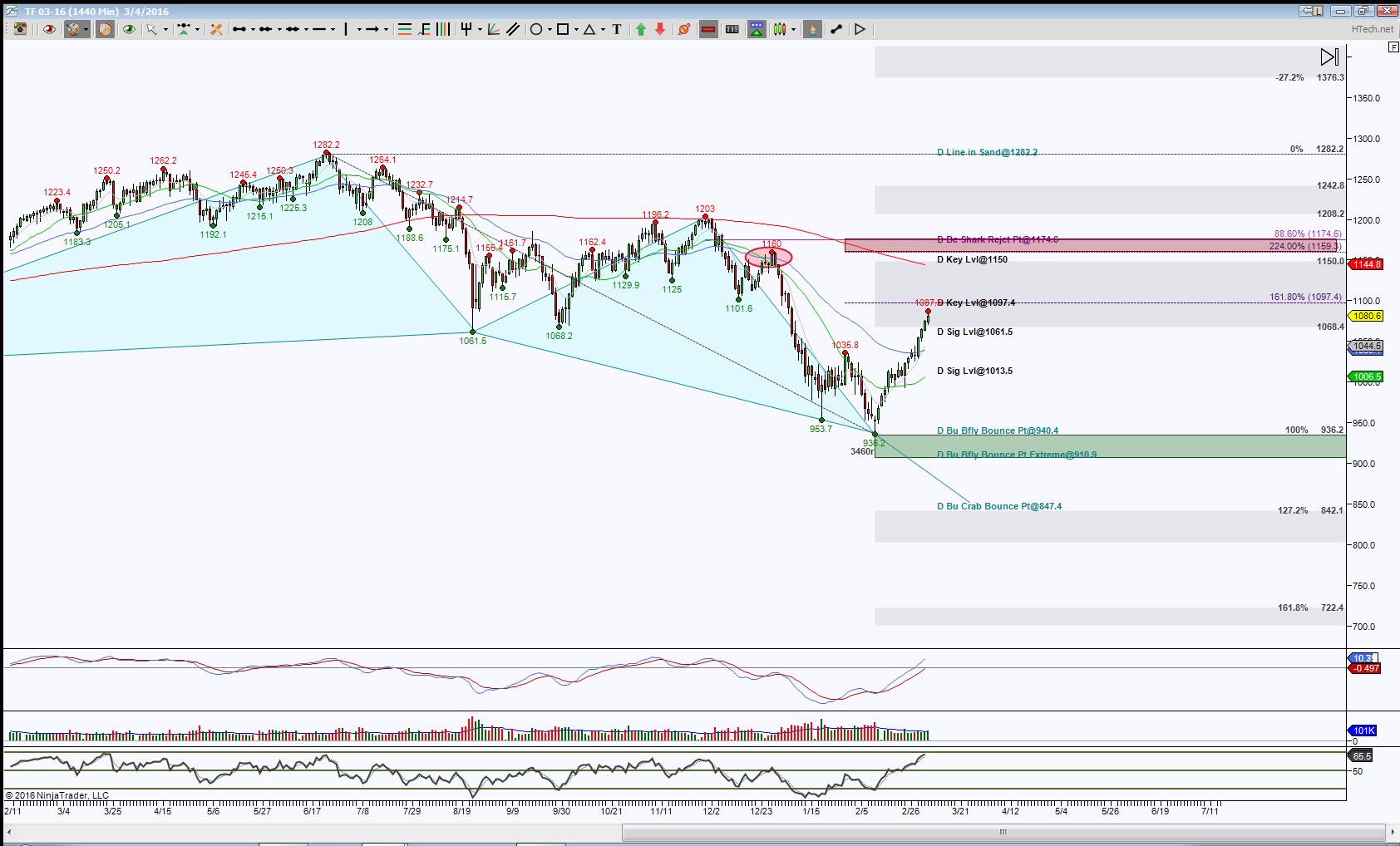

TFH16, the emini futures for Russell 2000, has been moving to the upside in a Retrace Mode compliments of a Bullish Butterfly harmonic pattern. How much a harmonic pattern retraces is key, and shallow retracements represent a cap to that movement.

The day chart shows the Butterfly completed at 936.2, this is actually the initial test of the PRZ (Potential Reversal Zone based off a harmonic pattern’s completion zone), upon completion retracement targets are immediately known, in this case, the initial retracement target to the upside is 1068.4 and the ideal target is 1282.2

Currently price has breached the minimum target, this places price inside what I call a GRZ (Golden Ratio Zone based off Fibonacci ratio’s area between 38.2% and 61.8%. So now where price breaks and holds outside the GRZ is important and offers a clue to directional bias and which targets have a higher probability of being tested.

Trading involves substantial risk and is not suitable for all investors. Past performance is not indicative of future results.

by Kathy Garber