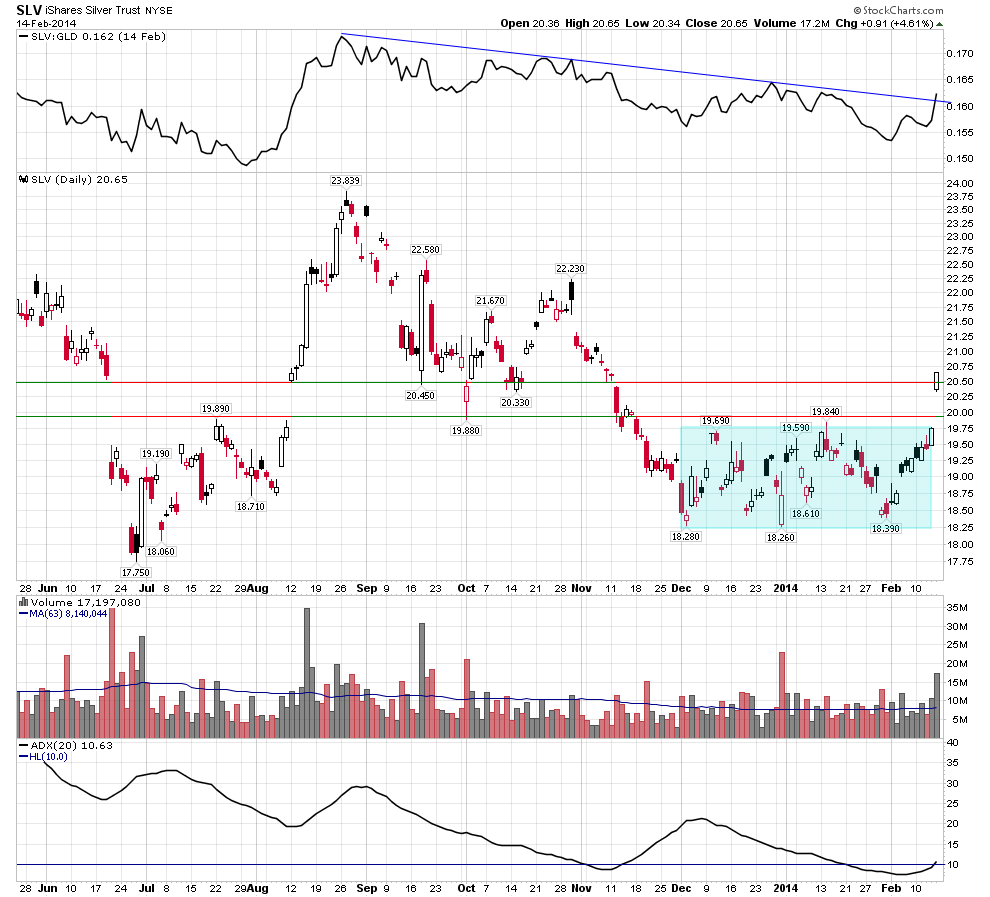

After spending two and a half months forming a rectangle consolidation (light blue) the Silver ETF (SLV) has followed Gold, and broken to the upside on twice its average volume. Friday’s breakaway gap and close above the strong resistance area at 20-20.5 validates the short-term trend reversal. The Average Directional Index (20) has turned up from below 10 confirming that a sideways trend is likely over (bottom pane). Note that SLV has started to outperform the Gold ETF (GLD) promising a better bang for the buck (top pane).

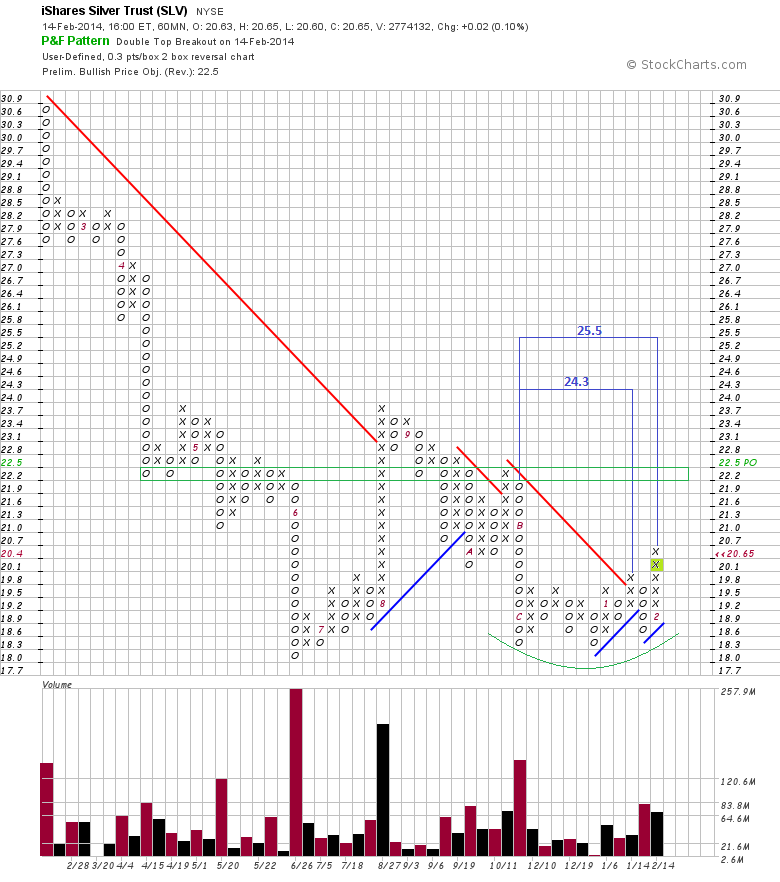

The short horizon P&F chart confirms the short-term trend reversal as well showing the completed interim fulcrum bottom with a buy signal (lime box) above the Bearish Resistance line. Two horizontal counts from this bottom project potential price targets at 24.3 and 25.5, with the next meaningful resistance at 22.2.

Disclaimer: I express only my personal opinion on the market and do not provide any trading or financial advice (see Disclaimer on my site).