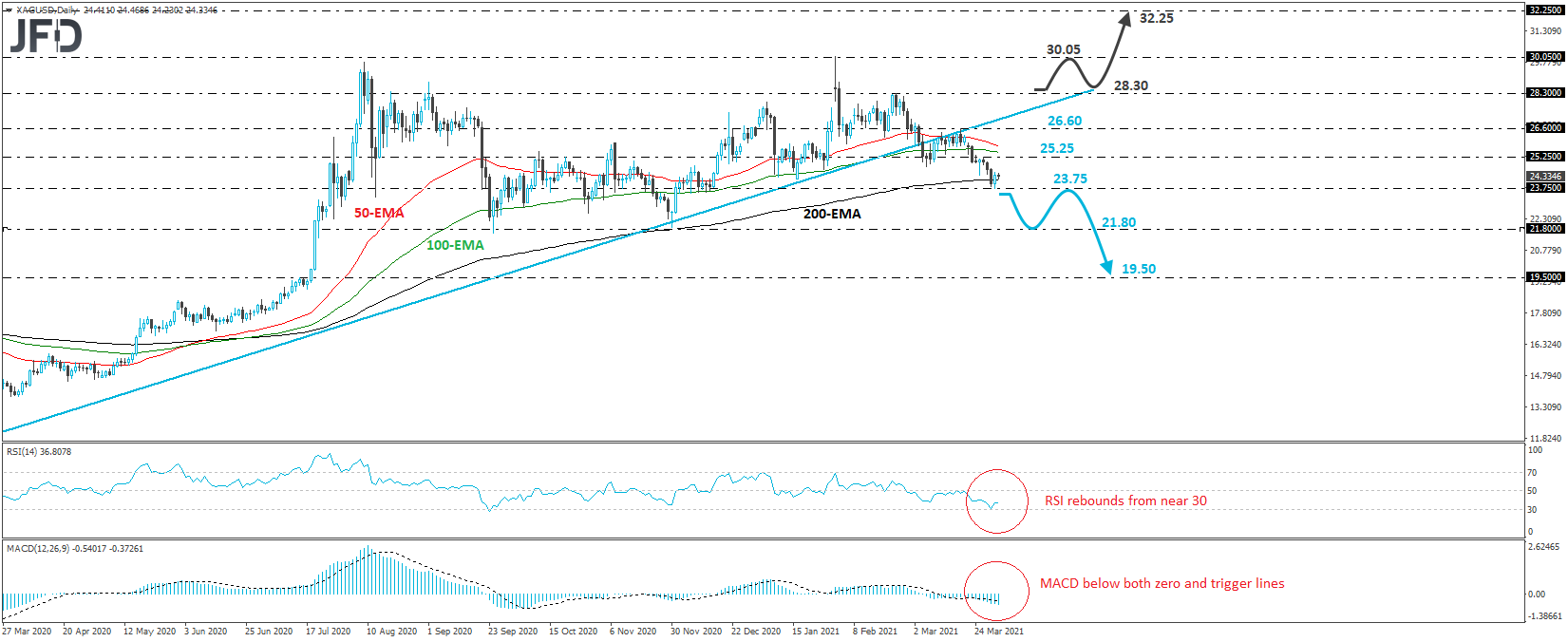

XAG/USD has been trading in a sliding mode since Mar. 18, when it hit resistance at the prior upside support line drawn from the low of Mar. 18, 2020. Yesterday, the metal hit support at 23.75 and rebounded somewhat. That said, as long as it continues to trade below that upside line, we will consider the outlook to be negative.

A clear and decisive dip below 23.75 may wake up more bears, encouraging them to push the battle towards the 21.80 area, which provided support on Sept. 24 and Nov. 30. If that zone is not able to withstand the pressure, then its break may pave the way towards the 19.50 territory, defined as a support by the inside swing high of July 15.

Shifting attention to our daily oscillators, we see that the RSI rebounded from near its 30 line, but the MACD remains below both its zero and trigger lines. Both indicators detect negative momentum, supporting the notion for more declines, but the fact that the RSI has rebounded somewhat suggests that the white metal may correct a bit higher before the bears decide to take the reins again.

In order to start examining whether the outlook has turned bullish again, we would like to see a decisive recovery back above 28.30, marked by the highs of Feb. 22 and 23. The price would also return back above the aforementioned upside line and may travel towards the high of Feb. 1, at 30.05. A break higher would take silver into territories last seen in February 2013, with the next potential resistance zone being the 32.25 area, which stopped the price from moving higher between Jan. 20 and Feb. 5 of that year.