Silver has been relatively volatile over the past few weeks as the metal has reacted to a range of rhetoric from the Fed on interest rate hikes. However, despite the recent pullback from the high at $17.99, the precious metal could be setting up to challenge the key $18.00 handle.

Currently, the precious metal is trading around the $17.26 mark which actually forms a key resistance point. Subsequently, any upward move will need to surmount this point if the metal has a chance of forming a new high for the year. However, an upward move is most definitely supported by the current technical setup.

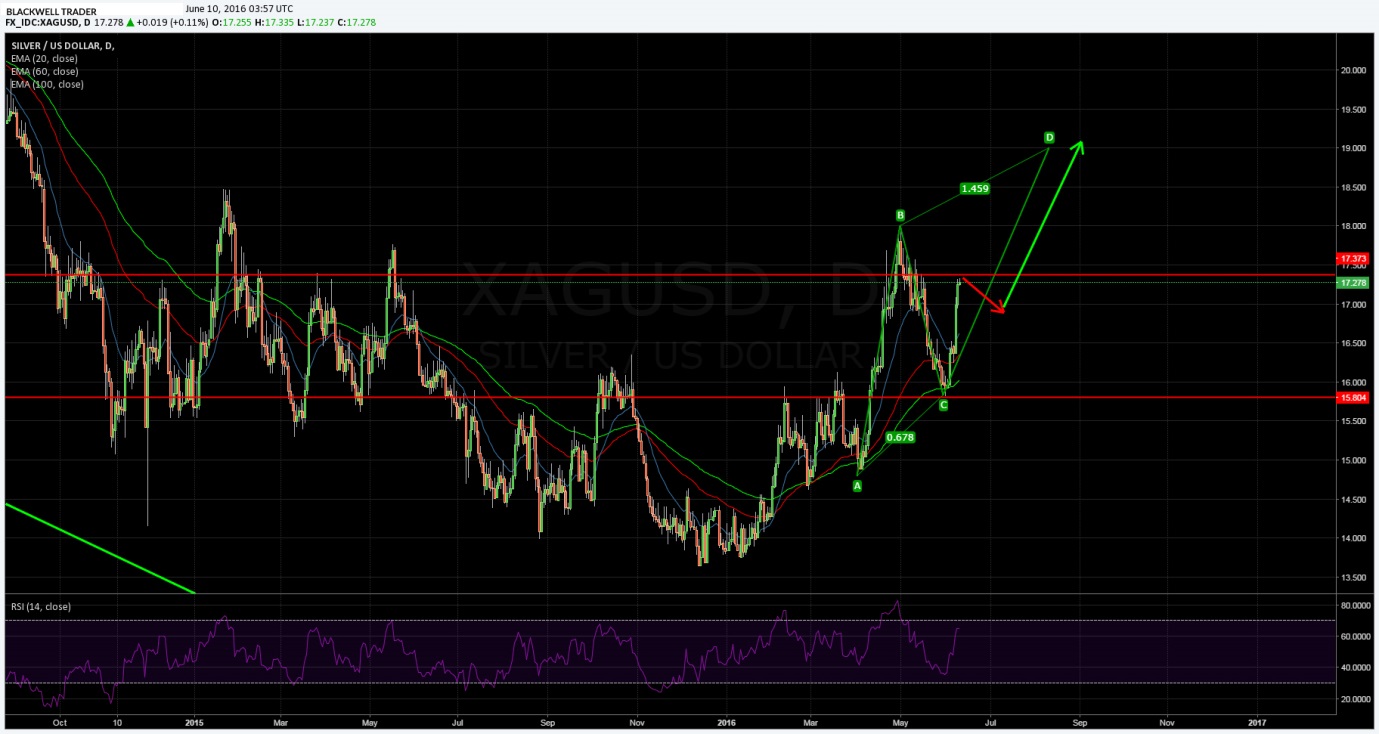

In fact, a review of the daily chart shows a relatively clear ABCD pattern in progress which is likely to mean plenty of upside pressure in the coming session. The “A” leg initially formed in the middle of March and it would subsequently appear that the “D” leg is now underway. Given the relatively large size of the structure, it would imply a completion of the ABCD pattern well around the $19.00 mark. Subsequently, there is plenty of scope for bullish activity around the metal in the coming days.

However, the RSI oscillator is coming close to overbought levels whilst Stochastics are strongly indicating a correction. This would tend to imply that there may be a small retracement back towards the $16.60 mark before the oscillators have enough breathing space to allow the trend to recommence.

Ultimately, silver is likely to remain relatively bullish in the medium term with as long as it can break free of the grips of the yearly resistance level around the $17.32 mark. If it can surmount this level we could very well see a sharp break above the next handle in short order. However, I foresee the need for a corrective pullback, either before or after a breach of that point in the near term.

From a medium term fundamental perspective, the metal’s fate is likely to be closely tied to that of gold and the Fed’s June rate hike meeting’s outcome. Subsequently, monitor any trades closely given the inherently volatile nature of the Fed’s policy decisions and rhetoric.