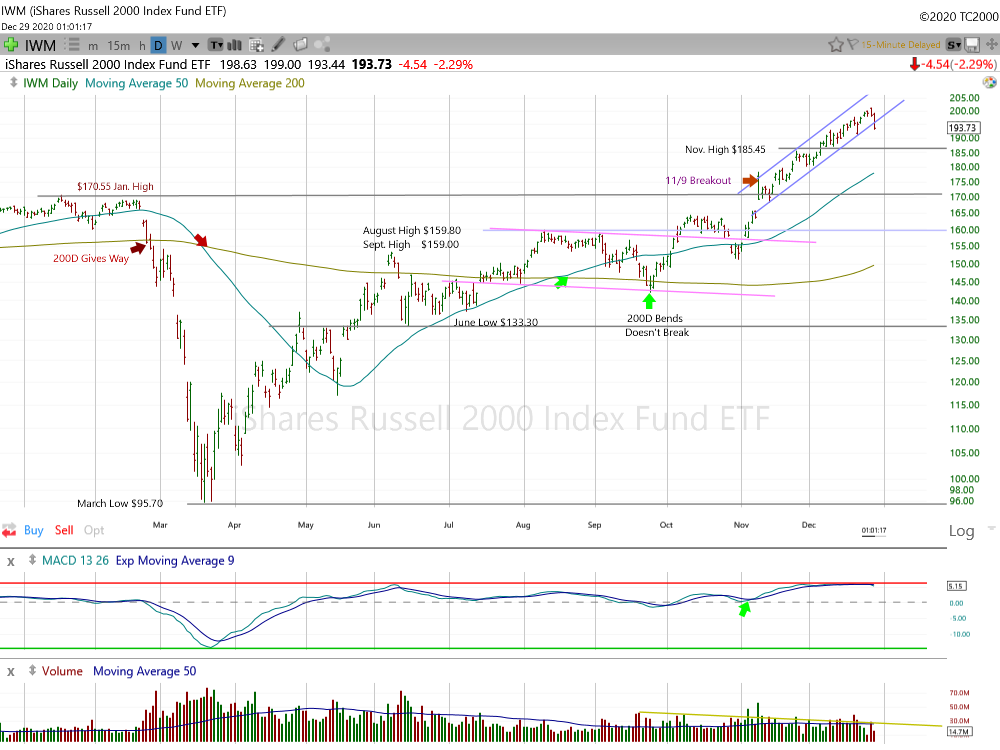

The Russell 2000 Index has been weak since Monday’s gap higher open. The (NYSE:IWM) began this week with gap higher open that lifted it into new all-time territory as the index extended the powerful Nov. 9 breakout to a 17% gain. IWM is now in danger of tracing out an ugly key weekly downside reversal after printing a new weekly high followed by a weekly close below the previous week’s low. The lower band of a narrow bull channel that has driven the index higher since Nov. 9 is also being violated.

A close on Friday below $191.40 would violate last week’s low. We would expect this downside reversal to lead to a deeper pullback in both the IWM and IJS. The next layer of support for the IWM is the $148.50 area (November high).

A 1/3 retracement of the powerful rally off the September lows (200-day moving average) would drop the index down to the $179.00 area. This key zone includes the Nov. 9 spike high as well as the upward sloping 50-day moving average. Of note, the IWM is working on its third straight higher monthly low since the September retest of the 200D.

Note: We have no position.

You can read Gary S. Morrow's original post here.