I came into work knowing that the bulls had to hold the 20-day moving average. That has been a level of support for them of late, and if they blew through it, things could certainly get dicey.

I covered my one short position in Intel (NASDAQ:INTC) Wednesday for a 2.1% profit and still have a nice profit in my TLT position too. The bulls held the 20-day moving average Thursday and as a result I added a couple of new positions to the portfolio — both of which are performing nicely.

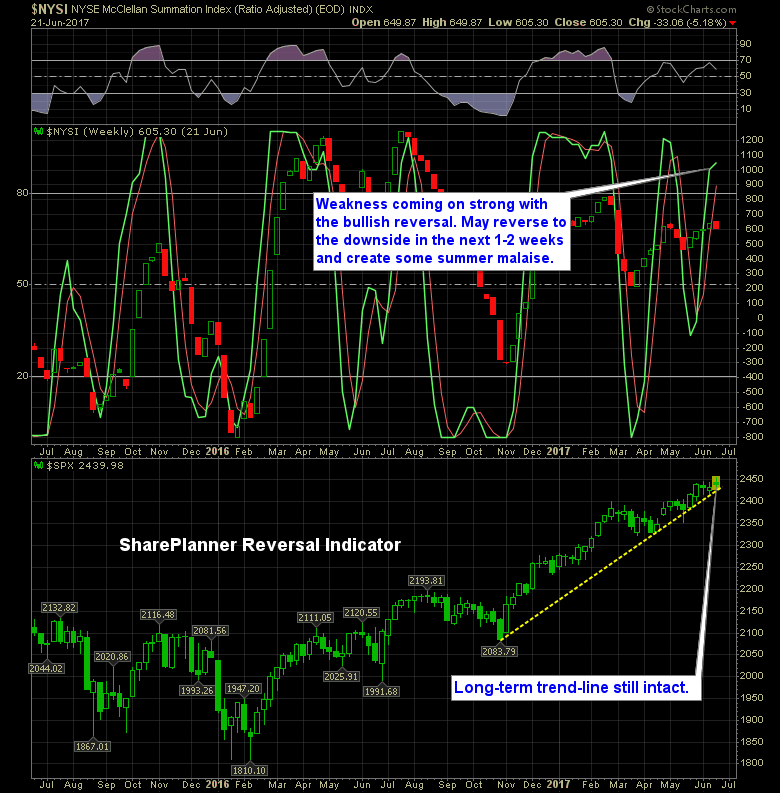

But when you look at the SharePlanner Reversal Indicator, there are some problems that could soon come into play. For one, we are nearing extremes, but the bulls also seem to be slowing down some and running out of steam with the SPRI starting to curve and flatten out its slope. If this continues, then we could easily see a bearish reversal in the next 2-3 weeks. But as is often the case with bearish reversals, it doesn't mean that we get a massive selloff, but instead could get a choppy market that trades sideways until the market can work off overbought conditions.

Here's The Reversal Indicator: